Tab B: INFC topics

Tab B: INFC topics

- Parliamentary Budget Officer Reports on the Investing in Canada plan

- Canada Infrastructure Bank

- Auditor General of Canada - Audit of Investing in Canada Plan

- COVID-19 Stream of the Investing in Canada Program

- Municipalities and Transit - Request for operational funding

- Transit Projects – Funding Pressures

- Gas Tax Fund

- Indigenous Funding

- Integrated Bilateral Agreements

- Administrative Burden

- Climate Lens

- Disaster Mitigation and Adaptation Fund

- Federation of Canadian Municipalities

- Economic Impacts of Infrastructure Investments

- Water and Wastewater Projects

- Community Employment Benefits

- Funding for Small, Rural and Northern Communities

Parliamentary Budget Officer Reports on the Investing in Canada plan

June 15, 2020

Issue

- The Parliamentary Budget Officer (PBO) has issued four reports on the Investing in Canada Plan that have been critical of the Plan in three areas: the pace of spending under the Plan, lower than forecast economic benefits, the displacement of federal spending by provinces and territories.

- The PBO has also raised issues about the transparency of reporting under the Plan, particularly with respect to the number of projects approved.

Responsive Lines – Pace of Spending under the Plan

- After lower than planned amounts in the early years of the Plan, spending rates are on the way back to getting on schedule.

- That said, spending is not a good indicator of progress. This is true because the work that matters to Canadians happens well before a dollar of federal money is transferred to provinces.

- Under the majority of Infrastructure Canada's programs, the flow of federal funds occurs when claims are submitted to Infrastructure Canada for reimbursement.

- Communities will generally incur expenses first and will be reimbursed by provinces and territories for their share of funding once the municipality submits its invoice. Finally, the federal government will reimburse the province, territory or community as they claim eligible expenses.

- We know that across Canada, even when we have not yet received claims for reimbursement of the costs, construction is underway, and people are benefitting from job opportunities.

- For example, Edmonton has received federal approval on the Winspear Centre Completion Project and construction has started on the building of a 41,000 square feet of mixed-use new cultural space that will increase access to community, cultural and recreational infrastructure for residents.

Responsive Lines – Lower than forecast economic benefits

- Most analysis of the economic benefits of federal infrastructure spending focuses on when federal spending actually occurs. This is a lagging indicator, since federal payments occur when provinces and territories submit claims for expenses incurred.

- Economic activity starts when projects are approved – since this is when planning, design, and construction can start.

- We know that this work is happening. According to Statistics Canada's Infrastructure Economic Account, between 2015 and 2019, the number of jobs related to the construction of infrastructure increased by 68,000 – from 540,000 to 608,000.

Responsive Lines – Displacement of federal funding by provinces and territories

- Under the Investing in Canada Plan, provinces and territories share in the cost of projects and have committed to ensuring that federal funding received over the life of their agreements will not displace provincial and territorial infrastructure spending on each of the asset classes funded.

- In any single year, we understand that provincial infrastructure spending might not happen as planned. It is therefore important to look at this issue over a longer time period.

- According to Statistics Canada's Infrastructure Economic Account, between 2015 and 2019, public spending on infrastructure increased by 19.5% - from $51.9 billion to over $62 billion.

- The Government is confident that federal infrastructure funding will continue to lead to an overall increase in infrastructure investment.

Responsive Lines – Reporting on Projects

- Infrastructure Canada is the lead for reporting for the Investing in Canada Plan and works closely with the 20 federal organizations involved in the delivery of more than 70 programs.

- To date, nearly 55,000 projects have been approved under the Investing in Canada Plan:

- A detailed list of over 33,000 projects has been provided to the PBO and three Parliamentary committees – TRAN, FINA (House Finance) and NFFN (Senate Finance);

- 12,000 projects funded under the Gas Tax Fund and reported on by provinces and territories; and

- Almost 10,000 projects funded through Canada Mortgage and Housing Corporation programs for which project-level information is not available for privacy or security reasons.

- I recently wrote to the Committee to provide additional information about the Investing in Canada plan. I attached a letter that my Deputy Minister sent to the Parliamentary Budget Officer, which provided all available information at the project level for programs under the Plan.

Background

PBO Reports on the Investing in Canada Plan

- At the request of Parliamentarians, the PBO has been closely monitoring the implementation of the Investing in Canada Plan and has written a number of high-profile reports about the Plan. The PBO will release a new report on the Plan on June 17, 2020.

- Infrastructure Canada worked with other federal departments to provide a detailed list of over 33,000 projects under the Investing in Canada Plan to the PBO.

- On May 29, 2020, the PBO, Yves Giroux, appeared before the House Standing Committee on Government Operations and Estimates. In his appearance, he stated that his office has received information on approximately 33,000 projects under the Plans. He further stated that he believes the additional 20,000 projects exists but he has no proof of their existence. He suggested that provinces have reduced spending since the commencement of the Plan and the economic benefits were relatively small given the amounts spent.

- In response, on June 5, 2020, the Deputy Minister of Infrastructure and Communities wrote to the PBO to provide additional detail and clarification on the full complement of Plan projects. Specifically extra information was provided on 12,000 projects delivered through the Gas Tax Fund and the over 9,900 projects delivered by Canada Mortgage and Housing Corporation.

- Over the course of four reports between March 2018 and April 2019, the PBO has raised various issues about the Plan.

- March 13, 2019 and April 9, 2019 - Infrastructure Update: Investments in Provinces/Territories and Municipalities

- In two reports, the PBO examined capital investments made by provinces, territories and five municipalities (Toronto, Ottawa, Calgary, Edmonton, and Montréal) with the objective of identifying the incremental impact of the Plan on their spending.

- For the purposes of these reports, the PBO used consolidated capital spending figures for provinces, territories and municipalities. These figures include significant amounts of spending that are not covered by federal programs, including hospitals and schools.

- The department has been working with provincial and territorial officials to develop a robust methodology to determine whether displacement has occurred. Given the long lifespan of the Plan, it will not be possible to determine whether displacement is occurring for a number of years.

- August 22, 2019 – Status Report on Phase 1 of the Investing in Canada Plan

- This report reiterated previous findings pertaining to delay in federal funding compared to Budget 2016 timeline, including the lower than forecast economic benefits. However, the report added that these delays were largely attributable to implementation delays by provincial and municipal governments.

- Prior to the release of this report, INFC worked closely with the PBO and participating departments to ensure that the PBO was provided with all requested information, including the development of an information request form that conformed to the way project information is provided to INFC for the purposes of the Investing in Canada Plan geo-map.

- As a result of these efforts, there was no suggestion that information was not provided to the PBO.

- This report triggered conversation about which level of government is responsible for the pace at which infrastructure spending is committed.

- This report reiterated previous findings pertaining to delay in federal funding compared to Budget 2016 timeline, including the lower than forecast economic benefits. However, the report added that these delays were largely attributable to implementation delays by provincial and municipal governments.

- March 29, 2018 – Status Report on Phase 1 of the New Infrastructure Plan

- This report noted that there have been delays in federal infrastructure spending, project identification, and project start dates. As a result of these delays, the PBO indicated that the expected economic benefits of Phase 1 of the Plan were lower than originally forecast by the Government.

- The report also noted that a number of federal departments and agencies did not respond to the PBO's request for information about their infrastructure spending. This lack of response was highlighted in the report and contributed to the narrative that the Plan was not well organized.

- On April 19, 2018, the then Minister of Infrastructure and Communities held a media event and provided a complete update on the status of the Plan.

- The Minister also released the Investing in Canada Plan: Canada's Long Term Infrastructure Plan, which provided a detailed description of the Plan.

- Following the report, the department also posted a table showing project approvals, funding committed and reimbursements claimed for all programs under the Plan. This table is updated regularly – at least quarterly for all departments.

Project Lists

- The project list provided to the Parliamentary Budget Officer contained 33,048 individual projects valued at $52.5 billion of approved federal spending, detailed by department below:

- Canada Infrastructure Bank: 4 projects;

- Canada Mortgage and Housing Corporation: 8,523 projects;

- Canadian Heritage: 417 projects;

- Crown-Indigenous Relations and Northern Affairs Canada: 459 projects;

- Employment and Social Development Canada: 2,434 projects;

- Environment and Climate Change Canada: 4 projects;

- Health Canada: 2 projects;

- Indigenous Services Canada: 11,980 projects;

- Infrastructure Canada: 5,972 projects;

- Innovation, Science and Economic Development: 85 projects;

- Natural Resources Canada: 308 projects;

- Parks Canada Agency: 132 projects;

- Public Health Agency of Canada: 81 projects;

- Transport Canada: 137 projects;

- Atlantic Canada Opportunities Agency: 656 projects;

- Federal Economic Development Initiative for Northern Ontario: 122 projects;

- Federal Economic Development Agency for Southern Ontario: 381 projects;

- Canada Economic Development for Quebec Regions: 514 projects;

- Western Economic Diversification Canada: 785 projects; and

- Canadian Northern Economic Development Agency: 52 projects.

- In sum, the total project count based on information available today is 54,993.This figure is composed of the 33,047 projects provided to the PBO, the estimated 12,000 projects under the Gas Tax Fund and the 9,946 Canada Mortgage and Housing Corporation projects for which project-specific information is either not publicly disclosed or not applicable.

- The Gas Tax Fund appears as a single entry on the list, valued at $8.5 billion of federally approved spending. The Government's project count for the Investing in Canada Plan includes 12,000 projects funded by the Gas Tax Fund – 4,000 for each of 2016-17, 2017-18 and 2018-19. The Gas Tax Fund is unique among the programs in the Investing in Canada Plan. It has been established as a permanent source of funding to communities, available to meet their local needs under 18 categories of infrastructure investment. Over the 12-year life of the Investing in Canada Plan, the federal government will provide over $26 billion in support to communities across Canada through this program.

- Gas Tax Fund recipients are required to attest that funds have been used in accordance with their respective Gas Tax Fund agreement, and to submit third-party audited financial statements. Under the administrative agreements of all provinces and territories except Quebec, Infrastructure Canada receives a list of projects funded by the Gas Tax Fund with an Annual Expenditure Report following the end of the fiscal year. Infrastructure Canada reviews the lists provided to ensure that the reporting requirements of the agreement have been met, however the projects themselves are not reviewed, approved or validated by Infrastructure Canada.

- Additionally, Canada Mortgage and Housing Corporation delivers a number of initiatives through bilateral agreements with provinces and territories that total 9,946 projects where no project-level information is available. This is intended to protect the privacy of individuals and the security of survivors of domestic violence. For example, some of these projects include rental subsidies to vulnerable individuals - whereby it would be inappropriate to provide their details publicly. Claims information is audited by a third party to confirm compliance with the bilateral agreements.

Canada Infrastructure Bank

Governance

Responsive Lines

- Crown corporations operate at arm's length from the Government of Canada and have the flexibility to fulfill their commercial mandates, while adhering to applicable policies and guidance.

- As per the Statement of Priorities and Accountabilities, the Minister encouraged the Canada Infrastructure Bank to develop a compensation policy that reflects the best practices of Crown corporations and other comparable organizations to ensure the rates of compensation are fair and appropriate.

- The rate of any remuneration paid to the Chief Executive Officer is based on the recommendation of the Board and approved by the Governor in Council.

- The Government abides by Privacy Act and Access to Information Act provisions concerning employee compensation. Any information concerning specific individuals and compensation is protected as it is personal information.

Background

- All Crown corporation Chief Executive Officers (CEOs) are subject to Governor in Council (GIC) appointee annual performance review processes, and performance rating recommendations come from the Board of Directors to the designated minister.

- The GIC Performance management regime require the Board of every Crown corporation to annually assess their CEO and share their assessment with the appropriate minister, as well reflect any minister's views in their performance rating of the CEO.

- The CIB develops and executes project deals with private sector investors to deliver the best value for public resources. To execute on its mandate, it must attract top global talent with competitive compensation packages.

- Results of individual awards and compensation are not disclosed for protection of personal privacy, although the framework and ranges are public.

- Remuneration for the CEO includes the following as set out in 2018/19 as year 1:

- Base salary: range of $510,000 - $600,000 per annum.

- In addition, the CEO's compensation includes annual short-term and long-term incentive awards, subject to the Board of Directors' review of performance against objectives, as follows:

- Annual Short-Term Incentive Award:

- Year 1: between 0% and 75% of base salary

- Year 2: between 0% and 120% of base salary

- Year 3: between 0% and 135% of base salary

- Year 4: between 0% and 160% of base salary

- Year 5: between 0% and 185% of base salary

- Long-Term Incentive Award:

- Year 1: between 0% and 75% of base salary

- Year 2: between 0% and 120% of base salary

- Year 3: between 0% and 135% of base salary

- Year 4: between 0% and 160% of base salary

- Year 5: between 0% and 185% of base salary

- The second CEO of the corporation is to be appointed by the Board of Directors, subject to GIC approval. Any changes to the performance regime would require GIC approval.

- Mr. Pierre Lavallée was the CEO of the Infrastructure Bank from June 18, 2018 to April 3, 2020. The Board of Directors is currently in the process of recruitment and selection of a CEO nominee.

Projects

Responsive Lines

- The Canada Infrastructure Bank is working on complex, long-term projects and is helping to build capacity with government partners across Canada on attracting private investment to help public policy challenges.

- Signature projects include an investment in REM light rail transit in Montréal, and development work with Ontario on GO Train Corridor Expansion in greater Toronto; and with VIA on High Frequency Rail in the Ontario Quebec Corridor. Other projects include advising territorial governments on hydro projects and electrical interties.

- As a Crown corporation, the Bank is responsible for costs related to its administration, human resources, information technology, professional fees and premises.

Background

The government reviews CIB projects for policy alignment and public interest through the Corporate Plan. The execution of CIB projects, their financing structure and terms, are overseen by their Board of Directors.

Projects

- The CIB's four announced investments include:

- A $1.28B investment in Réseau express métropolitain (REM) light rail in Montréal;

- An up to $2B investment in GO Expansion – On Corridor electric rail in Greater Toronto Area;

- An up to $20M investment in Mapleton municipal Water and Wastewater; and

- An up to $300M investment in construction of a new container terminal in Port of Contrecoeur outside Montréal.

- CIB has announced Memorandums of Understanding and advisory engagements on six projects:

- VIA High Frequency Rail: A Joint Project Office between CIB and VIA Rail to facilitate and oversee the conduct of pre-procurement, planning, due diligence and de-risking activities for VIA High Frequency Rail project between Ontario and Quebec;

- Lulu Island District Energy: A Memorandum of Understanding formalizing collaboration between CIB and Lulu Island Energy Company to develop a new district energy project in Richmond, BC;

- Taltson Hydroelectric: Advisory services engagement with Government of Northwest Territories to assist in developing a new 60 MW clean energy hydroelectric facility and 270km of transmission lines to reduce reliance on diesel, and facilitate a more flexible and balanced electricity load in the region;

- Pirate Harbour Wind Farm: A Memorandum of Understanding formalizing the collaboration between CIB and project proponents on the potential Pirate Harbour Wind Farm in Nova Scotia;

- Kivalliq Hydro-Fibre Link between Manitoba and Nunavut: A Memorandum of Understanding with Kivalliq Hydro-Fibre Link project proponents to work on planning and development of the proposal; and

- Calgary-Banff Passenger Rail: A Memorandum of Understanding with the Province of Alberta for a passenger railway between downtown Calgary and Banff. A potential connection to the Calgary airport is being explored as well but has not been formally studied at this stage.

Operating expenses

- Since its inception in 2017-18, the Canada Infrastructure Bank (CIB) has drawn down $39.6 million for operating costs.

- These costs include the CIB's contribution to the Joint Project Office (JPO) that supports the VIA high frequency rail project, which is expected to have operating costs of $55 million over FYs 2018-19, 2019-20 and 2020-21.

- For fiscal year 2019-20, in its second full year of operations, the CIB drew down (cash basis) $17.2 million for operating costs.

- In 2020-21, CIB is planning for operating expenses of $77.8 million, which includes $40 million in operating expenses for the VIA JPO.

- In its first two full years of operations (FY 2018-19 and FY 2019-20), the CIB's actual appropriations for operating expenses have come in well below planned levels.

Canada Infrastructure Bank Operating Expenses

| ($ M) | Planned Operating Expenses | Actual Appropriations | Planned Expenses for VIA JPO |

|---|---|---|---|

| 2017-18 | N/A | 2.2 | 0 |

| 2018-19 | 31.1 | 11.4 | 0 |

| 2019-20 | 42.4 | 17.2 | 5.5 |

| 2020-21 | 77.8 | 8.5 | 40.0 |

Auditor General of Canada Audit of the Investing in Canada plan

Responsive Lines

- The Government of Canada is committed to transparency and accountability in all its spending of public funds.

- Infrastructure Canada is working with the Office of the Auditor General to provide all required information for its audit of the Investing in Canada plan. We will welcome any findings and recommendations that the Auditor General may have.

- The Government of Canada will continue to ensure the Office of the Auditor General has the appropriate level of support it needs to do its work.

Background

- In February 2020, the Auditor General accepted a motion passed by the House of Commons, and noted that it would endeavour to table a report by January 2021. The motion noted "…immediately conduct an audit of the government's Investing in Canada Plan, including, but not be limited to, verifying whether the plan lives up to its stated goals and promises; and that the Auditor General of Canada report his findings to the House no later than one year following the adoption of this motion."

- At its June 9, 2020 meeting, the Standing Committee on Finance adopted the following motion: "That the Standing Committee on Finance call on the Auditor General of Canada to audit all federal programs associated with Canada's COVID-19 response and to complete all previously-scheduled audits and all audits requested by the House; and call on the government to provide the Office of the Auditor General all the funding it needs to carry out these audits and any other work it deems appropriate."

- Department officials have responded to all requests by the Office of the Auditor General. In addition, weekly meetings between the OAG and the department's Internal Audit and Evaluation and Policy and Results Branches are taking place to facilitate coordination of progress.

Approval

- Drafter and approver: Isabelle Trépanier, Chief Audit and Evaluation Executive

COVID-19 Stream of the Investing in Canada Program

Responsive Lines

- The health and well-being of Canadians remains our top priority as COVID-19 continues to have an unprecedented impact on people and economies across the country.

- To support Canadians during the pandemic, the Government of Canada is proposing changes to the $33.5-billion Investing in Canada Infrastructure Program bilateral agreements.

- We are proposing a new COVID-19 stream that would include new flexibilities, expanded project eligibility and accelerated approvals.

- The new COVID-19 stream would also provide an increased federal cost-share for a broader range of vital infrastructure projects like health facilities, shelters and emergency services buildings.

Background

- Infrastructure Canada (INFC) is expanding program parameters under Investing in Canada Infrastructure Program (ICIP) brought on by the COVID-19 pandemic.

- A key change to ICIP is the introduction of a new, time limited, COVID-19 Resilience stream. This new stream represents an initial step aimed at addressing the current health and socio-economic crisis and supporting economic stability.

- The COVID-19 Resilience stream investments are key to the economy and can be a driver of economic recovery by advancing the project approval process to allow for work to get underway.

- COVID-19 Resilience stream will be supported by a transfer of up to 10% ($3.5 billion) of the original allocations under the Public Transit, Green Infrastructure, Community, Culture and Recreation Infrastructure, and Rural and Northern Communities Infrastructure streams.

- The COVID-19 Resilience stream's eligibility will be determined based on the category and asset class and projects cannot exceed $10 million in total eligible costs.

- Projects must be completed by December 31, 2021, or by December 31, 2022 in the territories and in remote communities.

- The COVID-19 Resilience stream will provide funding to the following types of infrastructure projects:

- Retrofits, repairs and upgrades for municipal and provincial buildings, [redacted], health infrastructure and schools;

- COVID-19 Resilience infrastructure, including measures to support physical distancing and repurposing infrastructure to support pandemic response;

- Active transportation infrastructure, including parks, trails, foot bridges, bike lanes and multi-use paths; and

- Disaster mitigation, adaptation [redacted], including natural infrastructure, flood and fire mitigation, tree planting and related infrastructure, [redacted].

Approval Box

- Helene Picard – 613-862-8454

- Alison O'Leary – ADM POB

Operational Funding for Municipalities and Public Transit

Responsive Lines

Operational Support

- The federal government has announced that it will be contributing $14B and working with premiers from all provinces and territories to support cities and municipalities, so that Canadians can count on the services and programs they need for a safe restart to all areas of the economy.

- The federal government is working with all provinces and territories to develop the details of this initiative and will be there, alongside its partners, to help address challenges related to this crisis.

Existing Transit Funding

- Safe, modern, and efficient public transit systems are important for the health and sustainability of our communities.

- The Government of Canada is investing $28.7 billion over 12 years in public transit projects.

- This funding will make it possible for Canadian communities to transform the way people live, move and work.

Pandemic-Specific Infrastructure Funding

- I am currently engaged with provinces, territories, municipalities and other stakeholders on infrastructure measures aimed at addressing the current pressures facing communities due to the COVID-19 pandemic.

- As a result of these discussions, the Government of Canada is proposing changes to the Investing in Canada Infrastructure Program, including making some rules more flexible, expanding project eligibility and accelerating approvals.

- Among the changes being proposed is a new COVID-19 stream that would provide an increased federal cost-share – up to 80% for transit systems – covering a broader range of projects, and quicker project approvals in the short-term.

- Over $3 billion of existing funding could become available under this new stream, depending on the needs of each province and territory.

- This is funding for projects that can begin quickly while also maintaining our objectives of creating long-term economic growth, supporting a green economy and building inclusive communities.

Background

The FCM has recently requested $10 billion in emergency federal operations support to help alleviate revenue pressures local governments are reporting as a result of the pandemic lockdown. Municipalities have deferred the collection of property taxes and are unable to collect a range of user fees while simultaneously facing increased costs associated with managing the pandemic and protecting vulnerable populations.

The FCM request includes $2.4 billion for transit systems. As a result of the lockdown, ridership declined by ~80% nationally, and rear-door boarding - intended to protect drivers - has prevented many systems from collecting fares. Many systems have reduced service levels and, in some cases, furloughed workers to reduce operational deficits.

Public transit is key focus of federal infrastructure investments. The Investing in Canada Plan is investing over $28 billion to improve transit infrastructure throughout Canada. This includes $3.4 billion through the Public Transit Infrastructure Fund; $20.1 billion through the Investing in Canada Infrastructure Program; and $5 billion allocated to the Canada Infrastructure Bank.

The federal government does not fund the general operations of municipal governments and/or transit systems, as this is a provincial jurisdiction. [redacted] On June 11th, the Prime Minister reaffirmed that the Government of Canada is ready to contribute $14 billion to help provinces and territories address their critical needs over the next six to eight months. This includes personal protective equipment for healthcare workers and businesses, testing and contact tracing, childcare, assistance for vulnerable populations, support for municipalities, and paid sick leave for workers.

In recognition of these pressures, the Government recently announced that an allocation of $2.2 billion under the federal Gas Tax Fund would be accelerated this year, and provided in a single payment in June to help Canadian communities recover from the COVID-19 pandemic as quickly as possible, while respecting public health guidelines.

The Government of Canada has also recently announced proposed changes to the $33.5 billion Investing in Canada Infrastructure Program, making some rules more flexible, expanding project eligibility and accelerating approvals. Among the changes being proposed is a new COVID-19 funding stream that would provide an increased federal cost-share for a broader range of projects and quicker project approvals in the short-term. Over $3 billion in existing funding could be redirected to this new stream by provinces and territories.

Transit Projects – Funding Pressures

Responsive Lines

- Safe, modern, and efficient public transit systems are important for the health and sustainability of our communities.

- The Government of Canada is investing $28.7 billion over 12 years in public transit projects.

- This funding will make it possible for Canadian communities to transform the way people live, move and work.

- The Government of Canada is committed to establishing a permanent source of funds to support public transit, which would rise with the cost of construction over time.

Background

- The Province of Ontario has prioritized six major transit projects in the Greater Toronto Area and is seeking a federal commitment to fund a minimum 40% of its provincial priority projects, requiring approximately $6 billion beyond the $5.1 billion already notionally allocated for these projects under the Investing in Canada Infrastructure Program (ICIP).

- These six projects include four provincial priorities: Ontario Line, Scarborough Subway Extension, Yonge North Subway Extension and Eglinton Crosstown West Extension; and two projects put forward by the City of Toronto: Bloor-Yonge Station Capacity Enhancement and SmartTrack Stations.

- The preliminary cost estimate for the six major transit projects in Ontario is approximately $31.3 billion.

- Mayors Council (Metro Vancouver) has advocated for additional federal funding of $685-million in addition to ICIP. Specific pressures identified are:

- SkyTrain to the University of British Columbia (UBC): TransLink is studying an extension of the Millennium Line from Arbutus. Mayors Council is seeking federal commitment to the Arbutus to UBC line to allow for a continuity of work from Phase 1 (Vancouver Community College/Clark Station to Arbutus). Seeking at least $50-million from federal for completion of procurement readiness as part of a broader $215-million request relating to Sky Train, West Coast Express, Seabus.

- Surrey Sky Train Phase 2 (Fleetwood to Langley City Centre): Mayors Council intends to use the remaining TransLink allocation under the Public Transit Infrastructure stream (was $196-million – now likely $156-million as the federal funding has increased for Phase 1) and has requested an additional $330 million in federal support completion of this phase of the project.

- Quebec's top six public transit projects are a light rail system in Gatineau; the expansion/construction of a new Pink Line between Montréal North and Lachine; a new Transit Mode to extend the Yellow Line in Longueil (connected to the REM); and a new Transit Mode west of the Orange Line in Laval. [redacted]

- In addition, the Federation of Canadian Municipalities (FCM) has recently requested $10-billion in emergency federal operations support to help alleviate revenue pressures local governments are reporting as a result of the pandemic lockdown. The FCM request includes $2.4-billion for transit systems. As a result of the lockdown, ridership declined by ~80% nationally, and rear-door boarding - intended to protect drivers - has prevented many systems from collecting fares. Many systems have reduced service levels and, in some cases, furloughed workers to reduce operational deficits.

- The federal government does not currently fund the general operations of municipal governments and/or transit systems, as this is a provincial jurisdiction.

Drafted by: Marie-Pier Nassif

Phone number: 613-618-9216

Approved by: Alison O'Leary

Phone number: 613-618-8156

The Gas Tax Fund

Responsive Lines

- Each year, the federal Gas Tax Fund provides over $2.2 billion in stable and predictable funding to more than 3,600 communities across the country.

- Municipalities are able to pool, bank, and borrow against this funding, and the GTF can be used to support projects in 18 different categories. The funding supports about 4,000 projects each year.

- On June 1, the Government of Canada announced it was accelerating this year's payment to help Canadian communities recover from the COVID-19 while respecting public health guidelines.

Background

- The federal Gas TaxFund is a permanent, legislated and indexed funding program that currently provides $2.2 billion annually for municipal infrastructure.

- The Gas Tax Fund was established in 2005 and originally designed to provide municipalities with $5 billion in predictable funding over five years. The program was extended and legislated as a permanent source of federal infrastructure funding for municipalities. The federal Gas Tax Fund (signed in 2014) has been indexed at two percent per year, to be applied in $100 million increments. From 2014 to 2024, the GTF will provide municipalities with close to $22 billion in infrastructure funding.

- Typically, Infrastructure Canada makes two equal payments to each signatory each year. The first payment generally occurs in early summer, and the second in the fall. However, due to the COVID-19 pandemic, the full allocation was accelerated for 2020.

- Allocations are calculated on a per capita basis for provinces, territories and First Nations, and provide a base funding amount for smaller jurisdictions (Prince Edward Island and each territory). The GTF allocation is indexed at 2% per year and is paid out in $100 million increments (roughly every two years).

- Eligible categories of investment are broad and include public transit, local roads and bridges, drinking water and wastewater infrastructure, community energy systems, culture, recreation, disaster mitigation and capacity building.

- The federal Gas Tax Fund provides annual infrastructure funding to more than 3,600 communities across the country. In recent years the funding has supported approximately 4000 projects each year.

- On June 5, 2020, a list of projects under the Gas Tax Fund was provided to the Parliamentary Budget Officer in response to the request to clarify the number in projects reported under the Investing in Canada Plan (the Plan). The federal government does not approve review or approve projects under the Gas Tax Fund, and recipients are responsible for reporting on the outcomes of their projects to their residents.

- The list Infrastructure Canada receives from recipients about projects funded by the GTF is only used to provide an estimate of funded projects. Recipients have full discretion to change the project scope or substitute projects after they have been reported to the Department. Despite these limitations, the list provides a broad record of the kinds of projects being advanced by municipalities, and an indication of the overall use of funds under the program.

Drafted by: Shane McCaldin

Phone number: 343-543-5693

Approved by: Alison O'Leary

Phone number: 613-618-8156

Indigenous Funding

Responsive Lines

- Infrastructure Canada's programs complement the core funding being delivered by Indigenous Services Canada.

- All First Nations, Inuit, and Métis communities, governments, and organizations are eligible recipients under our programs.

- I am working with the Minister of Indigenous Services and my other Cabinet colleagues to engage Indigenous partners and support the co-development of distinctions-based community infrastructure plans that address critical infrastructure needs in both the near and long term.

- In addition, under the proposed COVID-19 stream, Indigenous recipients will be eligible for up to 100% in federal cost share funding from the program.

Background

- To date, under the Investing in Canada Infrastructure Program, we have committed more than $193 million to at least 32 First Nations projects and $284 million for 18 projects in Inuit Nunangat.

- Indigenous recipients receive a higher federal cost share (75%) and are not subject to "stacking limits" meaning they are eligible to have federal programs (from all departments) fund up to 100% of their projects – making Indigenous projects a low cost option for provinces and territories to prioritize.

- Under the new COVID-19 Resilience Infrastructure Stream, Indigenous ultimate recipients will be eligible for up to 100% in federal cost share funding from the program (no stacking required).

- Under the Disaster Mitigation and Adaptation Fund, we have announced more than $75 million for two projects benefiting the Mohawks of the Bay of Quinte in Ontario and Skwah First Nation in British Columbia.

- The Gas Tax Fund includes dedicated funding for First Nations, the Métis Settlements in Alberta, and Inuit Nunangat. Funding for First Nations on reserve in the provinces is delivered by Indigenous Services Canada.

- The department is co-chairing an infrastructure working group with Indigenous Services Canada and Inuit Tapiriit Kanatami under the Inuit-Crown Partnership Committee to implement the Infrastructure Work Plan.

Drafted by: Craig Devitt

613-324-5357, Manager, Indigenous Affairs

Approved by: Tim Angus

613-960-9648, Director General, Strategic and Sectoral Policy

Update on the Integrated Bilateral Agreements

Responsive Lines

- Under the ten-year Investing in Canada Infrastructure Program Bilateral Agreements, Infrastructure Canada is providing $33.5 billion in funding for public transit, green, community, culture and recreational, and rural and northern infrastructure projects from coast to coast to coast.

- Three years in, close to $10 billion for over 1200 projects has already been approved, and an additional $1.4 billion is currently under review.

- Once projects are approved, our partners can start their projects immediately.

Background

- The Investing in Canada Infrastructure Program (ICIP) is the centrepiece of Infrastructure Canada's funding initiatives supporting the broader Investing in Canada Plan.

- This ten-year allocation-based program promotes strong collaboration between all levels of government by advancing outcomes in a manner that is flexible and responsive to unique local, provincial and territorial circumstances, and supporting local and regional decision-making in the realm of public infrastructure.

- Provinces and territories (P/Ts), in consultation with municipalities and Indigenous communities, are responsible for identifying, prioritizing and submitting projects and flowing funds to eligible ultimate recipients.

- Managed through Integrated Bilateral Agreements (IBAs), the ICIP is divided into four funding streams: Public Transit ($20.1 billion); Green Infrastructure ($9.2 billion); Community, Culture and Recreation Infrastructure ($1.3 billion); and Rural and Northern Infrastructure ($2 billion + $400 million).

- Three years into the 10 year program, approvals are as follows:

- Projects approved to date: 1221, worth $9.8 billion

- Projects Under review: 273, worth $1.4 billion

- 64% or $20B remains uncommitted

(Info as of June 10, 2020)

- Examples of eligible projects include:

- Transit: New Light Rail Transit systems; Extensions of existing subway systems; electric bus purchases; or removing barriers in the built environment, such as by providing wheelchair ramps at transit stations.

- Green: Renewable energy storage; strategic Interties; publicly-accessible EV charging stations; preservation of natural wetland systems, rehabilitation of public infrastructure to be climate resilient; or, water main and sewer replacement, waste diversion, and recycling facilities.

- Community, Culture and Rec: Community centres, art galleries, community recreation and trails facilities, and community service hubs.

- Rural and Northern: Greenhouses, community freezers, short sea shipping wharves, and broadband projects.

Drafter: Tanya Osiowy (343-550-8623)

ADM: Alison O'Leary (613-618-8156)

Administrative Burden

Responsive Lines

- Infrastructure Canada provides billions of dollars every year to support communities from coast to coast to coast.

- These are public funds, and good management of taxpayer dollars is a top priority.

- The government works tirelessly to ensure the right balance of timely approvals, transparency and sound oversight.

- The Government is actively providing tools and funding to make the project intake, review and approval process efficient and effective.

Background

- The department's $33.5 billion flagship program, the Investing in Canada Infrastructure Plan (ICIP), is managed through comprehensive Bilateral Agreements with each province and territory.

- Through these agreements the Provinces and territories, in consultation with municipalities and Indigenous communities, are responsible for identifying, prioritizing and submitting projects and flowing funds to eligible ultimate recipients.

- To facilitate this, the Government of Canada has created an on-line portal to facilitate and expedite project submission as well as improve data integrity. In addition, provinces and territories are being provided with significant administrative funding to subsidize their costs. For example, as currently negotiated, PEI will receive $8.2 million to deliver its funding, and Ontario will receive $103.7 million for its administrative expenses.

- For the vast majority of projects, Infrastructure Canada requires only basic and key information to review and approve projects, such as:

- What the project is;

- Where it will be built;

- When it is expected to begin construction;

- How much the project will cost, how much funding is requested from the federal government, and when the funding is expected to be needed; and

- Why the project is being built, how it aligns to program outcomes or how the project will benefit the community in which it is being built.

- In terms of time to review, we have moved the bar significantly on project review timelines over the past three years. Five years ago a mega project could take one to two years to approve (from submission to agreement signing).

- Under the Integrated Bilateral Agreements, simple projects are approved in weeks and larger, more complex projects are approved in just months.

- Under ICIP, for projects that do not require Treasury Board approval, the department has a service standard of 60 business days from receipt of a complete project application. The average time to approve thus far has been 35 days.

- For some larger or more complex projects we require additional information.

- For example a multi-billion dollar transit project would be required to submit a full business case for evaluation.

- The Government also uses this information for public reporting.

Drafter: Tanya Osiowy (343-550-8623)

ADM: Alison O'Leary (613-618-8156)

Climate Lens

Responsive lines

- The Government of Canada is strongly committed to meeting its climate goals and achieving net-zero emissions by 2050.

- As part of the Investing in Canada plan, applicants seeking federal funding for major public infrastructure projects are asked to undertake an assessment of how their projects will contribute to or reduce carbon pollution.

- The Climate Lens assessment is required for all climate-focused projects, all projects valued over $10 million under the Infrastructure Canada bilateral agreements with provinces and territories, and projects under the Disaster Mitigation and Adaptation Fund.

- The Climate Lens is one of many measures to ensure that we are supporting a low carbon, green economy.

Responsive Lines: Application of the Climate Lens to the COVID-19 Resilience Stream

- The significant environment and climate-related commitments remain with the introduction of the new COVID-19 stream.

- The Climate Lens continues to apply to all projects over $10 million – about 90% of spending, as well as all climate-focused projects in the $9.2 billion Green Stream.

- At least 45% of the Green Infrastructure stream allocation must be used on projects to reduce GHG emissions; this funding cannot be used on the new COVID-19 stream.

- The new COVID-19 stream will support sustainable communities, investing in:

- retrofits and repairs to public buildings;

- active transportation projects;

- climate change adaptation projects; and

- pandemic response projects.

Background

- The Climate Lens was launched on June 1, 2018, and requires INFC-supported projects to:

- Assess their expected GHG emissions against a baseline, and;

- Consider resilience to the impacts of climate change using a risk management approach based on international standards at the planning stage.

- The Climate Lens is intended to (1) drive behavioural change and (2) support INFC in measuring its progress towards meeting its 10Mt GHG reduction target. Currently approved projects are estimated to reduce emissions in the range of 2 Mt.

- The Climate Lens applies to all projects over $10 million under the $33 billion Investing in Canada Infrastructure Program (ICIP).

- The Lens also applies to all climate-focused projects under the Green Stream of ICIP (where it serves as an eligibility test), and to all projects under the Disaster Mitigation and Adaptation Fund.

- A $10 million threshold was applied to ensure that major infrastructure projects consider mitigation and adaptation impacts without placing undue administrative burden on smaller projects. By design, over 80% of project funding was intended to be captured.

- A deferral option was introduced for non-climate-focused projects to address concerns around climate lens delaying project approvals. Deferred assessments must be submitted prior to first payment.

- Exemptions can be granted by the Minister on a case-by-case basis, to respond to capacity considerations or if the asset is unlikely to reduce GHG emissions or to be at risk from climate impacts.

- In total, 194 assessments (mitigation & resilience) have been required to date: 77 were completed on time; 99 deferred; and 18 exempted.

Disaster Mitigation and Adaptation Fund

Topic

The Disaster Mitigation and Adaptation Fund is a program aimed at strengthening the resilience of Canadian communities through investments in large-scale infrastructure projects, including natural infrastructure projects, enabling them to better manage the risk associated with current and future natural hazards, such as floods, wildfires and droughts.

Responsive lines

- Communities now more than ever need support to adapt to the intensifying weather events that are associated with climate change.

- The Government of Canada's Disaster Mitigation and Adaptation Fund (DMAF) helps protect Canadians, their homes and businesses, while reducing the long-term costs associated with replacing infrastructure following natural disasters.

- To date, more than $1.7 billion has been announced through DMAF for 59 large-scale infrastructure projects that will help protect communities across the country from the threats of climate change, such as natural disasters like floods and wildfires.

- In order to ensure that the remaining $232 million in the DMAF envelope can get to communities quickly, we are proceeding now with an accelerated review of projects previously submitted to Infrastructure Canada.

Background/Context

The Disaster Mitigation and Adaptation Fund (DMAF) was launched on May 17, 2018. DMAF is a $2-billion national merit-based program that supports large-scale infrastructure projects to help communities better prepare for and withstand the potential impacts of natural disasters, prevent infrastructure failures, and protect Canadians and their homes.

DMAF has a two-step application process: step one is the Expression of Interest and step two is the Full Application.

The Expression of Interest (EOI) for the first intake closed on July 31, 2018. The projects proposed in these EOIs addressed risks from a wide range of natural hazards, including flooding, extreme weather, permafrost thaw, wave surge and wildfire. The Department received EOIs from applicants in all provinces and territories. There is high demand for projects that address disaster mitigation and the program was significantly oversubscribed.

In October 2018, Infrastructure Canada invited eligible applicants to submit their completed Full Applications by January 11, 2019. Due to the fact that the program was so heavily subscribed, only eligible projects with construction start dates in either 2019 or 2020 were invited to submit full applications. The majority of these projects addressed flooding, however other projects address wildfires, erosion, seismic, and other hazards. [redacted]

Following the spring 2019 floods and wildfires, the Minister of Infrastructure and Communities invited those regions affected by the floods and wildfires to submit projects outside of DMAF's competitive process. Fourteen projects in Ontario, Quebec and Northwest Territories were subsequently approved under DMAF.

DMAF projects are supporting the Government of Canada's objectives laid out in the Pan-Canadian Framework on Clean Growth and Climate Change.

Investments through DMAF are expected to have a positive impact on the Disaster Financial Assistance Arrangements (i.e., leading to less payments through the DFAA). These investments are expected to reduce the financial and human impacts of ever-increasing natural hazards brought on or exacerbated by climate change.

In order to ensure that the remaining $232 million in the DMAF envelope can get to communities quickly, we are proceeding now with an accelerated review of projects previously submitted to Infrastructure Canada. This targeted intake will allow applicants of 37 DMAF projects on hold to move to the next application phase of the program.

Infrastructure Canada is currently working on the details to meet the mandate letter commitment to launch a second call for proposals to help communities, whether they are from small, rural and Indigenous communities, or large urban centres, to address the projected impacts disasters triggered by natural hazards and related impacts of climate change.

Funding

The Government announced all approved projects through spring and summer 2019. As of February 18, 2020, DMAF has funded the following 59 projects representing $1,759M in federal funding:

British Columbia (6 projects)

| Recipient | Project Summary | Federal contribution |

|---|---|---|

| Skwah First Nation | New dyke / flood barrier to protect Skwah FN, Shxwha:y Village and City of Chilliwack | $45,000,000 |

| City of Kelowna | Mill Creek Flood Protection | $22,000,000 |

| City of Victoria | Climate and Seismic Resilient Underground Infrastructure | $15,393,320 |

| City of Richmond | Richmond Flood Protection | $13,780,000 |

| City of Surrey | Coastal Flood protection for the cities of Surrey, Delta, and the Semiahmoo First Nation | $76,602,850 |

| Corporation of the City of Grand Forks | Grand Forks and Regional District of Kootenay Boundary Flood Mitigation | $19,987,653 |

Alberta (4 projects)

| Recipient | Project Summary | Federal contribution |

|---|---|---|

| Province of Alberta | Springbank Off-Stream Reservoir (SR1) | $168,500,000 |

| Town of Canmore | Flood Mitigation of Several Steep Mountain Creeks in the Bow Valley | $13,760,000 |

| Town of Drumheller | Drumheller Flood Mitigation and Climate Change Adaptation System | $22,000,000 |

| City of Edmonton | Riverine and Urban Buffer on Flood Mitigation | $53,766,000 |

Saskatchewan (5 projects)

| Recipient | Project Summary | Federal contribution |

|---|---|---|

| City of Meadow Lake | Sewage replacement and relocation for Meadow Lake sewage lagoon | $8,000,000 |

| Saskatchewan Power Corporation | Wildfire Risk Reduction and Capacity Development in Northern Saskatchewan | $19,802,475 |

| City of Saskatoon | Flood Control Strategy | $21,600,000 |

| Government of Saskatchewan | Saskatchewan Wildfire Risk Reduction and Community Resilience | $20,493,825 |

| Government of Saskatchewan | Highway 55 Corridor Improvements | $12,500,000 |

Manitoba (2 projects)

| Recipient | Project Summary | Federal contribution |

|---|---|---|

| Thompson Regional Airport Authority | Air Terminal Building Redevelopment | $23,200,000 |

| Province of Manitoba | Lake Manitoba / Lake St. Martin Outlet Channels (Announced in 2018.)* | $247,500,000 |

Ontario (23 projects)

| Recipient | Project Summary | Federal contribution |

|---|---|---|

| City of Markham | Flood Control Project (Don Mills Channel, West Thornhill, Thornhill Community Centre) | $48,640,000 |

| Corporation of the City of Sarnia | Combined Sewer Separation - Flooding and Overflow Mitigation | $10,412,000 |

| Regional Municipality of York | Aurora Sewage Pumping Station Overflow Mitigation | $8,280,000 |

| Regional Municipality of York | Enhancement and restoration of an urban forest | $10,136,000 |

| Regional Municipality of York | York Durham Sewage System Forcemain Twinning | $48,000,000 |

| City of Toronto | Construction of the Midtown Toronto Relief Storm Sewer for Basement Flooding Protection | $37,160,000 |

| City of Toronto | Construction of the Fairbank-Silverthorn Trunk Storm Sewer System for Flooding Protection and Overflow Reduction | $73,200,000 |

| City of Toronto | Repair, remediate, and enhance resilience of Toronto's tree canopy and waterfront shoreline structures | $11,989,186 |

| City of Toronto | 2020/2021 Culvert Rehabilitation * | $8,738,800 |

| City of Vaughan | From Average to Awesome-Implementing Vaughan Stormwater Flood Mitigation | $16,588,299 |

| City of Hamilton | Project Bundle - Extreme Storms - Shoreline Protection Resilience | $12,686,000 |

| Upper Thames River Conservation Authority | West London Dyke Reconstruction | $10,000,000 |

| Corporation of the City of Windsor | Disaster Mitigation and Infrastructure Enhancement Initiative | $32,090,691 |

| Municipality of Chatham-Kent | Flood Mitigation along Thames & Sydenham Rivers | $16,575,200 |

| Corporation of the City of Kitchener | Stormwater Network Adaptation | $49,990,000 |

| City of Greater Sudbury | Junction Creek Watershed Flood Mitigation, Control and Improvements | $8,840,000 |

| Toronto and Region Conservation Authority | Toronto Region Ravine Erosion Risk Management and Hazard Mitigation | $22,311,578 |

| Toronto and Region Conservation Authority | Toronto Waterfront Erosion Hazard Mitigation * | $33,794,667 |

| City of Thunder Bay | Community Flood Mitigation | $13,249,200 |

| Mohawks of the Bay of Quinte | Drought Reduction Project for the Mohawks of the Bay of Quinte Territory | $30,093,216 |

| City of Kingston | Shoreline Protection Works* | $9,806,191 |

| City of Kingston | Combined Sewer Separation and Storm Water Management Infrastructure* | $10,400,000 |

| St. Clair Conservation Authority | Shoreline Rehabilitation along Lake Huron and St. Clair River * | $8,000,000 |

Quebec (10 projects)

| Recipient | Project Summary | Federal contribution |

|---|---|---|

| Ville de Montréal | Construction d'un ouvrage de rétention visant la diminution des surverses lors de pluies abondantes (ouvrage St-Thomas) | $21,280,000 |

| Ville de Montréal | Construction d'ouvrages de rétention pour le contrôle des débordements et des surcharges des réseaux unitaires lors de pluies abondantes | $33,060,400 |

| Ville de Montréal | Protection des émissaires de débordement contre le refoulement provoqué par les inondations liées à l'augmentation des crues ou aux pluies abondantes (Pierrefonds-Roxboro) * | $50,000,000 |

| Gouvernement du Québec | Réhabilitation du tronçon ferroviaire de la Gaspésie : Port-Daniel-Gascons à Gaspé | $45,815,200 |

| Gouvernement du Québec | Projet d'intervention pour protéger la route 132 contre les aléas côtiers | $13,200,500 |

| Ville de Victoriaville | Protection et sécurisation de l'approvisionnement en eau potable dans le réservoir Beaudet de la Ville de Victoriaville * | $16,000,000 |

| Ville de Gatineau | Bassin versant du Ruisseau Wabassee * | $22,510,000 |

| Ville de Sainte-Marthe-sur-le-Lac | Travaux de réfection, renforcement, rehaussement, imperméabilisation de la digue de la Ville de Sainte-Marthe-sur-le-Lac * | $19,726,000 |

| Ville de Deux-Montagnes | Ouvrages de protection contre les inondations pour le secteur du lac des Deux-Montagnes (Oka, Pointe-Calumet, St-Joseph-sur-le-lac) * | $17,949,080 |

| Ville de Deux-Montagnes | Ouvrages de protection contre les inondations pour le secteur de la rivière des Mille Iles (St-Eustache, Rosemère, Boisbriand) * | $11,515,720 |

New Brunswick (3 projects)

| Recipient | Project Summary | Federal contribution |

|---|---|---|

| City of Saint John | Flood Mitigation Strategy: SeaWall/Pumping Stations/Waterfront Critical Electrical Utility Infrastructure | $11,916,074 |

| Province of New Brunswick | NB Arterial Highway # 11: Culvert Mitigation and Improvement * | $13,573,000 |

| City of Fredericton | Multiple Natural and Structural Infrastructure Projects to Adapt to Pluvial and Fluvial Flood Events in Fredericton * | $11,400,000 |

Nova Scotia (2 projects)

| Recipient | Project Summary | Federal contribution |

|---|---|---|

| Government of Nova Scotia – Department of Agriculture | Construction Upgrades to Dykes to Protect Communities from the Impacts of Coastal Flooding | $24,997,500 |

| Government of Nova Scotia - Transportation and Infrastructure Renewal | Upgrades to Dykes to Protect the Town of Windsor, Falmouth, and Surrounding Areas from Bay of Fundy Coastal Flooding | $32,000,000 |

Newfoundland & Labrador (1 project)

| Recipient | Project Summary | Federal contribution |

|---|---|---|

| Government of Newfoundland and Labrador | Replacement of provincial highway bridges | $15,180,000 |

Northwest Territories (3 projects)

| Recipient | Project Summary | Federal contribution |

|---|---|---|

| City of Yellowknife | Flood Hazard Mitigation for the Yellowknife Region | $25,862,218 |

| Government of Northwest Territories | Inuvik Airport Surface Structures Adaptation for Climate Change Resilience | $16,500,000 |

| Government of Northwest Territories | Increase fuel storage capacity to mitigate impacts to the public and essential services due to wildfires * | $21,750,000 |

*Projects approved outside the competitive process

Drafted by: Annie Geoffroy, 613-894-9564, Director

Approved by: Jenny Tremblay, 613-948-2844, Director General

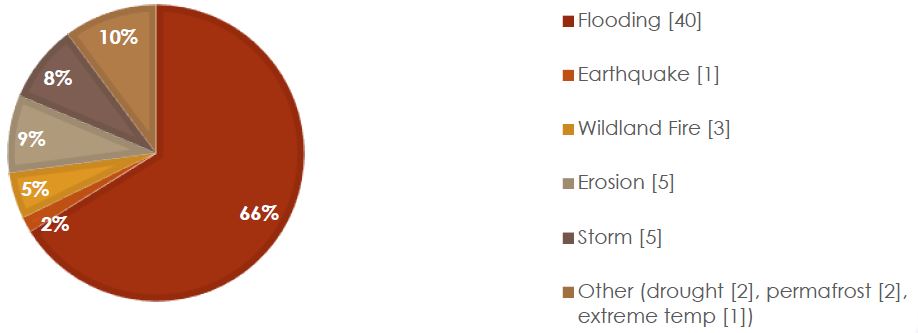

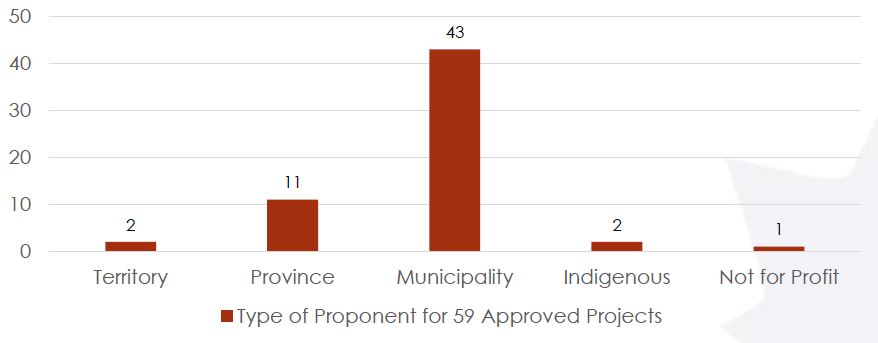

Overview of DMAF Approved Projects (59 Total)

Number of Approved Projects by Hazard Type

Text description

The graphic titled "Number of Approved Projects by Hazard Type" is a pie chart that shows the total number of approved projects by hazard type. The chart indicates that of 59 projects: 66% (40 projects) are flooding; 2% (1 project) are earthquake; 5% (3 projects) are wildfires; 9% (5 projects) are erosion; 8% (5 projects) are storm; and 10% are other (5 projects including 2 drought, 2 permafrost, and 1 extreme temperature.

Number of Approved Projects by Type of Proponent

Text description

The graphic titled "Number of Approved Projects by Type of Proponent" is a bar chart that shows the total number of approved projects by type of proponent. The chart indicates that of 59 projects: 2 territory; 11 province; 43 municipality; 2 Indigenous; and 1 is not-for-profit.

Federation of Canadian Municipalities

Topic

The FCM is a key stakeholder and partner in the delivery of public infrastructure funding programs. The Government works with the FCM to respond to the needs of the communities they represent.

Responsive Lines

- The Government of Canada works with the Federation of Canadian Municipalities to help municipalities strengthen their asset management practices, reduce greenhouse gas emissions and manage the impacts of climate change.

- Budget 2019 made an incremental $950 million available for the Green Municipal Fund and an additional $60 million for the Municipal Asset Management Program.

- Infrastructure Canada will continue to work with the Federation of Canadian Municipalities to ensure that these programs realize their greatest possible impacts.

- The Municipalities for Climate Innovation Program provides funding, training and resources to help Canadian municipalities adapt to the impacts of climate change and reduce greenhouse gas emissions and has been fully subscribed in advance of its scheduled end in 2022.

Background

- The Green Municipal Fund supports grants, loans and loan guarantees to encourage investment in environmental municipal projects. Since 2000, the Green Municipal Fund has financed more than 1,310 municipal sustainability initiatives. These projects have cut 2.6 million tonnes of greenhouse gas emissions through $862 million worth of approved sustainability initiatives.

- Budget 2019 significantly expanded the work of the Green Municipal Fund. Three upcoming initiatives include:

- Making affordable and social housing units more energy efficient.

- Supporting home energy projects to make homes more affordable and energy efficient.

- Supporting activities that reduce greenhouse gas emissions from large community buildings.

- The Federation of Canadian Municipalities delivers two programs funded by Infrastructure Canada, that were launched in February 2017:

- The Municipal Asset Management Program

- A program that helps Canadian municipalities make informed infrastructure investment decisions based on sound asset management practices. Initially designed as a five-year, $50 million program.

- Budget 2019 committed to provide an additional $60 million in funding for the program, as well as extend the program for an additional three years to 2024-2025.

- Benefits of improved asset management include reduced total cost of ownership and extend beyond this to lay the foundation for consideration of climate and other risks in infrastructure decision-making.

- The Municipalities for Climate Innovation Program

- A five-year, $75 million program that provides funding, training and resources to help Canadian municipalities adapt to the impacts of climate change and reduce greenhouse gas emissions. The Program is scheduled to end in 2021-2022, but is already fully subscribed.

- The program provides: (1) grants for training partners who provide assistance and expertise to municipalities; and (2) grants to municipalities to support plans, operational studies, feasibility studies, small capital projects, and climate change staff positions. The program has funded 276 municipal climate projects, reflecting investment of $48.5 million.

Drafted by: Annie Geoffroy, 613-894-9564, Director

Approved by: Jenny Tremblay, 613-948-2844, Director General

Economic Impact of Infrastructure Investments

Responsive Lines

- The Investing in Canada Plan is contributing to short-term economic growth through construction and supporting Canada's long-term economic prosperity.

- There is a lot of focus on when federal spending actually occurs, but this is a lagging indicator, since federal payments occur when provinces and territories submit claims for expenses incurred.

- Economic activity starts when projects are approved – since this planning, design, and construction can start.

- Between 2015 and 2019, jobs related to the construction of infrastructure increased by 68,000 – from 540,000 to 608,000.

- The COVID-19 resilience stream we have proposed will help to ensure that the construction of priority projects can occur quickly to address immediate infrastructure needs and restart local economies.

Background

- Under the Investing in Canada plan more than $68 billion in federal funding has been invested and nearly 55,000 projects have been approved.

- According to the Department of Finance's Budget 2019 estimates, the value of the overall investments made under the Investing in Canada plan in 2018-19 are associated with about 100,000 direct and indirect jobs. Slightly more than half of these jobs are associated with well-paid industries such as construction or manufacturing, whereas the rest are in the Canadian companies that supply the equipment, supplies and services needed for large-scale infrastructure projects.

- In 2019, the construction industry accounted for about 7 percent of Canada's GDP and employed about 1.4 million Canadians.

- In light of the economic impact of COVID-19, the government has accelerated payments of the Gas Tax Fund to provinces, territories, municipalities and First Nations. Local communities will receive a one-time payment of $2.2 billion to ensure much needed infrastructure investments can continue to be made during the current economic situation.

- Infrastructure Canada has also announced a new COVID-19 stream that will assist provinces and territories with more flexibility in their infrastructure priorities in the short-term. This new program streamlines approval processes to ensure construction can occur quickly, in particular this construction season, and projects can proceed without unnecessary delay.

- This new program stream will enable additional infrastructure investments by provinces and territories by allowing more eligible investment categories, including healthcare-related assets. Moreover, the new stream will take on a greater share of project funding, with the federal government matching up-to 80 per cent of eligible costs in provinces and 100 per cent in territories and First Nations communities.

Approval box:

Draft author: Negash Haile, 613-296-8974

Director General: Sean Keenan, 613-761-3188

Water and Wastewater Projects

The Canada Infrastructure Bank's involvement in the financing and procurement of water and wastewater treatment facilities.

Responsive Lines

- Public private partnerships or P3s allow municipalities and other governments to benefit from the experience, expertise and investment of the private sector. The Canada Infrastructure Bank is advancing traditional P3s as more advanced revenue and risk transfer models.

- Unlike privatizations, P3s are performance-based contracts for the delivery of major public infrastructure projects where the public sector retains ownership of the asset.

- There are over 280 P3 projects underway in Canada is a global leader in delivering and managing high-quality infrastructure projects that achieve Value for Money for taxpayers.

Background

- A P3 is a long-term, performance-based approach to procuring public infrastructure where the private sector assumes a major share of the responsibility in terms of risk and financing for the delivery and the performance of the infrastructure, from design and structural planning, to long-term maintenance.

- There are a variety of different P3 models that exist. Under a full lifecycle P3 model, the private sector is engaged to design, build, finance, operate and maintain an infrastructure project based on well-defined performance criteria over a fixed term. The public sector retains ownership of the asset.

- P3s are not for every project. They are one of many tools in the public sector's tool box for delivering and managing major infrastructure projects. P3s work best for large, complex projects that appropriately transfer project risks to the private sector in a manner that delivers positive Value for Money.

- A Value for Money analysis is a comparison of the present value of the estimated total cost of delivering a public infrastructure project using a traditional delivery model compared to the cost of delivering the project using a P3 delivery model. Using past projects as benchmarks, this analysis requires a detailed assessment of the various risks linked to the asset and identifies who is best placed to manage these risks – the public or private sector.

- The P3 model was an important building block in the formation of the CIB. The Bank is taking elements of the P3 model further by using revenue and user charges to fund the asset, in whole or in part, and transfer more revenue, usage and ownership risks to the private sector. This allows for equity to be shared with the private sector for a risk adjusted return.

- The municipality of Mapleton in Ontario, is working with the Canada Infrastructure Bank, on the procurement of its water and wastewater treatment facilities. The CIB has announced an investment of up to $20 million in the project. The project is currently in procurement.

- According to the Canadian Council for Public-Private Partnerships, there are currently 20 water and wastewater facilities across Canada delivered through the P3 model.

- Projects such as the Regina Wastewater Treatment Plant, will provide treatment capacity for a population of 258,000 and significantly reduce ammonia, nitrogen, phosphorous, E. Coli and suspended solids levels from entering the water system. As a P3, this contract transfers significant risks to the private sector over the whole lifecycle of the project, allowing the City of Regina to realize greater value for taxpayer's dollars.

- It was procured as a design-build-finance-operate-maintain P3 with a contribution from the P3 Canada Fund of up to $58.5 million.

Approval Box

Lisa Mitchell, Senior Director 343-540-9738

Mary McKay, Director General

Community Employment Benefits

Responsive lines

- The Government of Canada is committed to ensuring that infrastructure investments support stronger and more inclusive communities, and this is why the Community Employment Benefits initiative has been integrated in the Investing in Canada Plan.

- The Community Employment Benefits initiative encourages project planners and communities across the country to take advantage of their infrastructure projects to support the diversification of recruitment, training and procurement practices.

- Going forward, the federal government will continue to work with its provincial, territorial, municipal, and indigenous partners to promote socio-economic benefits derived from public investments in infrastructure.

Background

- The Community Employment Benefits initiative provides a framework for establishing project targets and reporting on results. Participation in the initiative is not an eligibility criterion for the approval of project funding under the Investing in Canada Infrastructure Program.

- The initiative applies to all projects funded under the Investing in Canada Plan over the total eligible costs threshold negotiated by the jurisdiction where the project is located. A threshold of projects over $25 million has been established in British Columbia, Alberta and Saskatchewan, and is set at $10 million in other jurisdictions.

- Implicated projects are to provide employment and/or procurement opportunities for at least three of the groups targeted by the initiative: apprentices; Indigenous peoples; women; persons with disabilities; veterans; youth; recent immigrants; and small and medium-sized businesses and social enterprises.

- Provinces and territories are to establish specific targets for each project, allowing for flexibility to consider various factors such as complementarity with existing local and regional employment initiatives or local labour market dynamics. The employment and procurement opportunities achieved against the project targets will be reported on an annual basis over the course of the project.

- Provinces and territories may also, on a case-by-case basis, decide that certain projects meeting or exceeding their jurisdiction's threshold are not suitable for participating in the initiative.

- In that case, the province or territory in question provide Infrastructure Canada with their rationale for exempting the project from the community employment benefits initiative. As of May 2020, 59 projects under the Integrated Bilateral Agreements have committed to report on Community Employment Benefits.

Infrastructure Canada funding to Rural and Small Communities (as of June 15, 2020)

Background

- Since 2015, Infrastructure Canada has approved funding for over 4,300 projects in rural and small communities. This funding has been delivered through a series of funding programs, some of which are now closed.

- This is an investment of over $9.3 billion in projects to improve the quality of life of rural Canadians, contribute to their economic growth, and build sustainable rural communities.

These investments include:

- More than $3 billion through the National and Regional Projects fund, supporting 183 medium and large scale infrastructure projects in rural communities;

- More than $1.3 billion through the Clean Water and Wastewater Fund (CWWF), supporting 1,914 projects to promote clean drinking water and water treatment infrastructure in rural communities;

- More than $1.7 billion through the Investing in Canada Infrastructure Program, supporting 441 projects in rural and remote communities, including:

- Over $850 million in funding to-date for 177 green infrastructure projects in rural communities;

- Over $114 million in funding to date for 70 community culture and recreation infrastructure projects in rural communities;

- $2 billion exclusively reserved for rural and northern infrastructure projects, including broadband infrastructure, currently supporting 170 projects totalling $548 million, with more investments yet to be made.

- More than $1 billion through the Small Communities Fund, providing direct investments in communities with less than 100,000 residents, currently supporting 638 projects.

- Rural communities have also received significant federal support for projects to adapt their infrastructure to address the threats of climate change through the Disaster Mitigation and Adaptation Fund. To-date, 29 projects have been approved for funding in rural communities representing, an investment of over $917 million dollars.

- Rural communities are also benefitting from the innovative Smart Cities Challenge, which is providing more than $17 million in competition-based funding to finalists and winners including: the town of Bridgewater, Nova Scotia; the City of Guelph and surrounding communities in Wellington County; and Northern communities across Nunavut. This funding is empowering these communities to improve the lives of their residents through innovation, data and connected technology.