Minister of Infrastructure and Communities Transition Book (October 2019)

Program Overview

Section A: This section includes program descriptions where project applications for approval are ongoing.

- Infrastructure Canada Programming

- Investing in Canada Plan

- Investing In Canada Infrastructure Program

- Disaster Mitigation and Adaptation Fund

- Smart Cities Challenge

- Gas Tax Fund

- Municipal Asset Management Program

- Municipalities for Climate Innovation Program

- Green Municipal Fund

Section B: This section includes program descriptions where project applications are no longer being accepted, and funding is committed and ongoing.

- Public Transit Infrastructure Fund and Clean Water and Wastewater Fund

- New Building Canada Fund

- P3 Canada Fund

- Green Infrastructure Fund

- Building Canada Fund

- Border Infrastructure Fund and Canada Strategic Infrastructure Fund

Section C: This section includes program descriptions that detail Infrastructure Canada's current research and data initiatives, along with research partnerships and grants with other departments.

- Research and Knowledge Initiative

- Climate-Resilient Buildings and Core Public Infrastructure Initiative

- Infrastructure Data Initiatives

Section D: This section describes two projects that Infrastructure Canada directly manages via two Crown Corporations.

Section E: This section describes Infrastructure Canada's portfolio organizations, their mandates, and flags area of responsibility.

- Canada Infrastructure Bank

- Toronto Waterfront Revitalization Initiative

- Windsor Detroit Bridge Authority

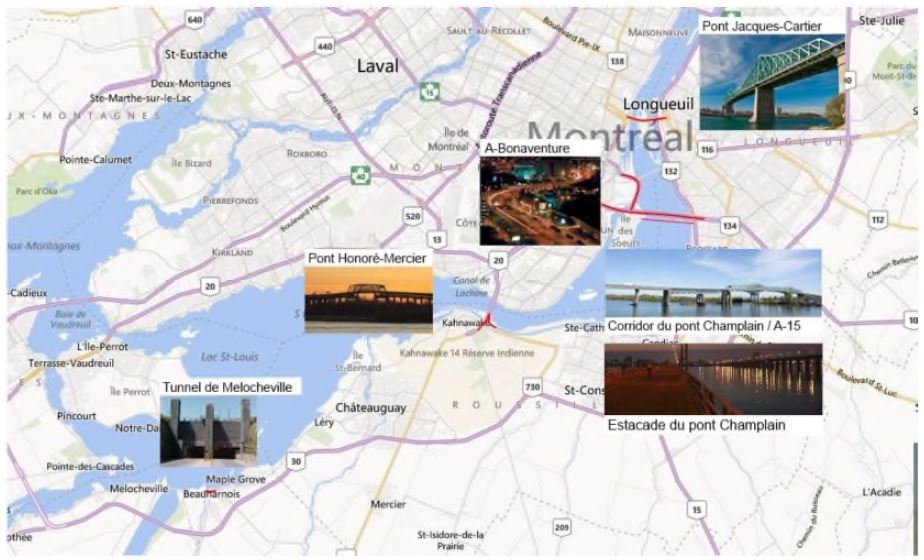

- Jacques Cartier and Champlain Bridges Incorporated

INFRASTRUCTURE CANADA PROGRAMMING

Active Programs

Investing in Canada Infrastructure Program

$31.3 B, Allocation Program ($22.2 B Available)- Cost-share funding through Bilateral Agreements.

- Four investment streams:

- Public Transit

- Green

- Community, Culture and Recreation

- Rural and Northern Communities

- Intake process: Open

- Program duration: 2018-28

Disaster Mitigation and Adaptation Fund

$2 B, Merit-Based Program ($232.2 M Available)

- Large-scale investments ($20 M+).

- Enables communities to better withstand current and future natural risks.

- Intake process: By Round

- Program duration: 2018-28

Smart Cities Challenge

$300 M, Merit-Based Program ($176.3 M Available)- Challenges communities to adopt a smart city approach to program design and delivery.

- Focuses on innovation, data and connected technology.

- Intake process: By Round

- Program duration: 2017-27

Federal Gas Tax Fund

$2.2 B Annually, Allocation Program

- Permanent, ongoing funding for local projects.

- Intake process: Open

- Program duration: Ongoing

Active Programs Delivered By the Federation Of Canadian Municipalities

Municipal Asset Management Program

$110 M, Allocation Program ($52.8 M Available)

- Direct support to municipalities.

- Build capacity for asset management practices.

- Intake process: Open

- Program duration: 2017-24

Green Municipal Fund

$1.75 B, Allocation Program (Not INFC-funded)- Encourages municipal environmental projects through grants, loans, and loan guarantees.

- Infrastructure Canada provides oversight and strategic advice, but no funding.

- Intake process: Open

- Program duration: 2017-24

Municipalities for Climate Innovation Program

$75 M, Allocation Program

- Encourages municipalities to prepare for climate-related challenges.

- Promotes greenhouse gas reduction.

- Intake process: Closed

- Program duration: 2017-24

Legacy Programs

New Building Canada Fund

$12.8 B, Allocation/Merit-Based Program

- Funding for projects that contribute to economic growth, a clean environment, and stronger communities.

- Two Components:

- Provincial-Territorial Infrastructure

- National Infrastructure

- Intake process: Closed

- Fully Committed

- Program duration: 2016-28

Building Canada Fund

$7.8 B, Allocation Program

- Investments in large-scale projects (National Highway System, public transit and green energy), and small-scale projects (cultural and sport facilities).

- Two components:

- Major Infrastructure

- Communities

- Application Process: Closed

- Fully Committed

- Program duration: 2009-23

Clean Water and Wastewater Fund

$2 B, Allocation Program

- Short-term funding for the rehabilitation, optimization and planning of water and wastewater infrastructure.

- Intake process: Closed

- Fully Committed

- Program duration: 2016-21

Green Infrastructure Fund

$743.9 M, Merit-Based Program

- Supports projects that improve environmental quality and long-term economic sustainability.

- Intake process: Closed

- Fully Committed

- Program duration: 2009-28

Border Infrastructure Fund

$592 M, Merit-Based Program

- Funding for physical infrastructure that aided the free-flow of people and goods across Canada’s borders.

- Intake process: Closed

- Fully Committed

- Program duration: 2003-21

Public Transit Infrastructure Fund

$3.4 B, Allocation Program

- Short-term funding for public transit rehabilitation and planning of public transit systems.

- Intake process: Closed

- Fully Committed

- Program duration: 2016-21

Canada Strategic Infrastructure Fund

$4.7 B, Merit-Based Program

- Funding for large-scale, strategic projects focused on economic performance and urban development.

- Intake process: Closed

- Fully Committed

- Program duration: 2002-21

P3 Canada Fund

$1.4 B, Allocation Program

- Advanced the public-private partnerships model within local and regional governments through long-term financial agreements.

- Intake process: Closed

- Fully Committed

- Expected funding duration: 2009-23

Data and research programs

Climate-Resilient Buildings and Core Public Infrastructure Initiative

$42.5 M, Research Program

- Provides funding to the National Research Council to develop guidelines, standards and specifications to inform changes to building codes in Canada.

- Fully Committed

- Program duration: 2018-24

Research and Knowledge Initiative

$10 M, Merit-Based Program ($7 M Available)- Aims to build external capacity by funding research and data projects that contribute to evidence-based decision-making for future investments.

- Intake process: Not yet launched

- Program duration: 2018-24

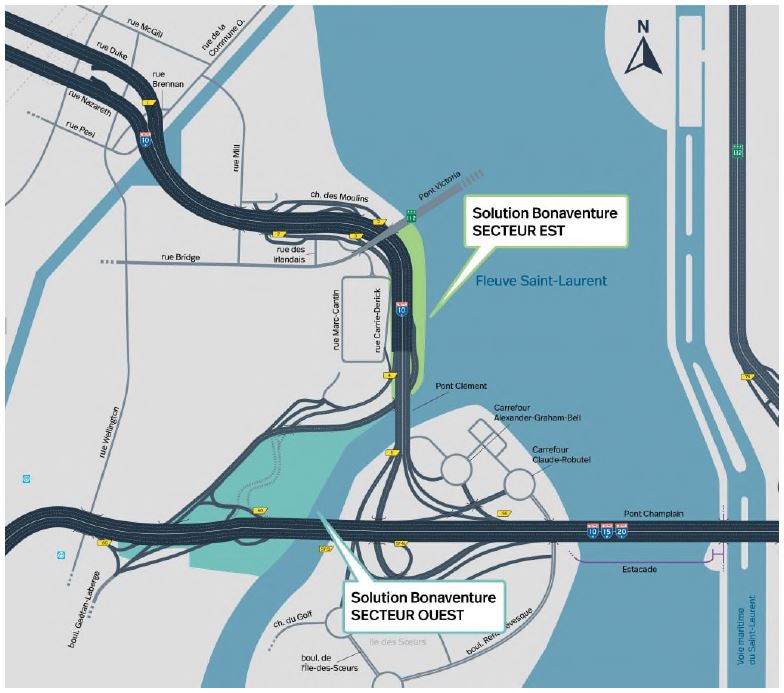

Major Bridge Projects

Gordie Howe International Bridge

$5.7 B, Bridge + Border Facilities Project

- A nation-building international crossing project that will provide additional capacity at the busiest

- Canada-U.S. trade corridor.

- Will accommodate future growth in traffic and trade, and create long term jobs and economic opportunity in both countries.

- Program Construction: 2018-24

Samuel De Champlain Bridge

$4.5 B, Bridge Project

- A replacement for one of Canada’s busiest bridges.

- Will allow for the continued generation of approx.

- $20 B in international trade per year.

- A crucial commuter and commercial link to the

- Montreal area and the Province of Quebec.

- Project Construction: 2015-19

Other Portfolio Initiatives

Canada Infrastructure Bank

$35 B (Current Funding), Crown Corporation

- Crown Corporation mandated use federal support to attract private sector and institutional investment into new, revenue-generating projects.

- investments in public transit, trade and transportation corridors, green infrastructure, and broadband.

- Years of operation: Ongoing (Current Funding to 2028)

Toronto Waterfront Tripartite Project

- Tripartite revitalization initiative to develop a major piece of underdeveloped property at the waterfront in the City of Toronto.

INVESTING IN CANADA PLAN

MANDATE

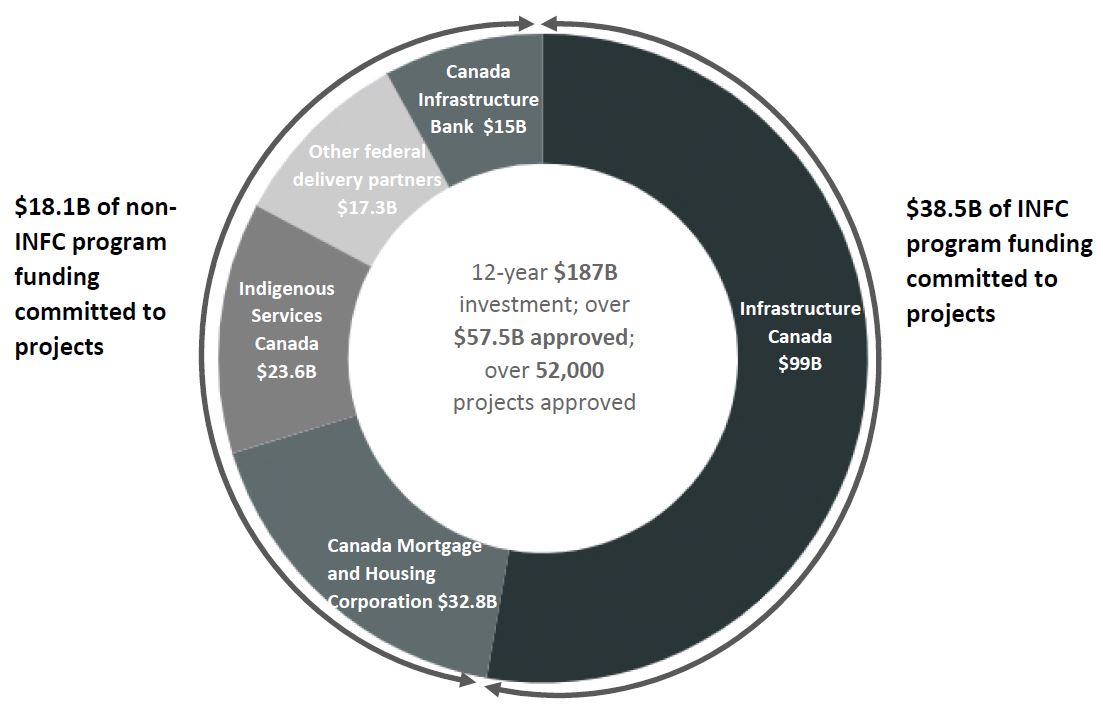

- Comprised of over seventy programs administered by a number of federal delivery partners, including Infrastructure Canada, the twelve-year, over $187 billion Investing in Canada Plan is a national strategy to address Canada's infrastructure needs through long-term investments.

DESCRIPTION

- The Investing in Canada Plan was announced in Budget 2016 with the Minister of Infrastructure and Communities as the lead Minister responsible for the overall implementation and reporting on the progress of the Plan. Infrastructure Canada is also directly responsible for the majority of the program funding ($99 billion) delivered under the Plan.

- Through the Plan, the Government of Canada is making investments in infrastructure to provide communities across the country with the tools they need to prosper and innovate. Investments are made across five priority areas:

- public transit infrastructure;

- green infrastructure;

- social infrastructure;

- trade and transportation infrastructure; and

- rural and northern communities infrastructure.

- These investments aim to create long-term economic growth, help build inclusive, sustainable communities and support a low carbon, green economy. The seven expected outcomes of the Plan are that the:

- rate of economic growth is increased in an inclusive and sustainable way;

- environmental quality is improved, greenhouse gas emissions are reduced and resilience of communities is increased;

- urban mobility is improved in Canadian communities;

- housing is affordable and in good condition and homelessness is reduced year over year;

- early learning and childcare is of high quality, affordable, flexible and inclusive;

- Canadian communities are more inclusive and accessible; and

- infrastructure is managed in a more sustainable way.

- Infrastructure Canada works with a number of federal delivery partners in delivering the plan, including:

- Canada Infrastructure Bank;

- Canada Mortgage and Housing Corporation;

- Canadian Heritage;

- Crown-Indigenous Relations and Northern Affairs;

- Employment and Social Development Canada;

- Environment and Climate Change Canada;

- Health Canada;

- Indigenous Services Canada;

- Innovation, Science and Economic Development Canada;

- Natural Resources Canada;

- Parks Canada;

- Public Health Agency of Canada;

- Public Safety Canada; and

- Transport Canada.

- The ultimate responsibility for the program delivery and financial reporting for each program under the Plan rests with the Minister responsible for the respective department or agency. The Minister of Infrastructure and Communities has the responsibility to report to Cabinet and the Prime Minister on the overall status of the implementation of the Plan.

- The Geomap on the Infrastructure Canada website is updated monthly to highlight the progress of selected approved and announced infrastructure projects across Canada, while the online funding table tracks spending under the Plan by all federal departments and agencies.

FUNDING

- The funding of the twelve-year Plan, totaling over $187 billion, was established in Budgets 2016 and 2017. This includes $92.2 billion in funding for initiatives in place pre-budget 2016, and $95.6 billion in new funding for infrastructure programs launched in 2016 and 2017. The initial phase of the new funding for the Plan announced in Budget 2016 ($14.4 billion), focused on short-term projects, with an emphasis on the repair and rehabilitation of existing infrastructure assets. Budget 2017 built on this foundation by providing new long-term funding ($81.2 billion) extending over the life of the Plan. In Budget 2019, all remaining funding under the Plan was allocated and additional funding was provided to some of the programs under the Plan. For example, an additional $400 million was allocated to the National Trade Corridors Fund, and the Gas Tax Fund was doubled for 2019-20, providing an additional $2.2 billion to communities.

- Of the over $187 billion total, Infrastructure Canada is directly responsible for $99 billion of funding. This funding supports various programs and initiatives, including bilateral agreements with provincial, territorial, and community partners, targeted funding programs such as the Disaster Mitigation and Adaptation Fund, the federal Gas Tax Fund, and innovative initiatives like the Smart Cities Challenge.

CURRENT STATUS

- As of October 2019, more than seventy programs are active under the plan, with over 52,000 projects approved representing approximately $57.5 billion in federal investments (see Annex A).

- Infrastructure Canada has published two reports on the Plan:

- Investing in Canada: Canada's Long-Term Infrastructure Plan (April 2018); and

- Building a Better Canada: A Progress Report on the Investing in Canada Plan 2016-2019 (May 2019).

NEXT STEPS

- Infrastructure Canada officials would be pleased to provide you with further information on the Investing in Canada Plan.

ANNEX A: OVERVIEW OF FUNDING BY FEDERAL DELIVERY PARTNERS

Note: The amount of $15B for the Canada Infrastructure Bank has been allocated separately as it is an independent Crown Corporation separate from Infrastructure Canada.

INVESTING IN CANADA INFRASTRUCTURE PROGRAM

MANDATE

- The Investing in Canada Infrastructure Program is a $33.5 billion program to provide federal cost-share funding support for infrastructure projects in communities across the country that will collectively advance national economic, social, and environmental outcomes.

DESCRIPTION

- Launched in 2017-18, the ten-year program has been designed to provide long-term, stable funding for public infrastructure initiatives across Canada. It is being delivered through bilateral agreements signed in 2018 with each province and territory. Allocations for each province and territory are set out in those agreements, each of which can be found on the Infrastructure Canada website.

- Funding levels have largely been set via a per capita allocation on top of a base amount. The funding has been allocated to provinces and territories under four funding streams, as follows:

- Public Transit: This stream provides funding for the construction, expansion, improvement and rehabilitation of public transit infrastructure, and supports active transportation that enhances mobility options and strengthens communities.

- Green Infrastructure: The Green Infrastructure stream is further divided into three sub-streams: climate change mitigation (supports greenhouse gas mitigation projects); adaptation, resilience, and disaster mitigation (infrastructure projects that will help communities adapt to the impacts of a changing climate); and environmental quality (such as water and wastewater infrastructure).

- Community, Culture and Recreation Infrastructure: This stream funds new, expanded or renewed community, cultural and recreational facilities.

- Rural and Northern Communities Infrastructure: This stream provides funding to smaller communities to address various rural and northern specific needs related to broadband, food security, transportation, energy and, where it supports the Truth and Reconciliation Commission's objectives, education and health facilities. It also includes the $400 million Arctic Energy Fund to address energy security in the territories.

- Provinces and territories are responsible for identifying and prioritizing eligible projects through engagement with local and regional governments, and Indigenous Ultimate Recipients and submitting projects to Infrastructure Canada and, if approved by Infrastructure Canada, flowing funds to eligible recipients.

- The Program uses an outcomes-based approach to eligibility, meaning that, to be eligible for funding, projects must directly support at least one immediate outcome sought under the program (see Annex A).

- Project eligibility is also dependent on stream-specific requirements and exclusions as well as horizontal federal requirements, as specified in the bilateral agreements. Horizontal federal requirements include, for projects meeting specified criteria, a Climate Lens assessment and consideration of Community Employment Benefits.

- The Climate Lens assessment requires projects to submit a greenhouse gas mitigation assessment and a climate change resilience assessment to ensure that climate change considerations are factored into the development of projects.

- The Community Employment Benefits initiative requires project proponents to consider establishing targets to increase employment opportunities for workers from under-represented groups, as well as to increase opportunities for small and medium-sized enterprises and social enterprises.

- As part of the overall management of the Program, provinces and territories must also submit three-year rolling Infrastructure Plans, to provide a better understanding of their approach to managing the prioritization of future projects and their progress on advancing program targets and outcomes.

FUNDING

Project Funding Envelope:Footnote 1 |

Funding Still Available: |

Projects Approved and Announced: |

||||

|---|---|---|---|---|---|---|

$31.3 B |

$22.2 B |

471 |

||||

Funding Profile: |

||||||

2018-19 |

2019-20 |

2020-21 |

2021-22 |

2022-23 |

||

$14.5 M |

$634.6 M |

$1.5 B |

$1.7 B |

$2.3 B |

||

2023-24 |

2024-25 |

2025-26 |

2026-27 |

2027-28 |

||

$3.2 B |

$3.8 B |

$5.7 B |

$5.7 B |

$7 B |

||

- Annex B provides further information on the funding envelopes by jurisdiction per stream.

CURRENT STATUS

- Infrastructure Canada is working with provinces and territories to support the continued implementation of the Program, including looking for opportunities to strengthen administrative efficiencies and make other adjustments as required.

- To this end, for example, the department is piloting a progress billing initiative in Alberta and Nova Scotia, which aims to better align the flow of funding with incremental progress on projects through payments to jurisdictions three times per year.

- Though the Program is still in early implementation, significant progress has been made under all streams, such as:

- 883 (new and expansion) transit vehicles;

- 6 new or expanded subway/light rail transit lines;

- 66 approved projects in that focus on wastewater in the Environmental Quality sub-stream; and

- 156,082 new households that have access to broadband at project conclusion.

NEXT STEPS

- Project approvals continue to be a top priority. Funding approval for projects is the responsibility of the Minister of Infrastructure and Communities. For projects under the Rural and Northern Communities Infrastructure stream, funding approval can also be granted by the Minister of Rural and Economic Development. Some projects require the approval of the Treasury Board, in accordance with the delegation of authorities.

- An evaluation of the Program is planned for 2022-23. The focus will be on early impacts of projects selected to date and on how the Program's design is supporting the achievement of intermediate and long-term outcomes.

ANNEX A: IMMEDIATE OUTCOMES FOR EACH OF THE INVESTING IN CANADA INFRASTRUCTURE PROGRAM FUNDING STREAMS AND SUB-STREAMS

Funding Stream |

Immediate Outcome |

|---|---|

Public Transit |

Improved capacity of public transit infrastructure |

Green Infrastructure - Climate Change Mitigation |

Increased capacity to manage more renewable energy |

Green Infrastructure - Adaptation, Resilience and Disaster Mitigation |

Increased structural capacity to adapt to climate change impacts, natural disasters and extreme weather events |

Green Infrastructure - Environmental Quality |

Increased capacity to treat and manage wastewater and stormwater |

Community, Culture and Recreation Infrastructure |

Improved access to and increased quality of community, cultural and recreational infrastructure for Canadians, including Indigenous Peoples and vulnerable populations. |

Rural and Northern Communities Infrastructure |

Improved food security |

ANNEX B: Infrastructure Plan - PHASE 2 Provincial and Territorial Project Funding Envelopes (as of Oct 16,2019)

| JURISDICTION | PUBLIC TRANSIT | GREEN | COMMUNITY, CULTURE & RECREATION | RURAL AND NORTHERN* | TOTAL ALLOCATION |

|---|---|---|---|---|---|

| Newfoundland & Labrador | $108,368,833 | $300,417,377 | $39,512,400 | $103,964,235 | $552,262,845 |

| Prince Edward Island | $26,494,894 | $223,351,721 | $28,450,243 | $80,966,769 | $359,263,627 |

| Nova Scotia | $286,693,431 | $378,095,460 | $50,733,020 | $104,686,318 | $820,208,229 |

| New Brunswick | $163,479,251 | $343,529,716 | $45,747,762 | $113,437,766 | $666,194,495 |

| Québec | $4,339,201,949 | $2,584,288,639 | $251,792,553 | $285,295,479 | $7,460,578,620 |

| Ontario | $7,394,246,194 | $2,223,533,590 | $403,129,346 | $295,359,346 | $10,316,268,476 |

| Manitoba | $540,678,441 | $447,272,662 | $60,713,465 | $111,690,824 | $1,160,355,392 |

| Saskatchewan | $304,792,315 | $412,171,326 | $55,649,268 | $114,746,868 | $887,359,777 |

| Alberta | $2,091,816,770 | $1,247,561,026 | $140,257,861 | $159,290,533 | $3,638,926,191 |

| British Columbia | $2,678,991,935 | $899,130,345 | $156,374,851 | $165,254,819 | $3,899,751,950 |

| Yukon | $9,822,007 | $204,522,062 | $25,699,769 | $200,099,088 | $440,142,926 |

| Northwest Territories | $8,196,535 | $204,531,239 | $25,722,214 | $322,187,412 | $560,637,400 |

| Nunavut | $0 | $200,823,353 | $25,235,247 | $323,580,035 | $549,638,635 |

| TOTAL | $17,952,782,556 | $9,669,228,516 | $1,309,017,999 | $2,380,559,493 | $31,311,588,563 |

*Arctic Energy Fund is reflected in Rural and Northern

DISASTER MITIGATION AND ADAPTATION FUND

MANDATE

- The Disaster Mitigation and Adaptation Fund invests in large-scale infrastructure projects, including natural infrastructure, to enable communities to better withstand current and future natural risks, as well as the continuity of services.

DESCRIPTION

- Launched in May 2018, the $2 billion Fund is a merit-based, competitive program that offers a complementary approach to support to the provincial and territorial funding allocations provided for climate change resilience projects across the country under the Investing in Canada Infrastructure Program's Green Infrastructure Stream.

- The Fund is designed to support significant, large-scale disaster mitigation and adaptation projects with total eligible costs of at least $20 million. The cost sharing and stacking limits are in Annex A. Eligible projects include:

- New construction of public infrastructure including natural infrastructure; and

- Modification and/or reinforcement including rehabilitation and expansion of existing public infrastructure including natural infrastructure.

- The Fund is designed to have periodic calls for applications through a two-step, competitive process:

- Step I: Expression of Interest (EOI) Application: This step is mandatory and determines project eligibility;

- Step II: Full Application: Successful applicants from the first step are invited to submit the full application. The full applications are assessed against merit criteria and federal requirements.

- In addition, in cases where the Minister of Infrastructure and Communities, in consultation with the Minister of Public Safety and Emergency Preparedness, has identified a specific area of concern due to urgent and emergent situations, projects can be considered outside the competitive intake process. For instance, in June 2019, provincial and territorial Ministers were invited to submit applications outside of the competitive process in response to the spring 2019 flooding events and other hazard risks, such as wildland fires.

FUNDING

Program Allocation: |

Funding Still Available: |

Projects Approved and Announced: |

||||

|---|---|---|---|---|---|---|

$2 B |

$232.2 M |

59 |

||||

Funding Profile: |

||||||

Prior to |

2019-20 |

2020-21 |

2021-22 |

2022-23 |

||

$0 |

$128.3 M |

$113.8 M |

$199.2 M |

$199.2 M |

||

2023-24 |

2024-25 |

2025-26 |

2026-27 |

2027-28 |

||

$249.2 M |

$249.2 M |

$254.2 M |

$299.2 M |

$299.2 M |

||

Approved Projects by Type of Hazard |

|||||

|---|---|---|---|---|---|

Flooding |

Wildland Fire |

Erosion |

Storm |

Other (drought, permafrost, extreme temperatures) |

Earthquake |

66% |

5% |

9% |

8% |

10% |

2% |

CURRENT STATUS

- There is significant interest in the program from across the country. The Fund's first competitive intake process launched in May 2018 identified more than $6 billion in potential federal investment opportunities.

- An internal audit of the Fund has been initiated by Infrastructure Canada's Audit and Evaluation Branch. The audit will focus primarily on the Fund's first intake and review processes. Future audits will likely focus on implementation and governance.

- Due to the scale of the funding sought under the first intake, only eligible projects with construction start dates in 2019 and 2020 were invited to the Full Application phase of the program.

- Overall, program uptake by provinces and territories, as opposed to other partners and stakeholders, has been limited. The program has been popular with municipalities; municipal projects represent 73 percent of projects approved. The majority of projects from municipalities do not include any provincial/territorial funding contributions.

- In terms of outcomes, all projects approved seek to increase their communities' resilience by reducing at least one of the following indicators: local economic loss; percentage of people directly affected; percentage of population without essential services; and percentage of missing people and loss of lives. In addition, the approved projects are expected to result in average long-term savings of 14:1.

NEXT STEPS

- The timing of a potential second intake under the Fund remains to be determined.

ANNEX A: DISASTER MITIGATION AND ADAPTATION FUND (DMAF) ELIGIBILITY CRITERIA AND MERIT CRITERIA

Eligibility Criteria |

Details |

|---|---|

Project Schedule |

Within the DMAF program timeline (March 31, 2028) |

Minimum Threshold |

$20 million in total eligible costs |

Cost Sharing and Stacking |

*For Indigenous assets, additional funding from any applicable federal source to a maximum federal contribution of 100% |

Recipient Type |

Municipal, Regional, Provincial, Territorial, For-profit, Not-for-profit and Indigenous communities |

Nature of the Project |

New construction, rehabilitation and/or expansion of an existing asset |

Asset Ownership, Use or Benefit |

The DMAF focuses on public infrastructure. Privately owned assets need to demonstrate public benefit. |

National Significance |

DMAF projects need to meet at least one of the six national significance criteria* |

Alignment with the Program Objectives |

DMAF projects must align with program objectives |

Merit Criteria |

Details |

|---|---|

Hazard Risk Assessment |

To assess the likelihood and impact of the hazard risk in consideration of current and future climate change impacts within the asset lifecycle. Socio-economic impacts are considered, including four key indicators: loss of lives/missing people; directly affected people; local economic loss; and population without essential services. |

Extent to which the project strengthens resilience |

To assess the expected risk impacts on a community. Applicants must indicate the impacts on the four key indicators before and after project completion. |

Return on Investment |

The ROI ratio measures the estimated disaster losses avoided by the investment, within the asset lifecycle. |

Project rationale |

Assess the investment rationale which could include the options considered for the project. Applicants must describe why the proposed project is the best and most appropriate option to address the natural hazard risk. |

Innovation |

To assess if innovative measures are considered as part of the project, including natural infrastructure, innovative technologies, global best practices. |

Risk Transfer Management Measures |

Must demonstrate that the proposed project addresses comprehensively the broad impacts of the hazard risk. |

Alignment with relevant municipal/provincial/ |

Projects are required to align with existing municipal/provincial/territorial plans, strategies and frameworks as well as legislation and regulations more broadly. |

Public and Indigenous Engagement |

Applicants must demonstrate that they have or will engage with province(s) or territory(ies) in which the project is situated, affected communities including Indigenous communities and the general public. |

Risks associated with project management and implementation |

Applicants must demonstrate the potential risks they could encounter during the project implementation. |

Project Benefits |

Merit is awarded to projects that offer additional benefits to Canadians, such as addressing multiple hazards, and providing environmental value and/or protecting valuable cultural assets. |

ANNEX B: PROJECT MAP

ANNEX C: DMAF Project List as of October 18, 2019

| Province/Territory | Name of Recipient | Project Title | Federal Contribution |

|---|---|---|---|

| ALBERTA - 4 PROJECTS | $258,026,000 | ||

| Alberta | Government of Alberta, Transportation Ministry | Springbank Off-Stream Reservoir (SR1) Project | $168,500,000 |

| Alberta | Town of Drumheller | Drumheller Flood Mitigation and Climate Change Adaptation System along the Red Deer River Valley | $22,000,000 |

| Alberta | Town of Canmnore | Flood Mitigation of Several Steep Mountain Creeks in the Bow Valley | $13,760,000 |

| Alberta | City of Edmonton | Riverine and Urban Buffer on Flood Mitigation | $53,766,000 |

| BRITISH COLUMBIA - 6 PROJECTS | $192,763,823 | ||

| British Columbia | Skwah First Nation | New dyke / flood barrier to protect Skwah FN and City of Chilliwack against flooding | $45,000,000 |

| British Columbia | Corporation of the City of Victoria | Climate and Seismic Resilient Underground Infrastructure | $15,393,320 |

| British Columbia | City of Kelowna | Mill Creek Flood Protection | $22,000,000 |

| British Columbia | City of Surrey | Reducing Coastal Flood Vulnerability in the Coastal Lowlands of City of Surrey, City of Delta and Semiahmoo First Nation | $76,602,850 |

| British Columbia | City of Richmond | Richmond Flood Protection Program | $13,780,000 |

| British Columbia | Corporation of the City of Grand Forks | Grand Forks and Regional District of Kootenay Boundary Structural and Natural Flood Mitigation | $19,987,653 |

| MANITOBA - 2 PROJECTS | $270,700,000 | ||

| Manitoba | Province of Manitoba | Lakes of Manitoba and St. Martin | $247,500,000 |

| Manitoba | Thompson Regional Airport Authority | Air Terminal Building Redevelopment project | $23,200,000 |

| NEW BRUNSWICK - 3 PROJECTS | $36,889,074 | ||

| New Brunswick | City of Saint John (COSJ) | Saint John Flood Mitigation Strategy | $11,916,074 |

| New Brunswick | New Brunswick Department of Transportation and Infrastructure | NB Arterial Highway # 11: Culvert Mitigation and Improvement | $13,573,000 |

| New Brunswick | City of Fredericton | Multiple Natural and Structural Infrastructure Projects to Adapt to Pulival and Fluvial Flood Events in Fredericton | $11,400,000 |

| NEWFOUNDLAND AND LABRADOR - 1 PROJECT | $15,180,000 | ||

| Newfoundland & Labrador | Government of Newfoundland and Labrador | Replacement of provincial highway bridges | $15,180,000 |

| NORTHWEST TERRITORIES - 3 PROJECTS | $64,112,218 | ||

| Northwest Territories | City of Yellowknife | Flood Hazard Mitigation for the Yellowknife Region | $25,862,218 |

| Northwest Territories | Department of Infrastructure, Government of NWT | Inuvik Airport - Adaptation to Increase the Resilience of the Surface Structures from Impacts of Climate Change | $16,500,000 |

| Northwest Territories | Government of NWT | Increase fuel storage capacity to mitigate impacts to the public and essential services due to wildfires | $21,750,000 |

| NOVA SCOTIA - 2 PROJECTS | $56,997,500 | ||

| Nova Scotia | Government of Nova Scotia - Department of Agriculture | Construction Upgrades to Protect 60 Communities in Nova Scotia from the Impacts of Coastal Flooding | $24,997,500 |

| Nova Scotia | Nova Scotia Transportation and Infrastructure Renewal (NSTIR) | Upgrades Aboiteaux and Dykes to Protect the Town of Windsor, Falmouth, and Surrounding Areas | $32,000,000 |

| ONTARIO - 23 PROJECTS | $530,981,028 | ||

| Ontario | Corporation of the City of Markham | City of Markham's Flood Control Program | $48,640,000 |

| Ontario | Corporation of the City of Sarnia | Combined Sewer Separation - Flooding and Overflow Mitigation Project | $10,412,000 |

| Ontario | Regional Municipality of York | Aurora Sewage Pumping Station Overflow Mitigation Work | $8,280,000 |

| Ontario | Regional Municipality of York | Natural Infrastructure - building climate change resilience through enhancement and restoration of the urban forest in York Region, Ontario | $10,136,000 |

| Ontario | Mohawks of the Bay of Quinte | Expansion to water infrastructure to reduce risk & impacts of drought MBQ Territory. | $30,093,216 |

| Ontario | Regional Municipality of York | York Durham Sewage System Forcemain Twinning Project | $48,000,000 |

| Ontario | City of Toronto | Construction of the Fairbank-Silverthorn Trunk Storm Sewer System for Basement Flooding Protection and Combined Sewer Overflow Reduction | $73,200,000 |

| Ontario | City of Toronto | Construction of the Midtown Toronto Relief Storm Sewer for Basement Flooding Protection | $37,160,000 |

| Ontario | Corporation of the City of Vaughan | Implementing Vaughan Stormwater Flood Mitigation projects | $16,588,299 |

| Ontario | City of Hamilton | City of Hamilton Project Bundle - Extreme Storms - Shoreline Protection Resilience | $12,686,000 |

| Ontario | Upper Thames River Conservation Authority (UTRCA) | West London Dyke Reconstruction | $10,000,000 |

| Ontario | Corporation of the City of Windsor | City of Windsor Disaster Mitigation and Infrastructure Enhancement Initiative | $32,090,691 |

| Ontario | Corporation of The City of Thunder Bay | Community Flood Mitigation Project | $13,249,200 |

| Ontario | Municipality of Chatham-Kent | Flood Mitigation Along Thames & Sydenham Rivers | $16,575,200 |

| Ontario | Corporation of the City of Kitchener | Kitchener Stormwater Network Adaptation |

$49,990,000 |

| Ontario | City of Greater Sudbury | Flood mitigation, control and improvements in the Junction Creek Watershed | $8,840,000 |

| Ontario | Toronto and Region Conservation Authority (TRCA) | Toronto Region Ravine Erosion Risk Management and Hazard Mitigation Project | $22,311,578 |

| Ontario | City of Toronto | Repair, remediate, and enhance resilience of Toronto's tree canopy and waterfront shoreline structures to protect against future flooding and storm events. | $11,989,186 |

| Ontario | City of Kingston | Shoreline Protection Works | $9,806,191 |

| Ontario | City of Kingston | Combined Sewer Separation and Storm Water Management Infrastructure | $10,400,000 |

| Ontario | St. Clair Conservation Authority | Shoreline Rehabilitation along Lake Huron and St. Clair River | $8,000,000 |

| Ontario | Toronto and Region Conservation Authority (TRCA) | Toronto Waterfront Erosion Hazard Mitigation Project | $33,794,667 |

| Ontario | City of Toronto | City of Toronto 2020-21 Culvert Rehabilitation | $8,738,800 |

| QUÉBEC - 10 PROJECTS | $251,056,900 | ||

| Quebec | City of Montreal/Water Services | Construction of a retaining structure intended to reduce overflows during heavy rains | $21,280,000 |

| Quebec | City of Montreal/Water Services | Construction of retaining structures to control overflows and overloading of combined sewer systems during heavy rains | $33,060,400 |

| Quebec | Quebec Ministry of Transport | Rehabilitation of the section of the Chemin de fer de la Gaspésie railway line- Port-Daniel-Gascons to Gaspé | $45,815,200 |

| Quebec | Quebec Ministry of Transport | Infrastructure development project to protect Highway 132 against coastal hazards | $13,200,500 |

| Quebec | City of Victoriaville | Protecting and safeguarding the drinking water supply in the Beaudet reservoir of the City of Victoriaville, Quebec | $16,000,000 |

| Quebec | City of Montreal/Water Services | Protection and resilience increase against flooding in Pierrefonds-Roxboro | $50,000,000 |

| Quebec | City of Gatineau | Wabassee Creek Watershed | $22,510,000 |

| Quebec | Town of Ste-Marthe-sur-le-lac | Repairing, Strengthening, Heightening, and Sealing Work to the Town of Sainte-Marthe-sur-le-Lac’s Dyke | $19,726,000 |

| Quebec | City of Deux-Montagnes | Protection Works Mitigating Floods In The Deux-Montagnes Lake Sector (Deux-Montagnes, Oka, Pointe-Calumet, St-Joseph-sur-le-lac) | $17,949,080 |

| Quebec | City of Deux-Montagnes | Protection works mitigating floods in the Rivière des Mille Iles sector (St-Eustache, Rosemère, Boisbriand) | $11,515,720 |

| SASKATCHEWAN - 5 PROJECTS | $82,396,300 | ||

| Saskatchewan | City of Meadow Lake | Replacement of common trench water and pressure sewer lines and the relocation of the sewage lagoon for Meadow Lake | $8,000,000 |

| Saskatchewan | Saskatchewan Power Corporation | Wildfire Risk Reduction and Capacity Development in Northern Saskatchewan | $19,802,475 |

| Saskatchewan | City of Saskatoon | Flood Control Strategy | $21,600,000 |

| Saskatchewan | Ministry of Environment Wildfire Management Branch (WFMB) Government of Saskatchewan |

Saskatchewan Wildfire Risk Reduction and Community Resilience Project | $20,493,825 |

| Saskatchewan | Saskatchewan Ministry of Highways and Infrastructure | Highway 55 Corridor Improvements | $12,500,000 |

| TOTAL - 59 PROJECTS | $1,759,102,843 | ||

SMART CITIES CHALLENGE

MANDATE

- The Smart Cities Challenge is an innovative and experimental program for the Government of Canada, testing new approaches to program design and delivery. The Smart Cities Challenge incents communities to adopt a smart cities approach to improve the lives of their residents through innovation, data and connected technology.

DESCRIPTION

- Established in 2017, the Smart Cities Challenge is a competition open to all municipalities, local or regional governments, and Indigenous communities.

- Communities of all sizes are confronting new ways to leverage data and connected technology into their operations. The Smart Cities Challenge aims to work with communities to do so in a way that puts the needs of residents first, and generates solutions that can be replicated across Canada. The process is designed to support the achievement of measurable positive results, with built-in flexibilities to encourage innovation and risk taking. This approach has been identified as valuable and promising by domestic and international commentators.

- An independent jury evaluates submissions and recommends slates of finalists and winners to the Minister of Infrastructure and Communities.

- Recognizing that most Canadian communities have capacity limitations, the Smart Cities Community Support Program was designed in parallel to the Smart Cities Challenge as a contribution program. Its objective is to provide advisory and capacity-building services directly to communities of all sizes across Canada as they explore and implement smart cities approaches.

Overview of the Challenge: Competition One

- The first round of the Challenge was launched in November 2017.

- An inclusive prize structure was designed: one $50 million prize for communities of all sizes, two $10 million prizes for communities with populations under 500,000, and one $5 million prize for communities with populations under 30,000 people.

- 130 applications were received, representing 225 communities from small towns to large cities in every province and territory. Twenty applications were received from Indigenous communities, either individually or as part of joint submissions.

- Twenty finalists were announced in June 2018. Each finalist received a $250,000 grant to support the development of their final proposal.

- Four winning communities were announced on May 14, 2019:

- Town of Bridgewater, Nova Scotia ($5 million prize)

- Bridgewater's project is focused on an Energy Poverty Reduction Program that uses data and connected technology to restore control to residents over their energy costs and infrastructure.

- City of Guelph and Wellington County, Ontario ($10 million prize)

- Guelph and Wellington County's project focuses on becoming Canada's first circular food economy by creating new circular business opportunities, transforming food waste into a resource, and increasing access to affordable, nutritious food.

- Nunavut Communities, Nunavut ($10 million prize)

- The project from the Nunavut Communities focuses on strengthening resilience and improving mental health among young Nunavummiut through technology-enabled Makerspaces in various communities across Nunavut.

- City of Montréal, Quebec ($50 million prize)

- The project of the City of Montréal takes action on systemic issues of urban life – enabled by technology – to improve mobility and access to food so that all Montrealers may enjoy a pleasant quality of life where their basic needs are met.

- Infrastructure Canada officials have maintained a visible presence by conducting site visits and outreach in participating municipalities. The program has been very well received and communities have been actively seeking information about future rounds.

- Participants in the Challenge have affirmed that it has enabled them to break down silos within their municipal governance structures and to build new partnerships. Many applicants and finalists have noted their plans to move forward in implementing their smart cities vision despite not having been selected as winners.

FUNDING

Project Allocation: |

Funding Remaining: |

Number of Approved and Announced Projects: |

||||

|---|---|---|---|---|---|---|

$300 M |

$176.3 M |

25 |

||||

Funding Profile: |

||||||

Prior to |

2019-20 |

2020-21 |

2021-22 |

2022-23 |

||

$7 M |

$10.2 M |

$25.9 M |

$30.2 M |

$60.1 M |

||

2023-24 |

2024-25 |

2025-26 |

2026-27 |

2027-28 |

||

$29.6 M |

$53.6 M |

$21.6 M |

$22.6M |

N/A |

||

- The Smart Cities Challenge program has been allocated $300 million over ten years to run up to three competitions and the Community Support Program, from 2017-18 until 2026-27.

- Winning communities receive a funding agreement with the Government of Canada. Milestone payments will be primarily tied to the performance / achievement of positive outcomes for residents.

- To date, twenty grants of $250,000 have been expended to the finalists of the first competition, for a total of $5 million. Winners of the first competition will receive a combined $75 million over five years.

- Two more competitions are expected with a total allocation in grants and contributions of $160 million between 2020 and 2027.

- $20 million has been allocated toward the CSP. In October 2018, a consortium led by national non-profit organization Evergreen was selected via an open call to receive up to $4.6 million in funding over two years.

- An Indigenous-specific stream of the Challenge had been envisioned but was reconsidered in light of the strong degree of Indigenous participation during Competition One. $15 million was instead transferred to Indigenous Services Canada to support the Indigenous Homes Innovation Initiative.

CURRENT STATUS

- Officials are working with the four winners of Competition One to ensure sound planning and governance as these communities begin implementing their smart cities projects.

NEXT STEPS

- Infrastructure Canada officials will provide you with a recommendation for the start of the next round of the competition for your consideration.

GAS TAX FUND

MANDATE

- The federal Gas Tax Fund is an infrastructure program, based on a statutory source of funding, that provides permanent, ongoing federal funding for local infrastructure projects prioritized by communities across Canada.

DESCRIPTION

- The Fund currently provides more than $2.2 billion annually to more than 3,600 communities. It is indexed at two percent per year, with increases to be applied in $100 million increments. Annual allocations are listed in Annex A.

- The Fund is implemented through administrative agreements with provinces and territories, as well as municipal associations in Ontario and British Columbia, and the City of Toronto. The current, ten-year agreements came into effect in April 2014, and expire in March 2024.

- Under the Gas Tax Fund, upfront funding is provided annually in two installments to provinces, territories, and municipal associations, who in turn flow this funding to their municipalities to support local infrastructure priorities. Municipalities can pool, bank and borrow against this funding, providing significant financial flexibility.

- A portion of the Gas Tax Fund is also allocated to First Nations on a per capita basis. This portion of funding is delivered by Indigenous Services Canada as part of the First Nations Infrastructure Fund.

- The Fund was launched in 2005 and originally designed to provide municipalities with $5 billion in predictable funding over five years. The Government of Canada announced in 2008 plans to make the fund permanent, and subsequently embedded it in legislation as an ongoing source of federal infrastructure funding for municipalities. Despite its name, the Fund currently has no specific relationship to tax revenues related to gas prices.

- In most cases, local governments, being the ultimate recipients, select how best to direct the funds with the flexibility to make strategic investments across the following eighteen different project categories: drinking water; wastewater; solid waste; public transit; local roads and bridges; community energy systems; capacity building; disaster mitigation; broadband connectivity; highways; short-line rail; short-sea shipping; brownfield redevelopment; regional and local airports; and, projects supporting culture, tourism, sport and recreation. In Quebec, funding under the program is directed to specific investment objectives established by the province.

- The overall strategic implementation of each of the Gas Tax Fund agreements is managed by an oversight committee co-chaired by senior officials representing the Government of Canada and each signatory.

- Infrastructure Canada is responsible for undertaking and managing the on-going federal administration, including making payments, receiving and reviewing required reports, executing evaluations, and reporting to Canadians and Parliamentarians.

- Non-federal signatories of the agreements are responsible for the administration and oversight of the program and for providing Infrastructure Canada reasonable assurance in the form of an Annual Report confirming that funds were expended for the purposes intended.

FUNDING

Project Funding Envelope:Footnote 2 |

Funding Still Available: |

Projects Approved and Announced: |

||||

|---|---|---|---|---|---|---|

$27.5 B |

N/A |

N/A |

||||

Funding Profile: |

||||||

Total Funding |

2019-20 |

2020-21 |

2021-22 |

2022-23 |

||

$23.1 B |

$4.3 B |

$2.2 B |

$2.3 B |

$2.3 B |

||

2023-24 |

2024-25 |

2025-26 |

2026-27 |

2027-28 |

||

$2.4 B |

$2.2 B |

$2.2 B |

$2.2 B |

$2.2 B |

||

CURRENT STATUS

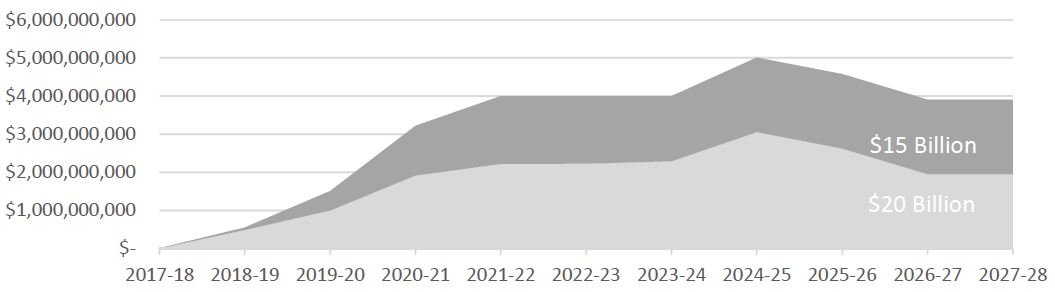

- The federal Gas Tax Fund delivers over $2.2 billion every year to 3,600 communities across the country. From 2014 to 2024, it will provide municipalities with close to $22 billion in infrastructure funding.

- At the start of each fiscal year, the Minister of Infrastructure and Communities confirms the Gas Tax Fund funding to signatories through a letter. Following this, Infrastructure Canada makes two equal payments to each signatory. The first payment generally occurs in early summer, and the second in the fall.

- The Gas Tax Fund is allocated on a per-capita basis for provinces, territories and First Nations, but provides a base funding amount of 0.75 percent of total annual funding for Prince Edward Island and each territory.

- Jurisdictional allocations are adjusted every five years corresponding with new census population data. As such, allocations were last updated based on census 2016 population data, starting in the 2019-20 fiscal year.

- As per Budget 2016, Infrastructure Canada committed to transfer over $30.1 million of uncommitted funds from previous federal infrastructure programs to the Gas Tax Fund by March 31, 2017. Legacy transfer payments by jurisdiction are listed in Annex B.

- Budget 2019 implemented a one-time additional transfer of $2.2 billion through the federal Gas Tax Fund to address short-term priorities in municipalities and First Nations communities. This doubled the Government of Canada's commitment to municipalities in 2018-19. Additional transfer allocations are listed in Annex B.

NEXT STEPS

- Infrastructure Canada is working in collaboration with provinces, territories, and municipal associations to improve outcomes reporting for the program and to identify alignment opportunities with reporting requirements of the Investing in Canada Infrastructure Program.

- As the Gas Tax Fund Agreements are only effective until March 31, 2024, new or amended agreements will eventually be required to account for allocations beyond the 2023-24 fiscal year, as well as any adjustments to the program terms and conditions.

ANNEX A: ANNUAL ALLOCATIONS OF THE GAS TAX FUND

Table of regular annual allocations of the federal Gas Tax Fund, per province and territory, from years 2014-15 to 2018-19:

Province/Territory |

2014-2015 |

2015-2016 |

2016-2017Footnote 3 |

2017-2018 |

2018-2019 |

|---|---|---|---|---|---|

British Columbia |

$253,276,892 |

$253,276,892 |

$265,940,736 |

$265,940,736 |

$278,604,581 |

Alberta |

$208,650,536 |

$208,650,536 |

$219,083,063 |

$219,083,063 |

$229,515,590 |

Saskatchewan |

$56,289,884 |

$56,289,884 |

$59,104,378 |

$59,104,378 |

$61,918,872 |

Manitoba |

$65,470,748 |

$65,470,748 |

$68,744,285 |

$68,744,285 |

$72,017,823 |

Ontario |

$744,948,996 |

$744,948,996 |

$782,196,446 |

$782,196,446 |

$819,443,895 |

Québec |

$458,218,932 |

$458,218,932 |

$481,129,879 |

$481,129,879 |

$504,040,826 |

New Brunswick |

$43,322,293 |

$43,322,293 |

$45,488,408 |

$45,488,408 |

$47,654,522 |

Nova Scotia |

$53,226,093 |

$53,226,093 |

$55,887,397 |

$55,887,397 |

$58,548,702 |

Prince Edward Island |

$15,000,000 |

$15,000,000 |

$15,750,000 |

$15,750,000 |

$16,500,000 |

Newfoundland and Labrador |

$29,865,059 |

$29,865,059 |

$31,358,312 |

$31,358,312 |

$32,851,564 |

Northwest Territories |

$15,000,000 |

$15,000,000 |

$15,750,000 |

$15,750,000 |

$16,500,000 |

Nunavut |

$15,000,000 |

$15,000,000 |

$15,750,000 |

$15,750,000 |

$16,500,000 |

Yukon |

$15,000,000 |

$15,000,000 |

$15,750,000 |

$15,750,000 |

$16,500,000 |

First Nation Infrastructure FundFootnote 4 |

$26,730,568 |

$26,730,568 |

$28,067,096 |

$28,067,096 |

$29,403,625 |

Total |

$2,000,000,000 |

$2,000,000,000 |

$2,100,000,000* |

$2,100,000,000 |

$2,200,000,000* |

Table of regular annual allocations of the federal Gas Tax Fund, per province and territory, from years 2019-20 to 2023-24:

Province/Territory |

2019-2020Footnote 5 |

2020-2021 |

2021-2022 |

2022-2023 |

2023-2024 |

|---|---|---|---|---|---|

British Columbia |

$280,416,420 |

$280,416,420 |

$293,162,621 |

$293,162,621 |

$305,908,822 |

Alberta |

$244,029,220 |

$244,029,220 |

$255,121,458 |

$255,121,458 |

$266,213,695 |

Saskatchewan |

$62,571,380 |

$62,571,380 |

$65,415,534 |

$65,415,534 |

$68,259,687 |

Manitoba |

$72,510,828 |

$72,510,828 |

$75,806,775 |

$75,806,775 |

$79,102,722 |

Ontario |

$816,507,200 |

$816,507,200 |

$853,621,164 |

$853,621,164 |

$890,735,127 |

Québec |

$495,770,253 |

$495,770,253 |

$518,305,265 |

$518,305,265 |

$540,840,276 |

New Brunswick |

$45,098,015 |

$45,098,015 |

$47,147,924 |

$47,147,924 |

$49,197,834 |

Nova Scotia |

$55,829,094 |

$55,829,094 |

$58,366,780 |

$58,366,780 |

$60,904,466 |

Prince Edward Island |

$16,500,000 |

$16,500,000 |

$17,250,000 |

$17,250,000 |

$18,000,000 |

Newfoundland and Labrador |

$31,583,477 |

$31,583,477 |

$33,019,089 |

$33,019,089 |

$34,454,702 |

Northwest Territories |

$16,500,000 |

$16,500,000 |

$17,250,000 |

$17,250,000 |

$18,000,000 |

Nunavut |

$16,500,000 |

$16,500,000 |

$17,250,000 |

$17,250,000 |

$18,000,000 |

Yukon |

$16,500,000 |

$16,500,000 |

$17,250,000 |

$17,250,000 |

$18,000,000 |

First Nation Infrastructure Fund |

$29,684,113 |

$29,684,113 |

$31,033,391 |

$31,033,391 |

$32,382,668 |

Total |

$2,200,000,000 |

$2,200,000,000 |

$2,300,000,000* |

$2,300,000,000 |

$2,400,000,000Footnote 6 |

ANNEX B: TOP-UP ALLOCATIONS OF THE GAS TAX FUND

Province/Territory |

Budget 2016 Legacy Transfer |

Budget 2019 Top-up |

|---|---|---|

2016-2017 |

2019-2020 |

|

British Columbia |

$3,439,041.83 |

$278,604,581 |

Alberta |

$2,661,350.83 |

$229,515,590 |

Saskatchewan |

$1,189,874.04 |

$61,918,872 |

Manitoba |

$835,093.32 |

$72,017,823 |

Ontario |

$13,778,252.73 |

$819,443,895 |

Québec |

$5,844,611.56 |

$504,040,826 |

New Brunswick |

$552,578.60 |

$47,654,522 |

Nova Scotia |

$678,902.19 |

$58,548,702 |

Prince Edward Island |

$228,651.74 |

$16,500,000 |

Newfoundland and Labrador |

$380,930.72 |

$32,851,564 |

Northwest Territories |

$188,869.74 |

$16,500,000 |

Nunavut |

$188,869.74 |

$16,500,000 |

Yukon |

$188,869.74 |

$16,500,000 |

First Nation Infrastructure Fund |

N/A |

$29,403,625 |

Total |

$30,155,896.78 |

$2,200,000,000 |

MUNICIPAL ASSET MANAGEMENT PROGRAM

MANDATE

- The Municipal Asset Management Program helps strengthen the capacity of Canadian municipalities to make informed infrastructure investment decisions based on sound asset management practices.

DESCRIPTION

- The program was launched in February 2017. As the recipient of Infrastructure Canada's transfer payment funding, the Federation of Canadian Municipalities undertakes the program activities, including selecting projects and entering into agreements with ultimate recipients.

- Activities funded under the program include direct support to municipalities to bolster their capacity, training and workshops, and developing and sharing asset management knowledge tools with stakeholders.

- This program is scheduled to end on March 31, 2025, with all projects under the Program completed by March 31, 2024.

FUNDING

Program Allocation: |

Funding Still Available: |

Projects Approved and Announced: |

||||

|---|---|---|---|---|---|---|

$110 M |

$52.8 M |

600+ |

||||

Funding Profile: |

||||||

Prior to |

2019-20 |

2020-21 |

2021-22 |

2022-23 |

||

$24.2 M |

$75.8 M |

$9.6 M |

$0.4 M |

N/A |

||

2023-24 |

2024-25 |

2025-26 |

2026-27 |

2027-28 |

||

N/A |

N/A |

N/A |

N/A |

N/A |

||

- The total funding envelope for the program is $110 million over eight years, with a ninth year for program close-out. The Program was originally established with a $50 million, five-year commitment from Phase 1 of the Investing in Canada Plan, as announced in Budget 2016. Budget 2019 committed an additional $60 million, as well as a three-year extension to the program.

- The additional $60 million from Budget 2019 has been provided to the Federation of Canadian Municipalities, and the organization is currently developing the implementation plan for the delivery of these incremental funds. They will make this funding available to potential applicants through a request for proposals, which will be announced publicly at a later date.

CURRENT STATUS

- The program has been very well received by the primary stakeholders of the program, which generally consist of local governments and the asset management communities of practice across the country.

- While the many potential outcomes from the program will only be able to be assessed at the end of the program, based on the most recent annual report, the program can already be seen to have achieved results such as:

- 78% of individual program participants have reported a better understanding of asset management;

- 71% of organizations receiving technical assistance have reported improved asset management capacity;

- 84% of individuals receiving technical assistance have reported an increase of their skills through participation in the program;

- 6,963 individual participants have benefited from awareness-building activities; and

- 1,343 municipalities have received technical assistance related to asset management through the program.

NEXT STEPS

- Infrastructure Canada is conducting an evaluation which will assess the relevance, effectiveness and efficiency of the program. Once completed, the evaluation will be published online.

MUNICIPALITIES FOR CLIMATE INNOVATION PROGRAM

MANDATE

- The Municipalities for Climate Innovation Program is designed to encourage Canadian municipalities to better prepare for and adapt to the new realities of climate change, as well as to reduce greenhouse gas emissions.

DESCRIPTION

- Launched in February 2017, as with the Municipal Asset Management Program, this program is also delivered by the Federation of Canadian Municipalities on behalf of Infrastructure Canada.

- Under this fully-subscribed program, applications were solicited through targeted requests for proposals.

- Projects under the program include direct funding for capital projects and asset management activities such as plans and studies, as well as grants for municipalities to bolster their abilities to integrate climate considerations into their planning processes.

- This program is scheduled to end in 2021-22, with all projects under the program requiring completion by March 31, 2021.

FUNDING

Program Allocation: |

Funding Still Available: |

Projects Approved and Announced: |

||||

|---|---|---|---|---|---|---|

$75 M |

$0 |

324 |

||||

Funding Profile: |

||||||

Prior to |

2019-20 |

2020-21 |

2021-22 |

2022-23 |

||

$31.5 M |

$25.8 M |

$17.4 M |

$0.4 M |

N/A |

||

2023-24 |

2024-25 |

2025-26 |

2026-27 |

2027-28 |

||

N/A |

N/A |

N/A |

N/A |

N/A |

||

- The Program is fully subscribed. The total funding envelope for the program is $75 million over five years, with a sixth year, 2021-22, for program close-out. Of the total funding envelope, approximately $68 million has been budgeted for the program's direct granting initiatives. The balance of the funding has been earmarked for the overhead costs of the program, which include administrative costs and costs to support workshops delivered by the Federation of Canadian Municipalities.

CURRENT STATUS

- The majority of projects approved under the Program are currently in the implementation phase, with the remaining projects expected to start this current fiscal year.

- The Program has been very well received by the primary stakeholders of the program, which generally consist of local governments and conservation groups across the country. The demand for program funding greatly surpassed the available funding, however.

- Based on the most recent annual report, the program has achieved initial results such as:

- 92% of participants in targeted municipalities have reported an increase in their awareness of the need to reduce greenhouse gases, as well as the need to adapt to climate change;

- 84% of responding participants in technical assistance activities have reported an increase in skills related to climate change mitigation and adaptation;

- 88% of surveyed members of the Canadian Asset Management Network have reported an increase in skills related to climate adaptation and integrating climate change considerations into their asset management plans; and

- 254 municipalities were reached by awareness-raising activities.

NEXT STEPS

- Infrastructure Canada will continue its ongoing monitoring of the program through regular Agreement Management Committee meetings to ensure a successful program closeout.

- As well, the Federation of Canadian Municipalities continues to work with successful recipients to flow funding, including final payments, under this program.

- Infrastructure Canada is conducting an evaluation which will assess the relevance, effectiveness and efficiency of the program. Once completed, the evaluation will be published online.

GREEN MUNICIPAL FUND

MANDATE

- The Green Municipal Fund is administered by the Federation of Canadian Municipalities to encourage investment in municipal environmental projects by providing grants, loans and loan guarantees.

DESCRIPTION

- The Green Municipal Fund was launched in 2000 to enhance Canadians' quality of life by supporting projects to improve air, water and soil quality and protecting the climate. The Fund was established through an initial endowment from the Government of Canada to the Federation of Canadian Municipalities. It is a revolving fund whereby the Federation of Canadian Municipalities must make strategic investments to ensure the fund's sustainability in perpetuity.

- The Green Municipal Fund is overseen by a Council that is composed of one third of members of the Government of Canada, one third from the public, academic, environment and private sectors, and the remaining membership appointed by Federation of Canadian Municipalities' National Board of Directors. Infrastructure Canada, as a signatory to the agreement, provides an official to sit as a member of the Council.

- Although the Minister of Infrastructure and Communities is a signatory to the agreement under which the Fund is administered, overall federal leadership with respect to the Fund is provided by Natural Resources Canada and Environment and Climate Change Canada. Infrastructure Canada's role is primarily limited to providing strategic advice via the participation of a departmental official on the Council.

- Potential recipients may apply for funding year-round, though offers on specific funding streams may close once the funding for specific initiatives has been fully allocated.

- Projects are ranked based on technical criteria which is reviewed by the Federation of Canadian Municipalities' peer review committee prior to being assessed by the Council.

- The Council typically meets ten times annually, with occasional ad hoc meetings being scheduled as required.

FUNDING

- Initially, the Government of Canada endowed the Federation of Canadian Municipalities with a total of $550 million for this initiative through a series of budget decisions from 2000 to 2005. Budget 2016 announced $125 million in additional funding to enhance the Fund.

- More recently, Budget 2019 provided an additional $950 million to support energy efficiency in the built environment through a top-up to the Green Municipal Fund as follows:

- $350 million for Sustainable Affordable Housing Innovation;

- $300 million for Community Ecoefficiency Acceleration to advance home retrofits and innovative financing mechanisms; and

- $300 million to fund Low Carbon Cities Canada and collaborate on Community Climate Action to improve energy efficiency in large buildings.

- The $950 million in additional funding from Budget 2019 has been flowed to the Federation of Canadian Municipalities by Natural Resources Canada and Environment and Climate Change Canada

- As a revolving fund, the Government of Canada's endowment is to be managed in a financially sustainable manner as to preserve the invested capital to meet future disbursement requirements. The Federation of Canadian Municipalities is therefore responsible for ensuring that the financials of the program, including the interest generated from loans and other investments, as well as the balance of loans and grants to recipients, are carried out in such a way as to ensure the sustainability of the fund in the long-term.

CURRENT STATUS

- The Green Municipal Fund has been one of the Federation of Canadian Municipalities' flagship programs since its inception. It is well received by municipalities as it provides funding opportunities for more innovative projects than the public sector will typically fund.

- The program is currently developing a strategy for the implementation of the initiatives tied to the Budget 2019 commitment by the federal government.

- A Performance Audit and Review of the program must be carried out by the Federation of Canadian Municipalities every five years. An audit is currently being finalized and the findings will be brought forward to the Council as appropriate. As per the agreement, the audit will be made public and may also be tabled in Parliament by one of the Ministers who are signatories to the agreement. The previous audit in 2014 found no significant issues.

NEXT STEPS

- The Performance Audit and Review mandated by the agreement with the Federation of Canadian Municipalities is currently being finalized. There are no other audits or evaluations planned at this point in time.

- Infrastructure Canada will continue participating on the Council to represent the Government of Canada and provide oversight of the program.

PUBLIC TRANSIT INFRASTRUCTURE FUND AND CLEAN WATER AND WASTEWATER FUND

MANDATE

- Budget 2016 provided funding for two short-term programs: the Public Transit Infrastructure Fund, which is targeted at the rehabilitation and planning of public transit systems, and the Clean Water and Wastewater Fund, which is aimed at the rehabilitation, optimization and planning of water and wastewater related infrastructure.

- Both Funds were designed to be short funding programs focused on the rehabilitation of existing infrastructure assets by provinces, territories and municipalities in advance of investments under longer-term funding arrangements in a second phase.

DESCRIPTION

- Both Funds were launched in April 2016.

- The Public Transit Infrastructure Fund was launched as a two-year, $3.4 billion fund to help accelerate municipal investments to support the rehabilitation of transit systems, new capital projects, and planning and studies for future transit expansion to foster long-term transit plans.

- The Clean Water and Wastewater Fund was launched as a two-year, $2 billion fund for projects that contribute to the rehabilitation of both water treatment and distribution infrastructure and existing wastewater and storm water treatment systems; collection and conveyance infrastructure projects; and initiatives that improve asset management, system optimization, and planning for future upgrades to water and wastewater systems.

- Infrastructure Canada entered into contribution agreements with all provinces and territories for the delivery of the programs. Provinces and territories were responsible for identifying projects, in collaboration with municipalities, to be funded under the programs.

- Both Funds are now closed to new applications.

- Infrastructure Canada originally launched both funds with a two-year program implementation horizon. In 2018, the deadline to incur eligible costs was extended to March 31, 2020, due to requests from provinces, territories and municipalities. In June 2019, the department received authorities to further extend the deadline for eligible costs beyond March 31, 2020 for certain projects where there is a demonstrated need. Approval for future extensions could be done on a case-by-case basis.

FUNDING

Public Transit Infrastructure Fund:

Project Funding Envelope:Footnote 7 |

Funding Still Available: |

Projects Approved and Announced: |

||||

|---|---|---|---|---|---|---|

$3.4 B |

$0 |

1194 |

||||

Funding Profile: |

||||||

Prior to |

2019-20 |

2020-21 |

2021-22 |

2022-23 |

||

$1.4 B |

$1.1 B |

$876.6 M |

N/A |

N/A |

||

2023-24 |

2024-25 |

2025-26 |

2026-27 |

2027-28 |

||

N/A |

N/A |

N/A |

N/A |

N/A |

||

Clean Water and Wastewater Fund:

Project Funding Envelope:Footnote 8 |

Funding Still Available: |

Projects Approved and Announced: |

||||

|---|---|---|---|---|---|---|

$2.0 B |

$0 |

2390 |

||||

Funding Profile: |

||||||

Prior to |

2019-20 |

2020-21 |

2021-22 |

2022-23 |

||

$1.1 B |

$598 M |

$317.5 M |

N/A |

N/A |

||

2023-24 |

2024-25 |

2025-26 |

2026-27 |

2027-28 |

||

N/A |

N/A |

N/A |

N/A |

N/A |

||

- Unspent funding from the Public Transit Infrastructure Fund will be transferred into the Investing in Canada Infrastructure Program's Public Transit funding stream, while unspent funding from the Clean Water and Wastewater Fund will be transferred to the Investing in Canada Infrastructure Program's Green Infrastructure stream.

CURRENT STATUS

- As of March 31, 2018, no additional projects can be approved under either Fund.

Public Transit Infrastructure Fund:

- A total of 1194 projects with a federal contribution of over $3 billion and total value of over $6.4 billion have been approved. A total of 576 projects have already been successfully completed, which represents 48 percent of approved projects.

Clean Water and Wastewater Fund:

- A total of 2390 projects with a federal contribution of $1.9 billion and total value of over $3.8 billion have been approved. A total of 1222 projects have already been successfully completed, which represents 51 percent of approved projects.

NEXT STEPS

- Infrastructure Canada will continue to work with provinces and territories to identify a list of projects that would need to extend completion deadlines beyond the March 2020 deadline.

- As of November 1, 2019, provinces and territories have submitted lists of projects to the department that should be cancelled, de-scoped or extended. The department is assessing the lists of projects and will present the recommended list to the Minister of Infrastructure and Communities for approval.

- Where approved, relevant Contribution Agreements will need to be amended before March 2020 to reflect the program extension.

NEW BUILDING CANADA FUND

MANDATE

- The New Building Canada Fund, now fully committed, provides funding for provincial, territorial and municipal infrastructure projects that contribute to economic growth and prosperity, a clean environment, and stronger communities.

DESCRIPTION

- Announced in Budget 2013 and established in 2014, the Fund is comprised of two components:

the Provincial-Territorial Infrastructure Component and the National Infrastructure Component.

Provincial-Territorial Infrastructure Component

- This component supports infrastructure projects of national and regional significance that contribute to economic growth, a clean environment and stronger communities. It is composed of two sub-components:

- The National and Regional Projects, which supports medium- to large-scale infrastructure projects across fourteen categories of investment that encourage job creation and economic growth; and

- The Small Communities Fund, which supports infrastructure projects in municipalities with fewer than 100,000 residents.

- Both of these sub-components are delivered through allocations to provinces and territories. Within their allocations, projects are prioritized by provinces and territories before being submitted to Infrastructure Canada for approval.

- In the case of the National and Regional Projects stream, individual contribution agreements are signed directly with eligible recipients for each project. Under the Small Communities Fund, a single funding agreement was signed between Infrastructure Canada and each province and territory, with the provinces and territories being responsible for entering into contribution agreements with the ultimate recipient of each project.

National Infrastructure Component

- This component supports projects of national significance that have broad public benefits with strong impacts on economic growth and productivity.

- Projects supported through this component will help to achieve one or more of the following objectives: generating or facilitating incremental economic activity; reducing potential economic disruptions or foregone economic activity; generating productivity gains for the Canadian economy; and, providing benefits that extend beyond the provinces or territories where the project would be located.

- Funding is awarded on a merit basis. Projects are submitted by proponents to Infrastructure Canada for approval. For projects selected for funding, the department enters into contribution agreements with recipients.

FUNDING

Project Funding Envelope:Footnote 9 |

Funding Still Available: |

Projects Approved and Announced: |

||||

|---|---|---|---|---|---|---|

$12.8 B |

$0 |

1261 |

||||

Funding Profile: |

||||||

Prior to |

2019-20 |

2020-21 |

2021-22 |

2022-23 |

||

$1.7 B |

$1.6 B |

$1.9 B |

$2.2 B |

$1.8 B |

||

2023-24 |

2024-25 |

2025-26 |

2026-27 |

2027-28 |

||

$1.7 B |

$819.7 M |

$686.2 M |

$226 M |

$151.4 M |

||

CURRENT STATUS

- All funding available for projects under these programs has been committed, and the department is no longer accepting additional applications.

- This program is scheduled to end in 2027-2028.

Provincial-Territorial Infrastructure Component - National Regional Projects

- A total of 286 projects with a federal contribution of $8.5 billion and total value of over $22 billion have been approved. A total of 48 projects have already been successfully completed, which represents 17 percent of approved projects.

- The largest categories of investment under this sub-component were highway and road projects and public transit projects.

Provincial-Territorial Infrastructure Component - Small Communities Fund

- A total of 966 projects with a federal contribution of $1.48 billion and total value of over $3.5 billion have been approved. A total of 321 projects have already been successfully completed, which represents 33 percent of approved projects.

- The largest categories of investment under this sub-component were highway and road projects and wastewater projects.

National Infrastructure Component