Office of Infrastructure of Canada — Quarterly Financial Report for the quarter ended June 30, 2024

Copyright

© His Majesty the King in Right of Canada, as represented by the Minister of Housing, Infrastructure and Communities, 2024.

Cat. No. T91-11E-PDF

ISSN 2818-2766

Pursuant to the Royal Assent of Bill C-59 and effective June 20, 2024, Infrastructure Canada (INFC) became Housing, Infrastructure and Communities Canada (HICC). The 2024-25 Q1 Quarterly Financial Report (QFR) will be the last report for INFC and all future QFRs will be reported under HICC.

Statement outlining results, risks and significant changes in operations, personnel and programs

Introduction

This quarterly report has been prepared by management as required by Section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Treasury Board. This quarterly report should be read in conjunction with the Main Estimates as well as Budget 2024.

The key to building Canada for the 21st century is helping all communities thrive by making housing more available and affordable while making public infrastructure more sustainable, inclusive and climate-resilient. INFC makes significant investments in housing and public infrastructure, addresses homelessness needs, builds public-private-partnerships, and delivers programs that improve Canadians' quality of life while creating jobs and supporting economic growth.

Further information on INFC's mandate, responsibilities, and programs can be found in INFC's 2024-25 Main Estimates.

Basis of Presentation

This quarterly report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities includes INFC's spending authorities granted by Parliament and those used by INFC consistent with the Main Estimates and Supplementary Estimates for the 2024-25 fiscal year (FY). This quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before monies can be spent by the government. Approvals are given in the form of annually approved limits through Appropriation Acts or through legislation in the form of statutory spending authority for specific purposes.

INFC uses the full accrual method of accounting to prepare and present its annual departmental financial statements that are part of the departmental performance reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

In the past, INFC has worked in collaboration with other federal departments and agencies to deliver some of its transfer payment programs (collectively known as federal delivery partners) and this remains accurate for the 2024-25 fiscal year.

It should be noted that this quarterly report has not been subject to an external audit or review.

Highlights of Fiscal Quarter and Fiscal Year-to-Date Results

This section highlights the significant items that contributed to the change in resources available for use from 2023-24 to 2024-25 and in actual expenditures from 2023-24 to 2024-25 as of June 30 (first fiscal quarter).

Authorities

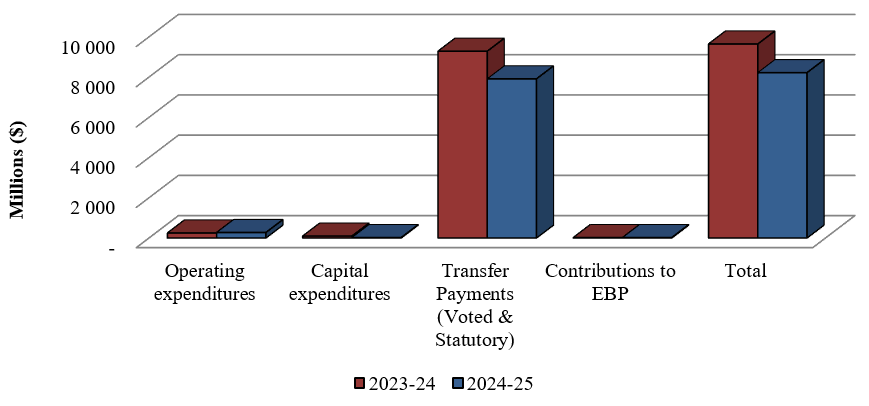

Graph 1: Comparison of Authorities Available as of June 30, 2023 and June 30, 2024

Text description of Graph 1: Comparison of Authorities Available as of June 30, 2023 and June 30, 2024

Bar graph showing the comparison of authorities available for use as of June 30, 2023 and June 30, 2024.

- Operating authorities available as of Q1 2023-24 were $247.7 million, compared with $271.0 million as of Q1 2024-25.

- Capital authorities available as of Q1 2023-24 were $93.9 million, compared with $18.8 million as of Q1 2024-25.

- Transfer Payment (Voted and Statutory) authorities available as of Q1 2023-24 were $9.3 billion, compared with $7.9 billion as of Q1 2024-25.

- Contributions to the Employee Benefit Plan authorities available as of Q1 2023-24 were $18.8 million, compared with $19.2 million as of Q1 2024-25.

- The total of authorities available for use as of Q1 2023-24 were $9.6 billion, compared with $8.2 billion as of Q1 2024-25.

Pursuant to the Royal Assent of Bill C-59, received on June 20, 2024, any unspent appropriations by INFC (Vote 1, 5, and 10) are deemed to have been appropriated to HICC. This QFR reports expenditures appropriated to both INFC and HICC for the quarter ended June 30, 2024.

As shown in the Statement of Authorities, INFC's total authorities available for 2024-25 are $8.2 billion as of the end of Quarter 1 (Q1) and represent a $1.4 billion decrease compared to the same quarter in the prior year.

This decrease is summarized in the table below:

| Authorities |

Increase/(Decrease) vs. Prior Year-to-date (000's) |

|---|---|

|

Operating Expenditures |

23,219 |

|

Capital Expenditures |

(75,093) |

|

Transfer Payments (Voted and Statutory) |

(1,374,573) |

|

Contributions to Employee Benefit Plans (EBP) |

438 |

Year-over-year changes are summarized as follows:

- Operating Expenditures – The increase is due to the transfer from the Canada Mortgage and Housing Corporation to support the transition of leadership for housing policy and program development, funding for the ratification of collective bargaining agreements, as well as new programs announced in recent Federal Budgets such as the Supporting Climate Resilient Infrastructure Initiative and the Veteran Homelessness Program. This increase is offset by sunsetting operating funding from items such as the Natural Infrastructure Fund and the High Frequency Rail.

- Capital Expenditures – The decrease in capital funding is primarily related to the Samuel de Champlain Bridge Corridor project as construction of the bridge nears completion.

- Transfer Payments (Voted and Statutory) – This decrease is mainly related to Green and Inclusive Community Building as well as Investing in Canada Infrastructure Program funding being moved to future fiscal years, offset by increases under the New Building Canada Fund – Provincial-Territorial Infrastructure Component – National and Regional Projects and the Permanent Public Transit Program.

- Contributions to Employee Benefit Plans – This increase is reflective of the growth in full time equivalents (FTEs) associated with the new Programs listed in the Operating Expenditures section and INFC's expanded mandate.

Expenditure Analysis

Expenditures at the end of Q1 were $0.63 billion, compared to $0.69 billion reported in the same period in 2023-24, representing a decrease of 8.6%. The source of the relative decrease is demonstrated in the tables, graphs and analysis below.

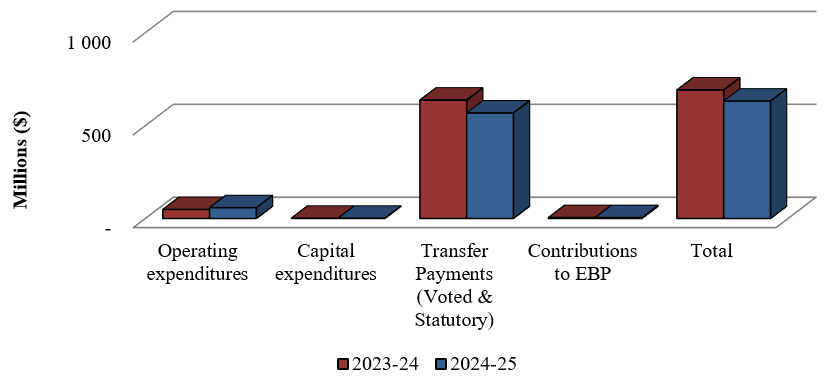

Graph 2: Comparison of Total Expenditures as of June 30, 2023 and June 30, 2024

Text description of Graph 2: Comparison of Total Expenditures as of June 30, 2023 and June 30, 2024

Bar graph showing the comparison of total expenditures used year-to-date as of June 30, 2023 and June 30, 2024.

- Authorities used for Operating as of Q1 2023-24 were $48.5 million, compared with $58.0 million as of Q1 2024-25.

- Authorities used for Capital as of Q1 2023-24 were $1.3 million, compared with $1.4 million as of Q1 2024-25.

- Authorities used for Transfer Payments (Voted and Statutory) as of Q1 2023-24 were $0.64 billion compared with $0.57 billion as of Q1 2024-25.

- Authorities used for Contributions to the Employee Benefit Plan as of Q1 2023-24 were $4.7 million, compared with $4.8 million as of Q1 2024-25.

- Total year-to-date budgetary expenditures as of Q1 2023-24 were $0.69 billion, compared to $0.63 billion as of Q1 2024-25.

| Year-to-date expenditures |

Increase/(Decrease) vs. Prior Year-to-date (000's) |

|---|---|

|

Operating Expenditures |

9,461 |

|

Capital Expenditures |

143 |

|

Transfer Payments (Voted and Statutory) |

(69,386) |

|

Contributions to Employee Benefit Plans |

105 |

Year-over-year changes are summarized as follows:

- Operating Expenditures – Further details by standard object can be found in Table 4.

- Capital Expenditures – Further details by standard object can be found in Table 4.

- Transfer Payments (Voted and Statutory) – Further details by program can be found in Table 3.

- Contributions to Employee Benefit Plans – Further details can be found in Table 1.

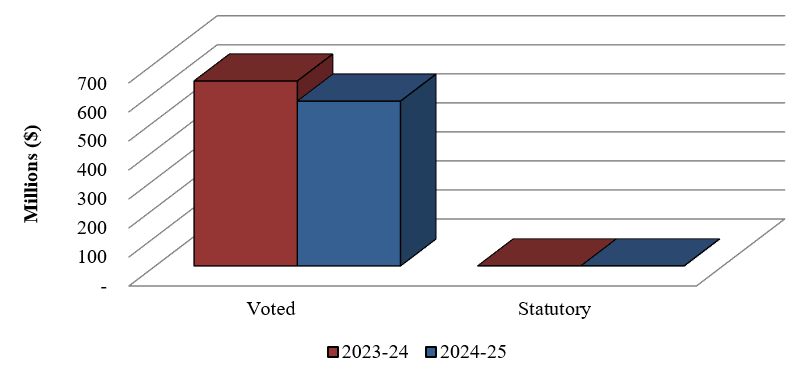

Graph 3: Comparison of Authorities used for Transfer Payments (Voted and Statutory) as of June 30, 2023 and June 30, 2024

Text description of Graph 3: Comparison of Authorities used for Transfer Payments (Voted and Statutory) as of June 30, 2023 and June 30, 2024

Bar graph showing the comparison of authorities used for Transfer Payment (Voted) and Transfer Payments (Statutory) as of June 30, 2023 and June 30, 2024.

- Voted transfer payments expensed as of Q1 2023-24 were $0.64 billion, compared with $0.57 billion as of Q1 2024-25.

- Statutory transfer payments expensed as of Q1 2023-24 were $0, compared with $0 as of Q1 2024-25.

Significant changes in year-to-date transfer payment expenditures between June 30, 2023 and June 30, 2024 were as follows:

| Program Fund |

Increase/(Decrease) vs. Prior Year-to-date (000's) |

|---|---|

|

New Building Canada Fund – National Infrastructure Component (NBCF - NIC) |

(33,265) |

|

Investing in Canada Infrastructure Program – Public Transit Infrastructure Stream (ICIP - PTIS) |

(19,204) |

|

Investing in Canada Infrastructure Program – COVID-19 Resilience Infrastructure Stream (ICIP - CVRIS) |

(9,209) |

|

Investing in Canada Infrastructure Program – Green Infrastructure Stream (ICIP - GIS) |

(8,619) |

|

New Building Canada Fund – Provincial-Territorial Infrastructure Component – National and Regional Projects (NBCF – PTIC - NRP) |

(7,724) |

|

Veteran Homelessness Program (VHP) |

6,392 |

|

Disaster Mitigation and Adaptation Fund (DMAF) |

5,955 |

|

Public Transit Infrastructure Fund (PTIF) |

4,952 |

|

Green and Inclusive Community Buildings (GICB) |

(4,400) |

|

New Building Canada Fund – Provincial-Territorial Infrastructure Component – Small Communities Fund (NBCF – PTIC - SCF) |

(4,161) |

Year-over-year changes are summarized as follows:

- NBCF-NIC – The program is approaching the end of its lifecycle (close to 70% of program funding has been disbursed). The $33.3 million decrease is due to no claims being received in Q1 of 2024-25.

- ICIP-PTIS – The $19.2 million decrease is mainly due to a decrease in claims received, particularly from British Columbia and Alberta.

- ICIP-CVRIS – The $9.2 million decrease is mainly due to agreements having been primarily executed at the height of the COVID-19 pandemic, particularly in Quebec, where $12.7 million was spent in Q1 of 2023-24 compared to no payments thus far in 2024-25. Payments under this stream are expected to continue to decrease as most ICIP-CVRIS projects are now either complete or nearing completion.

- ICIP-GIS – The $8.6 million decrease is mainly due to fewer overall claims received from recipients.

- NBCF-PTIC-NRP – The $7.7 million decrease is mainly due to fewer claims received in 2024-25, except from Alberta and Manitoba.

- VHP – This is a new program for which there was no spending in 2023-24. INFC began executing funding agreements with recipients in Q1 of 2024-25 with initial payments flowing shortly afterwards.

- DMAF – The $6 million increase is due to more claims received from Manitoba and Northwest Territories, offset by a decrease from Ontario.

- PTIF – While the program is coming to the end of its lifecycle (over 95% of program funding has been disbursed) and payments have been significantly reduced over the last fiscal years, the $5 million increase for Q1 compared to 2023-24 is related to claims received for Quebec projects.

- GICB – The $4.4 million decrease is due to fewer claims received thus far in 2024-25, particularly less payments for projects in Nova Scotia, offset by increased payments for projects in Ontario.

- NBCF-PTIC-SCF – The $4.2 million decrease is mainly due to a decrease in claims received, particularly from Ontario.

Departmental Budgetary Expenditures by Standard Object

The planned Departmental Budgetary Expenditures by Standard Object are set out in the table at the end of this report. Aggregate year-to-date expenditures in 2024-25 decreased by $0.06 billion, compared with the same quarter last year. The largest single factor was a decrease in transfer payments as explained above.

A breakdown of variances in year-to-date spending by standard object is below:

| Changes to Expenditures by Standard Object |

Increase/(Decrease) vs. Prior Year-to-date (000's) |

|---|---|

|

Personnel |

4,138 |

|

Transportation and communications |

(9) |

|

Information |

270 |

|

Professional and special services |

5,769 |

|

Rentals |

(28) |

|

Repair and maintenance |

(390) |

|

Utilities, materials and supplies |

1 |

|

Acquisition of land, buildings and works |

71 |

|

Acquisition of machinery and equipment |

(5) |

|

Transfer payments |

(69,387) |

|

Public debt charges |

(70) |

|

Other subsidies and payments |

(37) |

The most significant year-over-year changes are summarized as follows:

- Personnel – The increase is mainly due to employee growth from new funding received through recent Federal Budgets, as well as the ratification of collective bargaining agreements, as outlined in the authorities section above.

- Professional and special services – The increase is mainly due to the Climate Resilient Built Environment Memorandum of Understanding with the National Research Council which was expensed in Q2 of 2023-24.

- Transfer payments – Details were previously discussed.

Overall, INFC has spent 7.7% of its current Total Authorities as of June 30, 2024, compared to 7.2% at the end of Q1 in 2023-24.

Risks and Uncertainties

As part of its corporate risk management function, the Department regularly monitors and identifies strategic and department-wide risks that may affect the delivery of its mandate and expected results. INFC integrates risk management principles into strategic business planning, results-based management, decision-making and organizational processes to support the achievement of departmental priorities. Risk management at INFC is carried out in accordance with the Treasury Board Secretariat's (TBS) Framework for the Management of Risk, TBS's Guide to Integrated Risk Management.

The Corporate Risk Profile (CRP) is an important component of risk management as it is the primary document that describes the key risk information that should be considered in organizational decision-making and the achievement of departmental priorities. This document also serves as a cornerstone for implementing and monitoring risk responses to effectively address risks that could impede the success of INFC's priorities. INFC updates its CRP yearly and revises it every three years or when warranted as a result of significant changes in risk and threats or opportunities to the Department. This may include significant changes in mandate, changes to priorities and departmental direction, operational objectives, and other factors such as changing economic, political and environmental conditions that directly impact the Department.

The CRP for FY 2023-24 was updated in January 2024. Contrary to the 2022-23 update, the 2023-24 CRP does not feature a Financial Management risk as INFC has worked with provinces and territories to introduce improvements to the flow of funding processes to better align authorities of existing programs to expenditures and improve predictability of high materiality projects. It also used lessons learned from legacy programs to inform the design of new programs and introduce flexibility in funding mechanisms and basis of payments. Further, mandatory biannual reporting requirements and claim frequencies are being directly imbedded within agreement templates for new programs and we have accelerated the claims process once agreements are approved, improving forecasting accuracy. In addition, Treasury Board (TB) approved the lifting of INFC's temporary frozen allotments tied to early design projects as of June 2024. This business process change will improve INFC's financial management over its program funding envelope and will reduce annual grants and contributions lapses in the years to come.

The Department is currently revising its 2024-27 CRP, which is expected to be completed in Q3. The updated CRP will investigate whether any new financial management risks are deemed necessary in light of the recent growth in mandate and change in legislation, as well as the ambitious plan for the Department to develop, implement, and deliver on the new and renewed programming that was announced in the 2023 Fall Economic Statement and Budget 2024.

Significant Changes in Relation to Operations, Personnel and Programs

As stated above, pursuant to the Royal Assent of Bill C-59 on June 20, 2024, the Department's applied title changed from Infrastructure Canada to Housing, Infrastructure and Communities Canada (HICC).

In recognition of the important link between housing and infrastructure, the new legislation formalizes the mandate and role of the Department to advance national housing outcomes, reduce and prevent homelessness, and support and promote public infrastructure to foster inclusive, sustainable, and prosperous communities. This marks an important milestone in the Department's history. Integrating the mandate for housing and infrastructure under one department supports the alignment of the work across HICC, increasing the ability to address the most urgent priorities for Canadians.

As stated at the beginning of this report, the Quarterly Financial Report for Q1 of 2024-25 will be the last report for this department as INFC. All unspent authorities will be deemed appropriated to HICC and all future QFRs will be reported under the Department's new applied title.

As a result of its expanded mandate, we have begun building new capacities and functions within the Department to deliver on housing policy, and are working closely with the Canada Mortgage and Housing Corporation (CMHC) to advance a new partnership. This partnership includes the onboarding of CMHC employees to align human resource capacity to the recalibrated responsibilities between both organizations. The transition of the housing policy and program development to HICC is strengthening the government's overall capacity to provide advice and support on housing and homelessness issues.

In addition, since the last Quarterly Financial Report, the following significant changes have taken place within the Department:

- Pursuant to recent Budgets and the 2023 Fall Economic Statement (FES), the Department secured funding for the following initiatives:

- Canada Public Transit Fund - $3 billion ongoing to deliver stable funding for public transit providing municipalities, transit authorities and other groups with the resources they need to plan and implement key public transit projects over the long-term.

- Green and Inclusive Community Buildings - $500 million top-up over five (5) years to meet the incredible demand for energy-efficient and accessible community buildings across Canada and allow the Minister to approve funding for additional priority projects from coast to coast to coast.

- National Housing Strategy - $19 million over eight (8) years for the Affordable Housing Fund (AHF), Apartment Construction Loan Program (ACLP) and Federal Lands Initiative (FLI) in collaboration with CMHC to further support the Housing Strategy.

- Urban, Rural and Northern Indigenous Housing Strategy – $629 thousand over seven (7) years to narrow a core housing needs gap between Indigenous and non-Indigenous households in U.R.N. areas.

To deliver the new programming in a timely way, it is essential that INFC continue its efforts to attract and recruit employees through adaptable and innovative talent sourcing strategies and retain employees by investing in their professional development to meet business requirements, all while focusing on employee well-being. Initiatives to create an inclusive and barrier-free workplace will continue to be supported in order to ensure INFC remains a workplace of choice, made up of a workforce that is representative of the Canadians we serve.

The role and profile of the Department has grown over the last few years and Budget 2024 positions it well to deliver on the expanded and integrated portfolio. In the face of evolving challenges and growing housing needs, the mandate to design meaningful policies and provide communities with the tools they require to access INFC programs has never been more crucial.

The Department has a lot to look forward to, including:

- new programming that will provide water, wastewater, stormwater, and solid waste infrastructure that will directly enable new housing supply;

- more projects supported through the Green and Inclusive Community Buildings program;

- working collaboratively with Public Services and Procurement Canada (PSPC) and the Privy Council Office (PCO) to deliver a new Public Land Bank, which will contain an inventory of available federal lands, and a geo-spatial mapping tool; and;

- stabilizing funding for Reaching Home, putting communities on a solid footing for the coming years, and addressing the urgent issue of encampments and unsheltered homelessness.

The Department is committed to moving forward on the Budget 2024 measures referenced above in a timely manner as well as those in which it will play a collaborative role, such as a range of projects with CMHC, in an effort to deliver results for Canadians.

Approval by Senior Officials

Approved by:

Kelly Gillis

Deputy Head

Michelle Baron

Chief Financial Officer

Signed at Ottawa, Canada

Office of Infrastructure Canada

Quarterly Financial Report - Annex A

For the quarter ended June 30, 2024

Departmental budgetary expenditures by Standard Objects (unaudited)

(in thousands of dollars)

Fiscal year 2024-25

| N/A | Planned expenditures for the year ending March 31, 2025 |

Expended during the quarter ended June 30, 2024 |

Year-to-date used at quarter-end |

|---|---|---|---|

| Expenditures | |||

Personnel |

163,849 |

39,636 |

39,636 |

Transportation and communications |

1,987 |

299 |

299 |

Information |

1,601 |

465 |

465 |

Professional and special services |

53,069 |

11,253 |

11,253 |

Rentals |

4,130 |

1,089 |

1,089 |

Repair and maintenance |

19,286 |

3,075 |

3,075 |

Utilities, materials and supplies |

109 |

17 |

17 |

Acquisition of land, buildings and works |

13,484 |

1,302 |

1,302 |

Acquisition of machinery and equipment |

9,030 |

27 |

27 |

Transfer payments |

7,909,382 |

567,603 |

567,603 |

Public debt charges |

42,401 |

6,995 |

6,995 |

Other subsidies and payments |

- |

39 |

39 |

| Total net budgetary expenditures | 8,218,328 |

631,800 |

631,800 |

Departmental budgetary expenditures by Standard Objects (unaudited)

(in thousands of dollars)

Fiscal year 2023-24

| N/A | Planned expenditures for the year ending March 31, 2024 |

Expended during the quarter ended June 30, 2023 |

Year-to-date used at quarter-end |

|---|---|---|---|

| Expenditures | |||

|

Personnel |

142,447 |

35,498 |

35,498 |

|

Transportation and communications |

2,504 |

308 |

308 |

|

Information |

761 |

195 |

195 |

|

Professional and special services |

58,932 |

5,484 |

5,484 |

|

Rentals |

4,121 |

1,117 |

1,117 |

|

Repair and maintenance |

24,061 |

3,465 |

3,465 |

|

Utilities, materials and supplies |

74 |

16 |

16 |

|

Acquisition of land, buildings and works |

77,497 |

1,231 |

1,231 |

|

Acquisition of machinery and equipment |

4,089 |

32 |

32 |

|

Transfer payments |

9,283,956 |

636,990 |

636,990 |

|

Public debt charges |

45,897 |

7,065 |

7,065 |

|

Other subsidies and payments |

- |

76 |

76 |

| Total net budgetary expenditures |

9,644,338 |

691,475 |

691,475 |

Download

If the following document is not accessible to you, please contact info@infc.gc.ca for assistance.

Office of Infrastructure Canada

Quarterly Financial Report - Annex A

For the quarter ended June 30, 2024

Statement of Authorities (unaudited)

(in thousands of dollars)

Fiscal Year 2024-25

| N/A | Total available for use for the year ending March 31, 2025 |

Used during the quarter ended June 30, 2024 |

Year-to-date used at quarter-end |

|---|---|---|---|

| Vote 1 – Operating expenditures |

270,865 |

57,974 |

57,974 |

| Vote 5 – Capital expenditures |

18,774 |

1,408 |

1,408 |

| Vote 10 – Grants and Contributions |

5,541,224 |

567,604 |

567,604 |

| Budgetary Statutory Authorities | |||

| (S) – Contributions to employee benefit plans |

19,208 |

4,798 |

4,798 |

| (S) – Canada Community-Building Fund |

2,368,158 |

- |

- |

| (S) – Minister salary and car allowance |

99 |

16 |

16 |

| Total Budgetary Authorities |

8,218,328 |

631,800 |

631,800 |

| Non-Budgetary Authorities |

- |

- |

- |

| Total Authorities |

8,218,328 |

631,800 |

631,800 |

Statement of Authorities (unaudited)

(in thousands of dollars)

Fiscal Year 2023-24

| N/A | Total available for use for the year ending March 31, 2024 |

Used during the quarter ended June 30, 2023 |

Year-to-date used at quarter-end |

|---|---|---|---|

| Vote 1 – Operating expenditures |

247,556 |

48,505 |

48,505 |

| Vote 5 – Capital expenditures |

93,867 |

1,265 |

1,265 |

| Vote 10 – Grants and Contributions |

6,916,338 |

636,990 |

636,990 |

| Budgetary Statutory Authorities | |||

| (S) – Contributions to employee benefit plans |

18,770 |

4,693 |

4,693 |

| (S) – Canada Community-Building Fund |

2,367,617 |

- |

- |

| (S) – Minister salary and car allowance |

189 |

24 |

24 |

| Total Budgetary Authorities |

9,644,338 |

691,475 |

691,475 |

| Non-Budgetary Authorities |

- |

- |

- |

| Total Authorities |

9,644,338 |

691,475 |

691,475 |

Download

If the following document is not accessible to you, please contact info@infc.gc.ca for assistance.

- Statement of Authorities (PDF version) (46.67 KB)

Report a problem on this page

- Date modified: