Office of Infrastructure of Canada

Quarterly Financial Report for the quarter ended December 31, 2022

Office of Infrastructure of Canada

Quarterly Financial Report for the quarter ended December 31, 2023

Office of Infrastructure of Canada

Quarterly Financial Report for the quarter

ended December 31, 2023

(PDF Version)

Statement outlining results, risks and significant changes in operations, personnel and programs

Introduction

This quarterly report has been prepared by management as required by Section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Treasury Board. This quarterly report should be read in conjunction with the Main Estimates as well as Budget 2023.

The key to building Canada for the 21st century is a strategic and collaborative long-term infrastructure plan that builds economically vibrant, strategically planned, sustainable and inclusive communities. Infrastructure Canada (INFC) works closely with all orders of government and other partners to enable investments in housing, social, green, public transit and other core public infrastructure, as well as trade and transportation infrastructure.

Further information on INFC’s mandate, responsibilities, and programs can be found in INFC’s 2023-24 Main Estimates.

Basis of Presentation

This quarterly report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities includes INFC’s spending authorities granted by Parliament and those used by INFC consistent with the Main Estimates and Supplementary Estimates for the 2023-24 fiscal year (FY). This quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before monies can be spent by the government. Approvals are given in the form of annually approved limits through Appropriation Acts or through legislation in the form of statutory spending authority for specific purposes.

INFC uses the full accrual method of accounting to prepare and present its annual departmental financial statements that are part of the departmental performance reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

In the past, INFC has worked in collaboration with other federal departments and agencies to deliver some of its transfer payment programs (collectively known as federal delivery partners) and that remains accurate for the 2023-24 fiscal year.

It should be noted that this quarterly report has not been subject to an external audit or review.

Highlights of Fiscal Quarter and Fiscal Year-to-Date Results

This section highlights the significant items that contributed to the change in resources available for use from 2022-23 to 2023-24 and in actual expenditures from 2022-23 to 2023-24 as of December 31 (third fiscal quarter).

Authorities

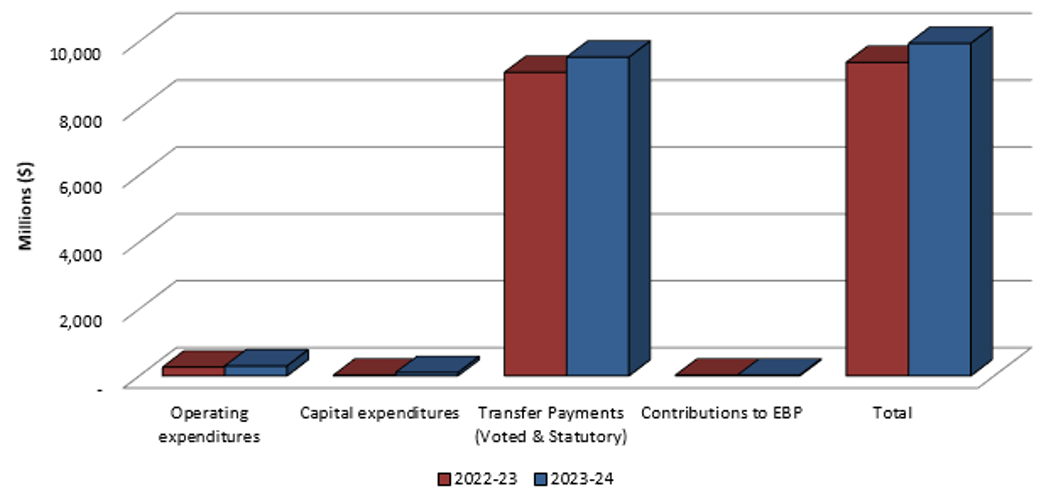

Graph 1: Comparison of Authorities Available as of December 31, 2022 and December 31, 2023

Text description of Graph 1: Comparison of Authorities Available as of December 31, 2022 and December 31, 2023

Bar graph showing the comparison of authorities available for use as of December 31, 2022 and December 31, 2023.

- Operating authorities available as of Q3 2022-23 were $258.8 million, compared with $294.4 million as of Q3 2023-24.

- Capital authorities available as of Q3 2022-23 were $21.7 million, compared with $97.1 million as of Q3 2023-24.

- Contribution (Voted and Statutory) authorities available as of Q3 2022-23 were $9.1 billion, compared with $9.5 billion as of Q3 2023-24.

- Contributions to the Employee Benefit Plan authorities available as of Q3 2022-23 were $18.8 million, compared with $21.7 million as of Q3 2023-24.

- The total of authorities available for use as of Q3 2022-23 were $9.4 billion, compared with $9.9 billion as of Q3 2023-24.

As shown in the Statement of Authorities, INFC’s total authorities available for 2023-24 are $9.9 billion as of the end of Quarter 3 (Q3) and represent a $0.6 billion increase compared to the same quarter in the prior year (PY).

This increase is summarized in the table below:

| Authorities |

Increase/(Decrease) vs. Prior Year-to-date (000's) |

|---|---|

Operating Expenditures |

35,624 |

Capital Expenditures |

75,359 |

Transfer Payments (Voted and Statutory) |

456,090 |

Contributions to Employee Benefit Plans (EBP) |

2,854 |

Year-over-year changes are summarized as follows:

- Operating Expenditures – The increase is mainly due to new funding announced through the Budget 2021 to deliver the National Infrastructure Assessment, through Budget 2022 to deliver the High Frequency Rail project and to implement the Veteran Homelessness Program, and through Budget 2023 to support resilient infrastructure in the face of changing climate. Finally, the increase is also attributable to funding for the ratification of collective bargaining agreements.

- Capital Expenditures – The increase in capital funding is primarily related to the Samuel de Champlain Bridge Corridor project.

- Transfer Payments (Voted and Statutory) – This increase is mainly related to the ramp up of the Investing in Canada Program and the Permanent Public Transit Program. The increase is also attributable to new funding such as funding to support resilient infrastructure in the face of a changing climate and funding to implement the Veteran Homelessness Program.

- Contributions to Employee Benefit Plans – This increase is reflective of the growth in full time equivalents (FTEs) associated with the new Programs listed in the Operating Expenditures section and INFC's expanding mandate.

Expenditure Analysis

Expenditures at the end of Q3 were $4.1 billion, compared to $3.7 billion reported in the same period of 2022-23, representing an increase of 9.5%. The source of the relative increase is demonstrated in the tables, graphs and analysis below.

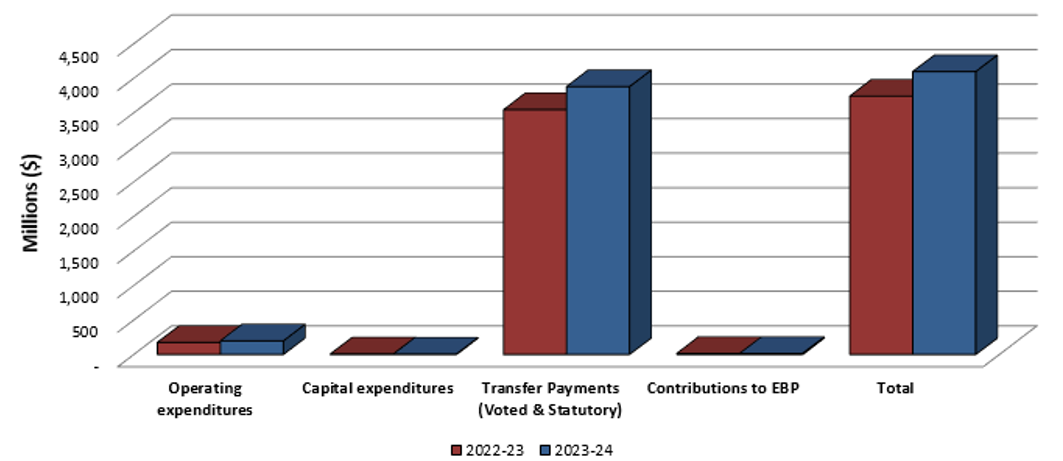

Graph 2: Comparison of Total Expenditures as of December 31, 2022 and December 31, 2023

Text description of Graph 2: Comparison of Total Expenditures as of December 31, 2022 and December 31, 2023

Bar graph showing the comparison of total expenditures used year-to-date as of December 31, 2022 and December 31, 2023.

- Authorities used for Operating as of Q3 2022-23 were $174.6 million, compared with $196.5 million as of Q3 2023-24.

- Authorities used for Capital as of Q3 2022-23 were $8.0 million, compared with $5.8 million as of Q3 2023-24.

- Authorities used for Contributions (Voted and Statutory) as of Q3 2022-23 were $3.5 billion compared with $3.9 billion as of Q3 2023-24.

- Authorities used for Contributions to the Employee Benefit Plan as of Q3 2022-23 were $14.1 million, compared with $14.1 million as of Q3 2023-24.

- Total year-to-date budgetary expenditures as of Q3 2022-23 were $3.7 billion, compared to $4.1 billion as of Q3 2023-24.

| Year-to-date expenditures |

Increase/(Decrease) vs. Prior Year-to-date (000's) |

|---|---|

Operating Expenditures |

21,902 |

Capital Expenditures |

(2,210) |

Transfer Payments (Voted and Statutory) |

334,550 |

Contributions to Employee Benefit Plans |

(45) |

Year-over-year changes are summarized as follows:

- Operating Expenditures – Further details by standard object can be found in Table 4.

- Capital Expenditures – Further details by standard object can be found in Table 4.

- Transfer Payments (Voted and Statutory) – Further details by program can be found in Table 3.

- Contributions to Employee Benefit Plans – The variance is minimal.

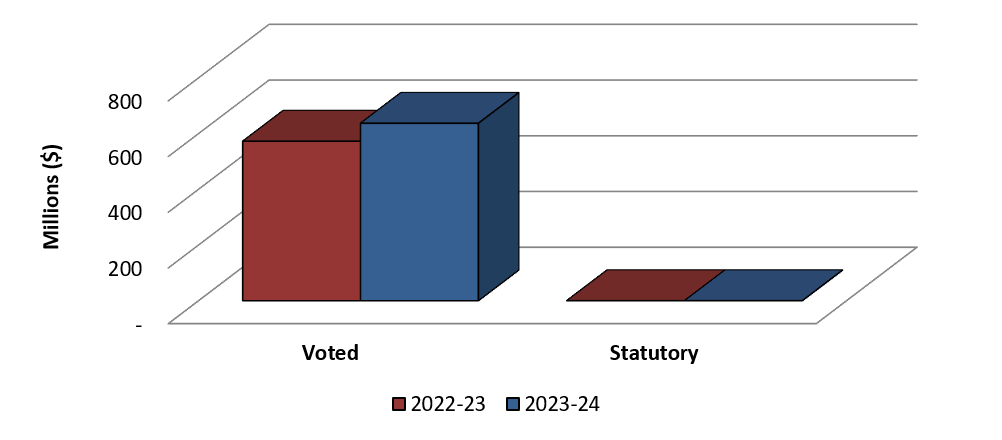

Graph 3: Comparison of Authorities used for Transfer Payments (Voted and Statutory) as of December 31, 2022 and December 31, 2023

Text description of Graph 3: Comparison of Authorities used for Transfer Payments (Voted and Statutory) as of December 31, 2022 and December 31, 2023

Bar graph showing the comparison of authorities used for Transfer Payment (Voted) and Transfer Payments (Statutory) as of December 31, 2022 and December 31, 2023.

- Transfer payments expensed as of Q3 2022-23 were $1.3 billion, compared with $1.6 billion as of Q3 2023-24.

- Total year-to-date transfer payments expensed as of Q3 2022-23 were $3.5 billion, compared with $3.9 billion as of Q3 2023-24.

Significant changes in year-to-date transfer payment expenditures between December 2022 and December 2023 were as follows:

| Program Fund |

Increase/(Decrease) vs. Prior Year-to-date (000's) |

|---|---|

Canada Community-Building Fund |

341,531 |

New Building Canada Fund-Provincial-Territorial Infrastructure Component-National and Regional Projects |

261,664 |

Investing in Canada Infrastructure Program - COVID-19 Resilience Infrastructure Stream |

(255,428) |

Green and Inclusive Community Buildings |

94,055 |

Investing in Canada Infrastructure Program - Public Transit Infrastructure Stream |

87,014 |

Toronto Waterfront Revitalization Initiative |

(64,782) |

New Building Canada Fund-National Infrastructure Component |

(53,951) |

Investing in Canada Infrastructure Program - Green Infrastructure Stream |

33,820 |

Disaster Mitigation and Adaptation Fund |

(31,766) |

Year-over-year changes are summarized as follows:

- Canada Community-Building Fund (CCBF) – an increase of $341.5 million mainly due to earlier second payments to several jurisdictions, and the regular index-based increase to the CCBF annual allocation in 2023-24.

- New Building Canada Fund-Provincial-Territorial Infrastructure Component-National and Regional Projects (NBCF-PTIC-NRP) – an increase of $261.7 million mainly due to more claims received in 2023-24, particularly from Quebec and Ontario.

- Investing in Canada Infrastructure Program – COVID-19 Resilience Infrastructure Stream (ICIP-CVRIS) – a decrease of $255.4 million mainly due to CVRIS agreements having been primarily executed through the COVID-19 pandemic. Payments under this stream are expected to continue to decrease.

- Green and Inclusive Community Buildings (GICB) – an increase of $94.1 million due to a greater number of claims received in 2023-24, particularly from Ontario, Manitoba, Nova Scotia and Alberta. This program is ramping up with an increased number of contribution agreements signed allowing for funding to flow to recipients for approved projects.

- Investing in Canada Infrastructure Program – Public Transit Infrastructure Stream (ICIP-PTIS) – an increase of $87.0 million mainly due to more claims received in 2023-24, particularly from Ontario and Alberta.

- Toronto Waterfront Revitalization Initiative (TWRI) – a decrease of $64.8 million due to program spending ramping down with an expected program closure currently planned for 2024-25.

- New Building Canada Fund-National Infrastructure Component (NBCF-NIC) – a decrease of $54.0 million is mainly due to less claims received in 2023-24, particularly from British Columbia.

- Investing in Canada Infrastructure Program – Green Infrastructure Stream (ICIP-GIS) – an increase of $33.8 million mainly due to more claims received in 2023-24 from the majority of jurisdictions, offset by a decrease in the claims received from Quebec.

- Disaster Mitigation and Adaptation Fund (DMAF) – a decrease of $31.8 million due to fewer claims received in 2023-24, mainly from projects in Ontario.

Departmental Budgetary Expenditures by Standard Object

The planned Departmental Budgetary Expenditures by Standard Object are set out in the table at the end of this report. Aggregate year-to-date expenditures in 2023-24 increased by $354.2 million, compared with the same quarter last year. The largest single factor was an increase in transfer payments as explained above.

A breakdown of variances in year-to-date spending by standard object is below:

| Changes to Expenditures by Standard Object |

Increase/(Decrease) vs. Prior Year-to-date (000's) |

|---|---|

Personnel |

28,957 |

Transportation and communications |

217 |

Information |

113 |

Professional and special services |

(11,455) |

Rentals |

300 |

Repair and maintenance |

2,509 |

Utilities, materials and supplies |

- |

Acquisition of land, buildings and works |

271 |

Acquisition of machinery and equipment |

(1,071) |

Transfer payments |

334,550 |

Public debt charges |

(270) |

Other subsidies and payments |

76 |

The most significant year-over-year changes are summarized as follows:

- Personnel – The increase is mainly due to employee growth associated with new funding announced through Budget 2021 (National Infrastructure Assessment), through Budget 2022 (High Frequency Rail, Veteran Homelessness Program), through Budget 2023 (to support resilient infrastructure in the face of changing climate), as well as funding for the ratification of collective bargaining agreements. The increase is also attributable to the Reaching Home program transition from Employment and Social Development Canada.

- Professional and special services – The decrease in expenditures is mainly attributable to the lower value of the Memorandum of Understanding with Employment and Social Development Canada in 2023-24 compared to 2022-23 as a result of the continued transition of the Reaching Home program within INFC.

- Repair and maintenance – The increase is mainly related to the Samuel de Champlain Bridge Corridor project as construction of the bridge is well underway and nearing completion.

- Transfer payments – Details were previously discussed.

Overall, INFC has spent 41% of its current Total Authorities as of December 31, 2023, compared to 40% at the end of Q3 in 2022-23.

Risks and Uncertainties

As part of the Department’s corporate risk management function, the Department regularly monitors and identifies strategic and department-wide risks that may affect the delivery of the Department’s mandate and expected results. INFC integrates risk management principles into strategic business planning, results-based management, decision-making and organizational processes to support the achievement of departmental priorities. Risk management at INFC is carried out in accordance with the Treasury Board Secretariat's (TBS) Framework for the Management of Risk, TBS’s Guide to Integrated Risk Management, and INFC's Integrated Risk Management Framework.

The Corporate Risk Profile (CRP) is an important component of risk management as it is the primary document that describes the key risk information that should be considered in organizational decision-making and the achievement of departmental priorities. This document also serves as a cornerstone for implementing and monitoring risk responses to effectively address risks that could impede the success of INFC’s priorities. INFC updates its CRP yearly and revamps it every three years or when warranted as a result of significant changes in risk and threats or opportunities to the department. This may include significant changes in mandate, changes to priorities and departmental direction, operational objectives and other factors such as changing economic, political and environmental conditions that directly impact the department.

The INFC’s CRP was last updated during the third quarter of 2023-24 to reflect the significant changes in its mandate and the current environment. In line with the last update, there were no Financial Management risks that were retained as INFC’s top corporate risks given the continued improvements made in recent years on the Flow of Funding and positive results under the Management Accountability Framework (MAF) Area of Management. Work with provinces and territories to introduce improvements to the flow of funding processes to better align authorities of existing programs to expenditures and improve predictability of high materiality projects is ongoing. Lessons learned from past programming are used to continue improving the design of new programs in areas such as funding mechanism, basis of payment, mandatory reporting requirements and claim frequencies which will likely continue to accelerate the claims process once agreements are approved and improve forecasting accuracy.

Significant Changes in Relation to Operations, Personnel and Programs

INFC continues to grow and evolve. Since the last Quarterly Financial Report, the following significant change has taken place within the department:

- INFC has secured $6.7M over two years to finalize negotiations with CN towards the potential repatriation and rehabilitation of the Quebec Bridge.

- Included as a frozen allotment in Supplementary Estimates B, Refocusing Government Spending reduced INFC’s operating budget by $1.6M for fiscal year 2023-24. More information on future years reductions will be made available in the 2024-25 Departmental Plan.

In the 2023 Fall Economic Statement, the government proposed to introduce legislation that would establish the Department of Housing, Infrastructure and Communities (currently Infrastructure Canada) and clarify the department’s powers, duties, and functions. The review of the legislation is underway, currently proceeding in the House of Commons before being reviewed by the Senate for final approval. As the department evolves and transitions towards becoming the Department of Housing, Infrastructure and Communities, it will support the government in delivering on Canada’s housing priorities.

While INFC will increase its focus on harmonization of policy functions across the organization (i.e. housing and homelessness) with regular infrastructure policy development in order to ensure an integrated approach, it will also need to adapt to new ways of working as well as for its employees to gain new skills and competencies to undertake the work in the immediate and longer term. INFC will continue its effort to attract and recruit employees through adaptable and innovative talent sourcing strategies and retain employees by investing in their professional development to meet business requirements, all while focusing on employee well-being. Initiatives to create an inclusive and barrier-free workplace will continue to be supported in order to ensure INFC is a workplace of choice, made up of a workforce representative of the Canadians we serve.

INFC is committed to making infrastructure investments that support housing outcomes, economic growth and job creation, help combat the effects of climate change, and build inclusive communities. As current programs are winding down and the department turns its attention towards developing and launching a suite of new programming, resource management practices and sound financial stewardship are front and center in ensuring successful delivery. To support program delivery, INFC is undertaking the following initiatives:

- Provide internal advice and a full range of financial services and related reporting.

- Support the organization in securing funding that will enable the achievement of its priorities and goals, including future programming and the transition of the housing policy mandate.

- Support INFC's operational requirements and grow regional presence in an environment of fiscal restraints.

- Mature corporate processes, planning and reporting functions; including results reporting, investment planning and project management, budgeting and forecasting while promoting opportunities for automation and/or increasing efficiency.

Approval by Senior Officials

Approved by:

Kelly Gillis

Deputy Head

Michelle Baron

Chief Financial Officer

Signed at Ottawa, Canada

Office of Infrastructure Canada

Quarterly Financial Report

For the quarter ended December 31, 2023

Departmental budgetary expenditures by Standard Objects (unaudited)

(in thousands of dollars)

Fiscal year 2023-24

| N/A | Planned expenditures

for the year ending March 31, 2024 |

Expended during the

quarter ended December 31, 2023 |

Year-to-date used

at quarter-end |

|---|---|---|---|

| Expenditures: | |||

| Personnel | 167,615 |

54,856 |

135,621 |

| Transportation and communications | 3,311 |

542 |

1,214 |

| Information | 1,531 |

171 |

489 |

| Professional and special services | 77,977 |

10,170 |

29,210 |

| Rentals | 5,166 |

484 |

1,872 |

| Repair and maintenance | 24,415 |

7,102 |

14,173 |

| Utilities, materials and supplies | 693 |

45 |

87 |

| Acquisition of land, buildings and works | 78,637 |

1,894 |

4,994 |

| Acquisition of machinery and equipment | 7,284 |

197 |

385 |

| Transfer payments | 9,530,410 |

1,605,862 |

3,878,448 |

| Public debt charges | 46,572 |

10,550 |

28,192 |

| Other subsidies and payments | - |

-27 |

80 |

| Total net budgetary expenditures | 9,943,611 |

1,691,846 |

4,094,765 |

Departmental budgetary expenditures by Standard Objects (unaudited)

(in thousands of dollars)

Fiscal year 2022-23

| N/A | Planned expenditures

for the year ending March 31, 2023 |

Expended during the

quarter ended December 31, 2022 |

Year-to-date used

at quarter-end |

|---|---|---|---|

| Expenditures: | |||

| Personnel | 144,936 |

38,681 |

106,664 |

| Transportation and communications | 1,191 |

606 |

997 |

| Information | 949 |

73 |

376 |

| Professional and special services | 64,389 |

20,982 |

40,665 |

| Rentals | 4,930 |

456 |

1,572 |

| Repair and maintenance | 15,045 |

4,556 |

11,664 |

| Utilities, materials and supplies | 98 |

56 |

87 |

| Acquisition of land, buildings and works | 11,206 |

1,792 |

4,723 |

| Acquisition of machinery and equipment | 3,040 |

470 |

1,456 |

| Transfer payments | 9,074,320 |

1,266,601 |

3,543,898 |

| Public debt charges | 53,580 |

10,653 |

28,462 |

| Other subsidies and payments | - |

1 |

4 |

| Total net budgetary expenditures | 9,373,684 |

1,344,927 |

3,740,568 |

Download

If the following document is not accessible to you, please contact info@infc.gc.ca for assistance.

- Departmental budgetary expenditures by Standard Objects (PDF version) (105.04 KB)

Office of Infrastructure Canada

Quarterly Financial Report

For the quarter ended December 31, 2023

Statement of Authorities (unaudited)

(in thousands of dollars)

Fiscal Year 2023-24

| N/A | Total available for use for the year ending March 31, 2024 |

Used during the quarter ended December 31, 2023 |

Year-to-date used at quarter-end |

|---|---|---|---|

| Vote 1 – Operating expenditures | 294,256 |

79,017 |

196,377 |

| Vote 5 – Capital expenditures | 97,072 |

2,251 |

5,752 |

| Vote 10 – Grants and Contributions | 7,162,793 |

605,586 |

1,694,364 |

| Budgetary Statutory Authorities | |||

| (S) – Contributions to employee benefit plans | 21,683 |

4,692 |

14,077 |

| (S) – Canada Community-Building Fund | 2,367,617 |

1,000,276 |

2,184,084 |

| (S) – Minister salary and car allowance | 190 |

24 |

111 |

| Total Budgetary Authorities | 9,943,611 |

1,691,846 |

4,094,765 |

| Non-Budgetary Authorities | - |

- |

- |

| Total Authorities | 9,943,611 |

1,691,846 |

4,094,765 |

Statement of Authorities (unaudited)

(in thousands of dollars)

Fiscal Year 2022-23

| N/A | Total available for use for the year ending March 31, 2023 |

Used during the quarter ended December 31, 2022 |

Year-to-date used at quarter-end |

|---|---|---|---|

| Vote 1 – Operating expenditures | 258,637 |

70,223 |

174,517 |

| Vote 5 – Capital expenditures | 21,713 |

3,373 |

7,962 |

| Vote 10 – Grants and Contributions | 6,805,354 |

558,531 |

1,701,344 |

| Budgetary Statutory Authorities | |||

| (S) – Contributions to employee benefit plans | 18,829 |

4,707 |

14,122 |

| (S) – Canada Community-Building Fund | 2,268,966 |

708,070 |

1,842,554 |

| (S) – Minister salary and car allowance | 185 |

23 |

69 |

| Total Budgetary Authorities | 9,373,684 |

1,344,927 |

3,740,568 |

| Non-Budgetary Authorities | - |

- |

- |

| Total Authorities | 9,373,684 |

1,344,927 |

3,740,568 |

Download

If the following document is not accessible to you, please contact info@infc.gc.ca for assistance.

- Statement of Authorities (PDF version) (84.19 KB)

Report a problem on this page

- Date modified: