Canada Infrastructure Canada

Copyright

Aussi disponible en français sous le titre :

Examen de la Loi sur la Banque de l’infrastructure du Canada 2017-2022 : Rapport.

Information contained in this publication or product may be reproduced, in part or in whole, and by any means, for personal or public non-commercial purposes without charge or further permission, unless otherwise specified. Commercial reproduction and distribution are prohibited except with written permission from Infrastructure Canada.

For more information, contact:

Infrastructure Canada

180 Kent Street, Suite 1100

Ottawa, Ontario K1P 0B6

info@infc.gc.ca

© His Majesty the King in Right of Canada, as represented by the Minister of Intergovernmental Affairs, Infrastructure and Communities, 2022.

Cat. No.T94-49/2023E-PDF

ISSN 978-0-660-49085-4

Table of Contents

- Message from the Minister of Intergovernmental Affairs, Infrastructure and Communities

- Executive summary

- 1. Introduction

- 2. Foundation and evolution of the CIB

- 3. Results

- 4. Key findings

- 5. Moving forward

- Annex A: Engagements

- Annex B: Project list

- Annex C: Advisory work

- Endnotes

Message from the Minister of Intergovernmental Affairs, Infrastructure and Communities

Infrastructure is the foundation of a competitive economy. Since 2016, the Government of Canada has made historic investments in infrastructure, but we know that meeting our infrastructure needs across the country continues to place significant fiscal pressures on all orders of government. No community alone can overcome Canada’s infrastructure gap. From day one, we acknowledged the need to utilize all possible tools in our toolbox to ensure we are creating the right suite of programs and incentives that will deliver the infrastructure of today and tomorrow. When we mobilize private and institutional capital and expertise, we can mitigate fiscal pressures on all orders of government and, in doing so, allow government spending to go further. We also recognized the need to develop innovative financing approaches that lead to transformative outcomes. That’s why in 2017, our Government took the bold step of creating the Canada Infrastructure Bank (CIB, or “the Bank”) as a key component of our Investing in Canada Plan.

In its first five years of operation, the Bank has matured and grown as an institution. It has had to evolve and refocused its efforts in the face of the global pandemic. It has begun to serve as an important tool that governments can use to foster partnerships with the private sector and institutional investors, and to support the development of infrastructure projects across Canada. I am encouraged to see the growing portfolio of projects, 46 as of March 31, 2023, that the Bank has advanced. These projects are driving more than $27 billion in infrastructure investment into communities from coast to coast to coast. Investments to date have attracted $8.6 billion in private and institutional capital to help finance important infrastructure projects across Canada that in many cases would not have come to be without the Bank’s financial support.

Building on its current portfolio of investments, Budget 2023Footnote 1announced the Bank will invest at least $10 billion of its $35 billion in capital in each of its Clean Power and Green Infrastructure priority areas, doubling the previous target of $5 billion per sector. This allows the Bank to invest at least $20 billion to support the building of major clean electricity and clean growth infrastructure projects. Budget 2023 also announced that the Bank will provide loans to Indigenous communities to support them in purchasing equity stakes in infrastructure projects in which the Bank is also investing, unlocking infrastructure development opportunities that otherwise would be more challenging to finance. These new investment priorities will help to further align the CIB with the Government of Canada’s priorities of building infrastructure that will provide social, economic, and environmental benefits for Canadians.

I would like to thank all of our partners, stakeholders, and experts, including Indigenous leaders and provincial, territorial, and municipal governments. Their invaluable feedback and expertise have helped to inform this legislative review. This Report examines the CIB’s experience over its first five years and will help to position the Bank for success in the future. Through our joint efforts and investments, Canadians can look forward to the advantages of infrastructure being built today that will help their communities thrive, and will make people’s lives better over the long term.

The Honourable Dominic LeBlanc, P.C., K.C., M.P.

Minister of Intergovernmental Affairs, Infrastructure and Communities

Executive summary

The Canada Infrastructure Bank was established in 2017 as a federal Crown corporation. It aims to ensure Canadians benefit from modern and sustainable infrastructure that is built through strategic partnerships between governments and the private sector. Its mandate is to invest and seek to attract investment from private sector and institutional investors in infrastructure projects that are in the public interest, for example, supporting conditions that foster economic growth or by contributing to the sustainability of infrastructure in Canada. Priority sectors of investment are guided by the Government of Canada and the Minister with designated responsibility, the Minister of Intergovernmental Affairs, Infrastructure and Communities.

Under the CIB’s enabling statute, the designated Minister must undertake a review of the CIB and table a report in Parliament every five years. The Minister initiated this Review in June 2022, which sought to answer:

- whether the policy premises and the context underpinning the creation of the CIB are still sound and pertinent;

- whether the CIB's legislated mandate and the authorities supporting its operations remain relevant in the context of an evolving policy and infrastructure landscape; and

- whether any changes or clarifications are needed to equip the CIB for success in the future.

The review process was informed by research, analysis and broad public and stakeholder engagement. External stakeholder engagement consisted of a series of meetings and roundtables held with more than 80 stakeholder representatives from governments, Indigenous partners, industry, market participants, academia and international organizations. A formal call for written comments and submissions was also posted on the Government of Canada’s (Consulting with Canadians) website in January 2023 and it received more than 40 written submissions. As part of the Review, stakeholder input from past consultations with public and private stakeholders and evidence provided at parliamentary committees were also taken into consideration.Footnote 2

Highlights of the Canada Infrastructure Bank’s progress and impact

In its first five years, the CIB has grown and matured as an arms-length Crown corporation making independent investment decisions. The CIB required time to establish itself as an institution, to develop the appropriate investment tools and offerings, and to work with partners to identify the right projects that would benefit from the CIB’s model. As of March 2023, the CIB has achieved the following results:

- 46 investment commitments in projects across five priority sectors, focused on Public Transit, Trade and Transportation, Green Infrastructure, Broadband, and Clean Power;

- 13 formal advisory, project development and project acceleration initiatives, plus ongoing provision of advice on projects in early stages of development;

- $9.7 billion in commitments to invest in infrastructure projects;

- $8.6 billion in investment from private and institutional investors;

- $8.7 billion in investment from other public partners; and

- $27 billion in total capital for infrastructure projects from public and private partners.Footnote 3

Review findings

The Review provided a timely opportunity to revisit the underlying rationale and premise of the CIB, the roles and expectations set out for the Bank, and key challenges and opportunities that arose over its first five years.

The Bank was founded in 2017 and became operational early in 2018. There was recognition that setting up a new Crown corporation would take time and would require adjustments in response to partners and the market environment. The CIB was also expected to advance bold and innovative financing models. In light of the time needed to develop the CIB’s role in certain sectors, the Government took steps to enable CIB investment across a broader range of infrastructure assets.

The Review was informed by examination and assessment of the CIB's legislation, governance, mandate, capital and risk management, and operations. The Review found that the legislation governing the CIB is appropriate and the CIB’s core objectives remain sound and relevant. A fundamental premise underlying the creation of the CIB was that there is a clear need for alternative financing mechanisms that leverage private sector investment, in order to develop public infrastructure and/or infrastructure that is in the public interest. This premise has been tested and reaffirmed. By leveraging private and institutional capital and expertise, the Bank is working in the public interest to facilitate the development of complex, often transformational infrastructure projects. These are projects that may not get built otherwise. Or, if they were financed through public funds alone, they would place too heavy a burden on all orders of government and taxpayers. Other countries and international institutions have also recognized the need for alternative financing mechanisms and have created instruments like the CIB.

The Review also found that, following an initial, three-year period of slow portfolio growth, the CIB’s pace of investment has accelerated from 2020 to the present. The CIB’s capital deployment has been consistent with targets, budget projections, and priority sectors identified by the Government. In response to stakeholder feedback, changing market conditions and policy priorities, the Government of Canada expanded and evolved the role of the CIB and its priority sectors. This increased its impact and enabled it to support emerging, infrastructure-related priorities that relate to the transition to a low-carbon economy, increased connectivity, and reconciliation with Indigenous peoples.

The existing legislative framework enabled the CIB to respond to this evolution. The Review concluded that no legislative amendments are necessary, and the Bank remains well-positioned to advance a range of projects across its priority sectors.

Opportunities for further success

During the Review process, stakeholders recognized the need for the CIB to operate with clearer and more stable parameters, a greater focus on its advisory and knowledge and research functions, and with strong governance and performance measurement. Based on the findings of the Review and feedback from stakeholders, the Review identified the following opportunities in three broad areas:

Providing greater clarity on the CIB role/model

- Alignment with sectors and models — Continued guidance on how the CIB is to invest across its priority sectors and deliver on its targets could help improve stakeholder awareness and understanding of the CIB’s role and model.

- Interaction with other federal programming — More can be done to help proponents and investors understand how the CIB’s investment tools fit within the broader suite of federal programs and initiatives that support infrastructure development.

- Investment process — As it matures and grows, more transparency in how the CIB invests and operates would help stakeholders to better understand the CIB’s processes and how they can best engage with the Bank. This includes more clearly explaining how the use of concessionary capital is considered in its investment framework.

Engaging public partners to advance the use of alternative financing

- Advising other orders of government — The CIB can enhance its role as an advisor to provinces, territories, municipalities, and Indigenous communities to facilitate the use and promote the benefits of alternative financing models where appropriate.

- Promoting the CIB and alternative financing models – In its next phase, the CIB can deepen its efforts as a centre of expertise by working with stakeholders to identify and disseminate the data and knowledge needed to promote greater acceptance and adoption of alternative financing models.

Supporting CIB governance and results measurement

- Enabling strong governance — As the CIB moves into its next phase, the CIB would continue to benefit from a robust and effective corporate governance framework to oversee management and strategy, including a strong Board of Directors that continues to possess an appropriate mix of diverse skills and experience needed to address current and future challenges.

- Demonstrating results — The CIB can work to refine its results framework to demonstrate the benefits of alternative financing and better communicate its results to Canadians.

1. Introduction

The Canada Infrastructure Bank was established in 2017 as a key component of the Government of Canada’s historic investments through the Investing in Canada Plan. The Canada Infrastructure Bank Act (CIB Act) set out broad authorities for the Bank to “invest and seek to attract investment from private-sector investors and institutional investors, in infrastructure projects in Canada or partly in Canada that will generate revenue and that will be in the public interest.” Footnote 4 The CIB was given a mandate to make investments in revenue-generating infrastructure projects that contribute to the long-term sustainability of infrastructure across the country. The Bank’s role includes working with project sponsors to:

- structure, negotiate, and deliver federal support for infrastructure projects with revenue-generating potential;

- use innovative financial tools to invest in national and regional infrastructure projects, and attract private-sector and institutional capital to public infrastructure projects;

- serve as a single point of contact for unsolicited proposals from the private sector; and

- improve evidence-based decision making and advise governments on the design and negotiation of revenue-generating infrastructure projects.Footnote 5

Sections 27(1) and (2) of the CIB Act call on the designated Minister to “have a review of the provisions and operations of this Act undertaken” every five years, and to table a report on the review before each House of Parliament within one year after the review is commenced. The inaugural Review began on June 22, 2022, and covers the period from June 2017 to June 2022. With respect to results and impact, the Review considers data up to March 31, 2023, to ensure it reflects the most up-to-date information.

The Review studied the provisions and operations of the CIB Act, examined how the CIB has fulfilled its mandate over its first five years of operation, and considered how the CIB might best address future infrastructure challenges in line with its core mandate and responsibilities. The Review centred around the following lines of inquiry:

- whether the policy premise and the context underpinning the creation of the CIB are still sound and pertinent;

- whether the CIB's legislated mandate and the authorities supporting its operations remain relevant in the context of an evolving policy and infrastructure landscape; and

- whether any changes or clarifications are needed to equip the CIB for success in the future.

The Review was informed by an examination and assessment of the CIB's legislation, governance, mandate, capital and risk management, and operations. The process included direct stakeholder engagement through roundtables and bilateral discussions with more than 80 stakeholders from November 2022 to April 2023.

Infrastructure Canada (INFC) also invited submissions from the public and key stakeholders through direct outreach and through its departmental website and social media. It ensured the opportunity was transparent on the Government of Canada’s “Consulting with Canadians” webpage, which received more than 40 written submissions from various stakeholders and partner organizations, which includes the CIB. Annex A provides additional details on the engagement process including a list of all those who participated in discussions or provided written submissions.

2. Foundation and evolution of the CIB

2.1 Need for alternative infrastructure financing

Infrastructure is a key driver of economic growth and prosperity, as well as a key enabler of the transition to a low-carbon economy. The quality, access, and affordability of infrastructure are determinants of growth, equity, and access to opportunity.

While all orders of government across Canada are making significant investments to meet the infrastructure needs of the future, there is general recognition that Canada faces large and varied infrastructure gaps. Whether it be supporting the transition to a low-carbon economy, keeping up with maintenance and modernization requirements, meeting the needs of a growing population, or addressing acute needs in Indigenous communities, continued investments are required across the country. While estimates of the size of these infrastructure gaps vary, addressing them would place fiscal pressures on all orders of government and trying to eliminate them through public funds alone would place too heavy a burden on taxpayers. However, not closing the gap places Canada at risk of undermining economic growth; the provision of secure and reliable public services; and our ability to achieve net zero greenhouse gas (GHG) emissions by 2050.

“No order of government can do it alone. Partnerships are essential, and we need to continuously find new ways of delivering the infrastructure that Canadians expect and that will position Canada for success over the long-term.”

Another option has emerged to help fill this gap: alternative financing. In contrast to traditional models, which rely on government grants and contributions, alternative financing models use partnerships to leverage the innovation, expertise, asset management and capital of the private sector to support infrastructure development and delivery.

Faced with large infrastructure gaps, fiscal constraints, and pressures to maintain national competitiveness, a growing number of countries have sought to increase the role of private capital in public infrastructure investments. They have leveraged national or multilateral development banks and other international financial institutions to experiment with different models. In some cases, this has involved the development of new institutional structures, such as infrastructure banks, to facilitate private-sector investment. In other cases, countries developed vehicles to mobilize private capital —examples include infrastructure funds, green bonds, and new forms of public-private partnerships (P3s).

In Canada, the CIB model is founded on lessons learned and best practices from nations around the world in addressing similar challenges with the financing of infrastructure. The approach is well grounded in international policy development, including the work of the G20 and the Organization for Economic Cooperation and Development on promoting long-term investment in infrastructure.Footnote 6 Overall, this body of work has supported countries in developing and adapting such policy frameworks and tools, including national infrastructure banks and related models, to attract more long-term private investment that can assist in solving complex public policy challenges.

2.2 Benefits of the CIB model

The CIB was established to catalyze revenue models through partnerships between the private sector and public sponsors. Through the creation of a revenue stream associated with usage-pricing, this model aims to attract private and institutional capital. For projects with economic or financing gaps, or with too prohibitive a risk profile for private-sector investment alone, the CIB is able to take on risk in its investments, and it does this to attract or crowd-in private and institutional capital. By strategically leveraging the CIB and attracting private and institutional capital, more projects can be built.

The CIB was established as an arms-length Crown corporation that makes independent investment decisions within priority sectors identified by the Government. It was created with two clear objectives:

- to provide innovative financing and investment solutions to infrastructure projects in the public interest that have the potential to generate revenue and attract private-sector and institutional investment; and

- to become a leading centre of expertise in alternative financing; offer advisory services to other orders of government and to parties interested in the various dimensions of this model; support these advisory services with research and data to inform decision making.

The CIB draws on a wide array of financing tools and approaches, including concessional structures that differ from and are complementary to traditional funding streams within government. The model is also intended to build on several of Canada’s strengths: its robust and respected financial system;Footnote 7 the fact it is home to several of the world’s largest infrastructure investors;Footnote 8 and the success of its P3 model.Footnote 9

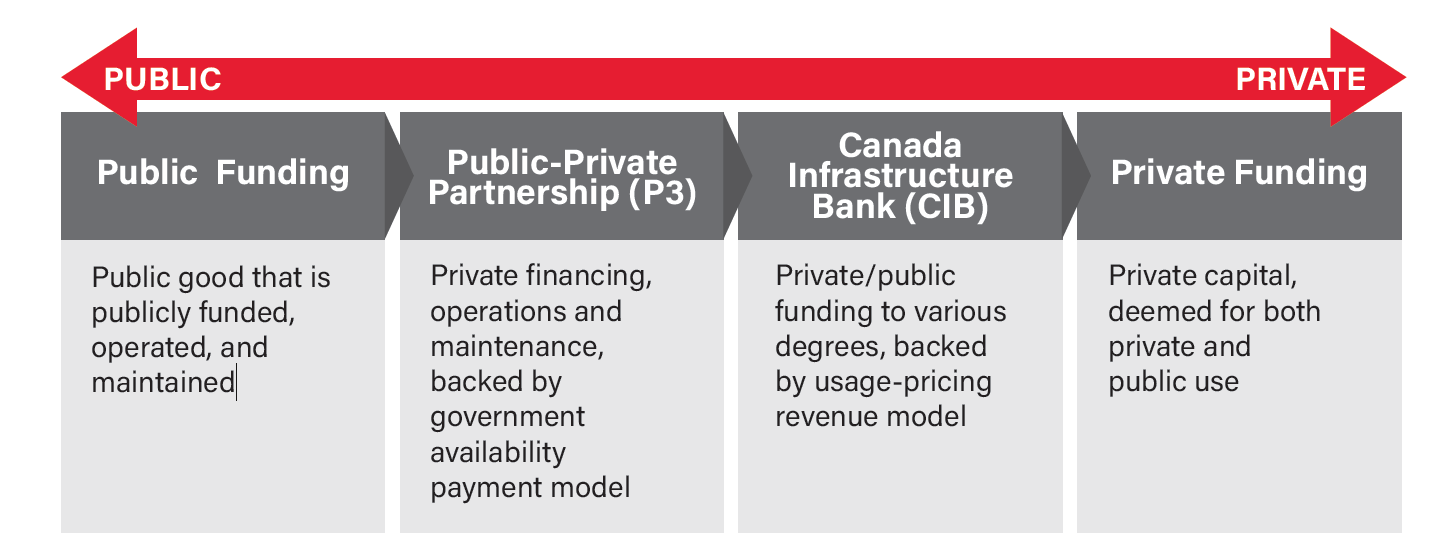

Infrastructure Funding and Financing Models

Source: Developed for this Report based on data from Deloitte.

Text Description: of Figure 1 Infrastructure Funding and Financing Models

Figure 1 is a spectrum diagram showing four funding and financing models for infrastructure projects in Canada from fully public to fully private ones. The spectrum, going from public to private, includes the following four models:

- 1) Public funding: under a public funding and financing model a public good is publicly-funded, operated, and maintained;

- 2) Public-private partnership: under a public-private partnership or P3 model, private financing, operations, and maintenance is backed by a government availability payment model;

- 3) Canada Infrastructure Bank: under the Canada Infrastructure Bank or CIB model, private and public funding is provided to various degrees, and is backed by usage-pricing revenue model;

- 4) Private funding: under a private funding model, private capital is deemed for both private and public use.

In adopting these tools and approaches, the CIB model aims to alleviate fiscal pressures on governments by shifting, where appropriate, some of the cost of major infrastructure projects to those who use and benefit from it. This helps generate new revenue streams, which can support greater investment by the private sector, and can also help promote the efficient use of and demand for infrastructure.

By involving the private sector early in scoping projects and by considering the best ways to manage infrastructure assets across their lifespan, the Bank’s model can also encourage greater innovation and efficiency in meeting infrastructure needs. For example, private and institutional investors can bring an additional layer of due diligence to a project. By including long-term private and institutional capital in infrastructure investment, public authorities can share responsibility for ensuring public infrastructure performs as intended.

The CIB was mandated to invest $35 billion in capital. Of that amount, up to $15 billion was able to be expensed and included in the over $180 billion Investing in Canada Plan. The CIB can use this $15 billion to make investments that may be concessionary (e.g., below market or subordinated) in order to attract private-sector investment to projects that would not otherwise be viable. As a result, the CIB’s investments have the potential to enable more projects to be completed than would occur through traditional cost-sharing models alone. The CIB was expected to minimize the amount of federal government support required to make projects financially viable.

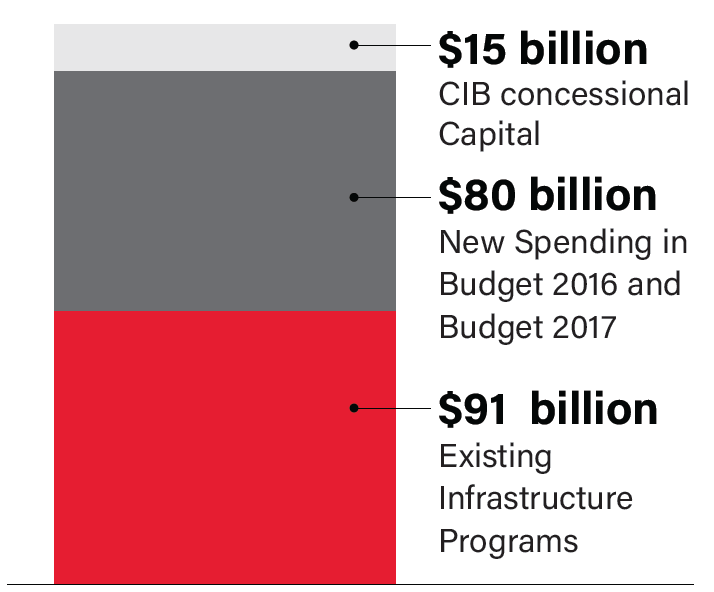

Investing in Canada Plan

Announced 12-year funding beginning in 2016-17

Source: INFC

2.3 Priority sectors

In 2017, the CIB was directed by the Government to invest in large and transformative projects across three priority sectors: 1) Public Transit, 2) Trade and Transportation, and 3) Green Infrastructure. These were consistent with the three streams of the Investing in Canada Plan.

Since then, the CIB’s role and priority sectors have broadened to support emerging priorities. This happened in response to challenges with early uptake of the CIB model, and to enable the CIB to play a larger role in supporting the Government’s agenda, specifically the transition to a low-carbon economy.

Text Description: of Figure 2 Announced 12-year funding beginning in 2016-17

Figure 2 is a staked bar graphic showing the breakdown for the Investing in Canada Plan (for the announced 12-year funding beginning in 2016-2017) as follows:

CIB concessional capital - $15 billion,

New Spending in Budget 2016 and Budget 2017 - $80 billion,

Existing Infrastructure Programs - $91 billion.

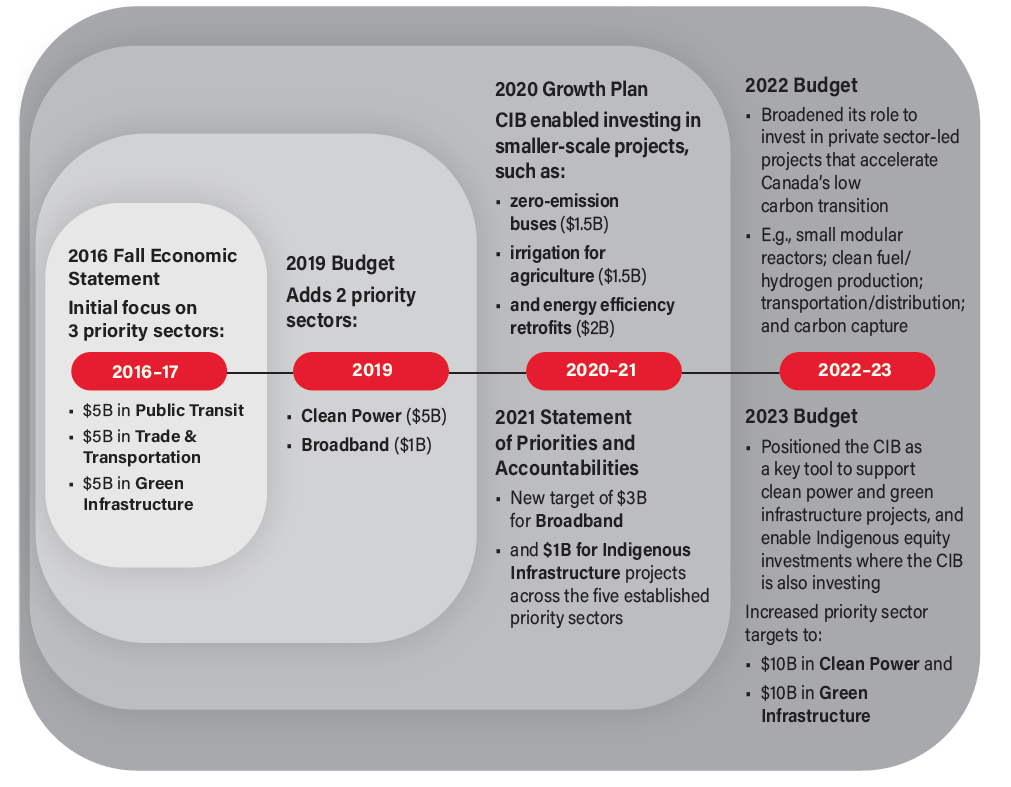

Evolution in CIB Role and Priorities

Source: Developed for this Report based on 2016 Fall Economic Statement,

2017 Statement of Priorities and Accountabilities, 2019 Budget, 2020 Growth Plan,

2021 Statement of Priorities and Accountabilities, 2022 Budget and 2023 Budget.

Text Description: of Figure 3 Evolution in Role and Priorities

Figure 3 depicts the evolution in CIB role and priorities over time.

2016 Fall Economic Statement announced CIB’s initial focus on 3 priority sectors including: $5 billion in Public Transit, $5 billion in Trade and Transportation, and $5 billion in Green Infrastructure.

2019 Budget added 2 priority sectors: Clean Power ($5 billion) and Broadband ($1 billion).

2020 Growth Plan: CIB enabled investing in smaller-scale projects, such as: zero-emission buses ($1.5 billion), irrigation for agriculture ($1.5 billion), and energy efficiency retrofits ($2 billion).

2021 Statement of Priorities and Accountabilities announced new target of $3 billion for broadband and $1billion for Indigenous infrastructure projects across the five established priority sectors.

2022 Budget broadened CIB’s role to invest in private sector-led projects that accelerate Canada’s low carbon transition, e.g., small modular reactors; clean fuel/hydrogen production; transportation/ distribution; and carbon capture.

2023 Budget positioned the CIB as a key tool to support clean power and green infrastructure projects, and enable Indigenous equity investments where the CIB is also investing. It also increased priority sector targets to: $10 billion in Clean Power and $10 billion in Green Infrastructure.

Today, the CIB operates in five priority sectors with associated investment targets, as described in the 2021 Statement of Priorities and Accountabilities.Footnote 10These sectors are Public Transit ($5 billion), Green Infrastructure ($10 billion), Trade and Transportation ($5 billion), Broadband ($3 billion), and Clean Power ($10 billion). Within these priority sectors, the Government has asked the CIB to target at least $1 billion in investments in Indigenous infrastructure projects.

Budget 2023 announced that the CIB will invest at least $10 billion through its Clean Power priority area and at least $10 billion through its Green Infrastructure priority area to support the building of major clean electricity and clean growth infrastructure projects. Funds to support the increased investment targets are sourced from the CIB’s existing $35 billion in capital.

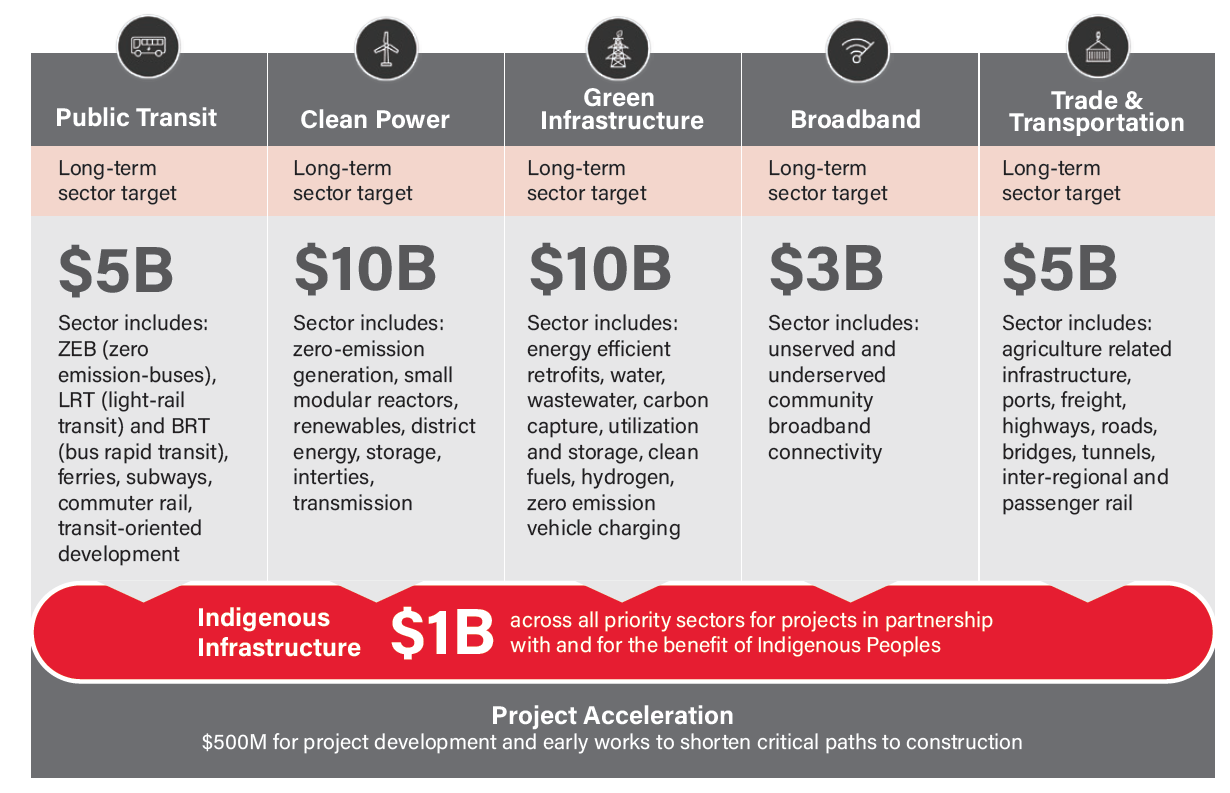

Priority Sectors

Source: CIB data.

Text Description: of Figure 4 Priority Sectors

Figure 4 shows a table describing the five priority sectors for CIB investments. The five priority sectors are: Public Transit, Clean Power, Green Infrastructure, Broadband, and Trade and Transportation. The figure shows the long-term sector targets and describes the type of projects included under each sector, as follows:

- 1) Public Transit - Long-term sector target: $5 billion. Sector includes: ZEB (zero-emission buses), LRT (light rail transit), BRT (bus rapid transit), ferries, subways, commuter rail, transit-oriented development;

- 2) Clean Power - Long-term sector target: $10 billion. Sector includes: zero-emission generation, small modular reactors, renewables, district energy, storage, interties, transmission;

- 3) Green Infrastructure - Long-term sector target: $10 billion. Sector includes: energy efficient retrofits, water, wastewater, carbon capture, utilization and storage, clean fuels, hydrogen, zero emission vehicle charging;

- 4) Broadband - Long-term sector target: $3 billion. Sector includes: unserved and underserved community broadband connectivity;

- 5) Trade and Transportation - Long-term sector target: $5 billion. Sector includes: agriculture related infrastructure, ports, freight, highways, roads, bridges, tunnels, inter-regional and passenger rail. CIB plans to invest on Indigenous Infrastructure - $1 billion across all priority sectors for projects in partnership with and for the benefit of Indigenous Peoples. CIB Project Acceleration consists of $500 million for project development and early works to shorten critical paths to construction.

2.4 Operations

Based on legislative requirements and guidance by the Government, the CIB has organized its activities as follows:

- Investments: The CIB acts as a catalyst to spur private and institutional investment in infrastructure projects in all five priority sectors. In some cases, these sectors are split further into asset classes.

To help translate Government policy direction and guidance into action, the CIB has put in place an investment framework to guide its decision-making. Under the framework, the CIB established quantifiable metrics to measure impacts in each of the priority sectors established by the Government (e.g., measuring GHG emissions reductions, or the daily trips on mass transit). The framework links these metrics to the use of its capital, including its concessional capital, by looking at investments that achieve certain targets of impact per amount of capital deployed. The framework also includes guardrails to ensure each project is consistent with the CIB’s purpose under the CIB Act; and to ensure the Bank’s support for the project is right-sized (i.e., it provides the minimum amount of financing needed to address an identifiable barrier). Finally, the framework allows for a portfolio strategy that encourages a diversity of project sizes, investment terms, and geographies. The CIB has also put in place another framework that sets out the processes for receiving, considering, and advancing unsolicited proposals in collaboration with the private sector and public sponsors.

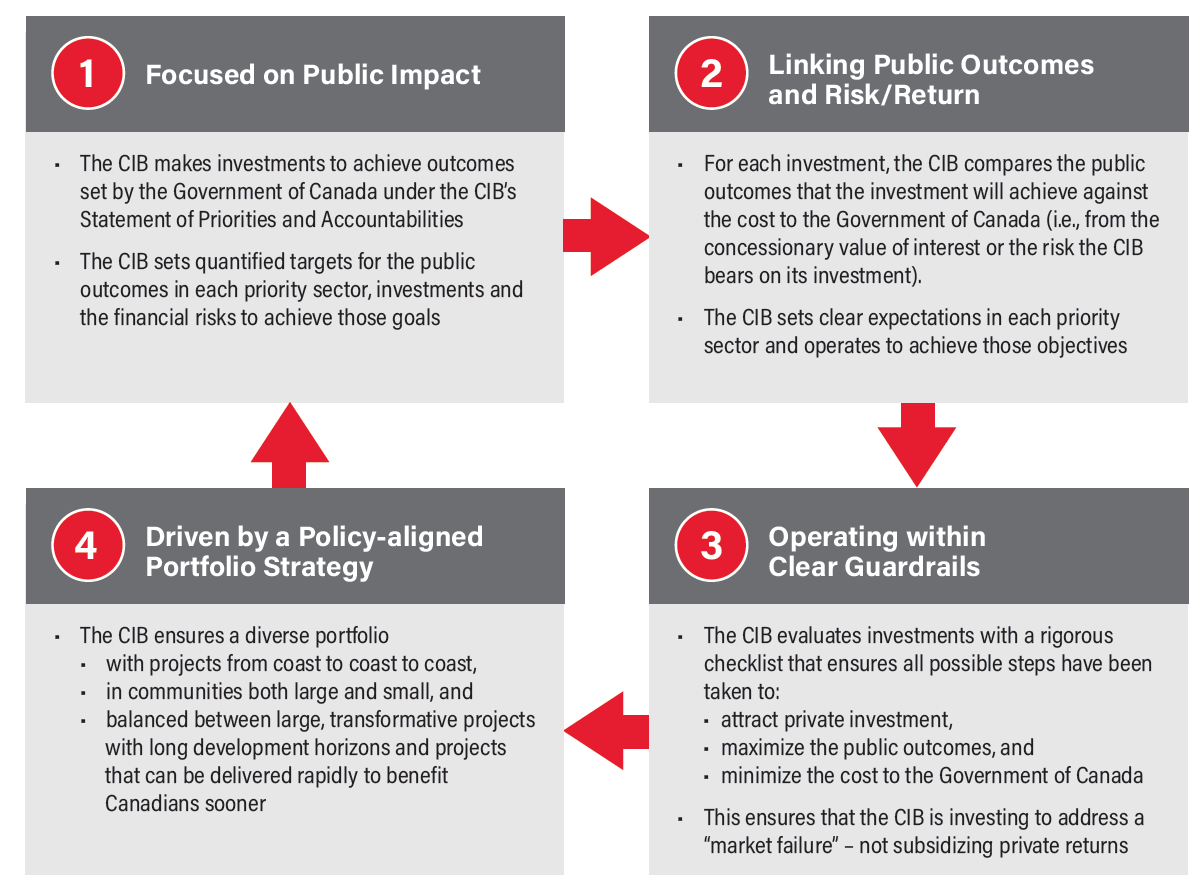

Investment Framework Overview

Source: CIB submission to the Legislative Review: Investing in Impact: A Submission to the Minister of Intergovernmental Affairs, Infrastructure and Communities’ Legislative Review of the Canada Infrastructure Bank Act.

Text Description: of Figure 5 Investment Framework Overview

Figure 5 presents an overview of the CIB Investment Framework in a four step process. The four quadrants of the CIB investment framework are:

- 1.) CIB’s framework focuses on public impact;

- 2.) CIB’s framework links public outcomes and risk/return;

- 3.) CIB’s framework operates within clear guardrails; and

- 4.) The CIB is driven by a policy-aligned portfolio strategy. Each quadrant is described in further details as follows:

- 1) CIB’s framework focuses on public impact:

- 1.1) The CIB makes investments to achieve outcomes set by the Government of Canada under the CIB’s Statement of Priorities and Accountabilities;

- 1.2) The CIB sets quantified targets for the public outcomes in each priority sector, investments and the financial risks to achieve those goals.

- 2) CIB’s framework links public outcomes and risk/return:

- 2.1) For each investment, the CIB compares the public outcomes that the investment will achieve against the cost to the Government of Canada (i.e., from the concessionary value of interest or the risk the CIB bears on its investment);

- 2.2) The CIB sets clear expectations in each priority sector and operates to achieve those objectives.

- 3) CIB’s framework operates within clear guardrails:

- 3.1) The CIB evaluates investments with a rigorous checklist that ensures all possible steps have been taken to: attract private investment, maximize the public outcomes, and minimize the cost to the Government of Canada.

- 3.2.) This ensures that the CIB is investing to address a “market failure” – not subsidizing private returns.

- 4) The CIB is driven by a policy-aligned portfolio strategy:

- 4.1) The CIB ensures a diverse portfolio: with projects from coast to coast to coast, in communities both large and small, and balanced between large, transformative projects with long development horizons and projects that can be delivered rapidly to benefit Canadians sooner.

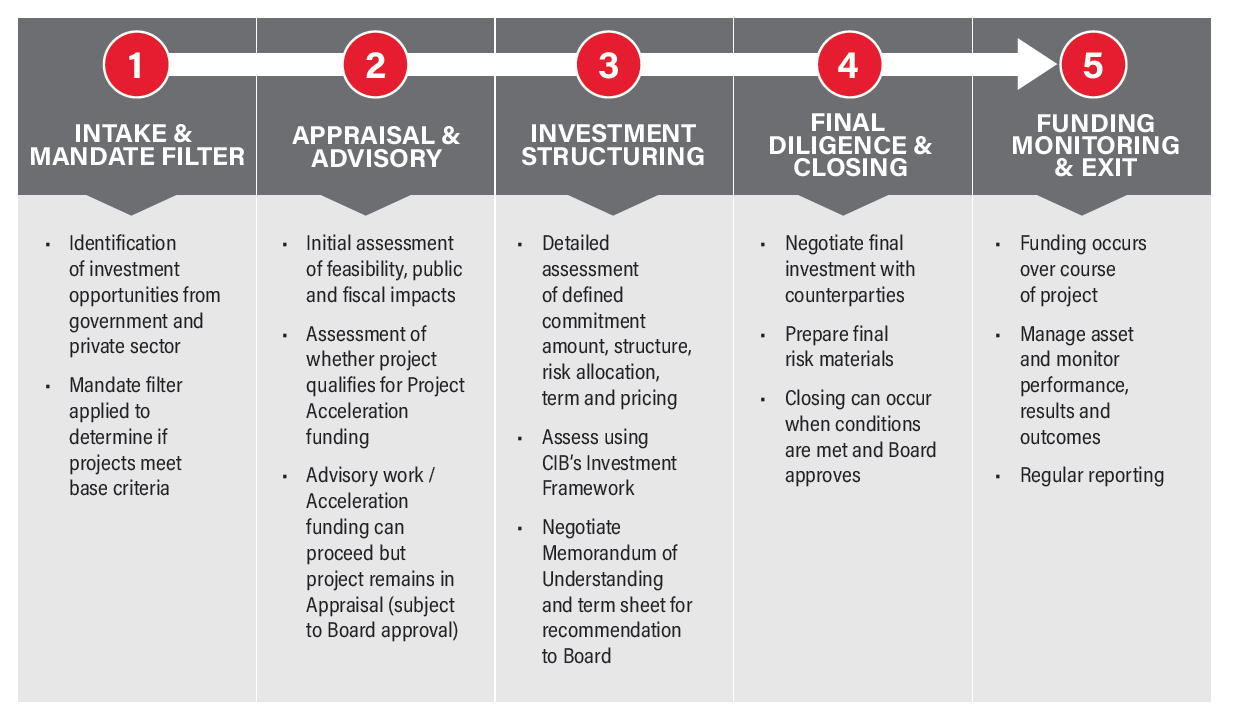

Investment Process Overview

Source: CIB 2021-2022 Annual Report.

Text Description: of Figure 6 Investment Process Overview

Figure 6 shows an overview of the CIB investment process in five consecutive steps. The fives steps are:

- 1) Intake & Mandate Filter;

- 2) Appraisal & Advisory;

- 3) Investment Structuring;

- 4) Final Diligence & Closing; and

- 5) Funding Monitoring & Exit. The fives steps are described in further details as follows:

- 1) Intake & Mandate Filter:

- 1.1) Identification of investment opportunities from government and private sector;

- 1.2) Mandate filter applied to determine if projects meet base criteria.

- 2) Appraisal & Advisory:

- 2.1) Initial assessment of feasibility, public and fiscal impacts;

- 2.2) Assessment of whether project qualifies for Project Acceleration funding; and

- 2.3) Advisory work / Acceleration funding can proceed but project remains in Appraisal (subject to Board approval).

- 3) Investment Structuring:

- 3.1) Detailed assessment of defined commitment amount, structure, risk allocation, term and pricing;

- 3.2) Assess using CIB's Investment Framework; and

- 3.3) Negotiate Memorandum of Understanding and term sheet for recommendation to Board.

- 4) Final Diligence & Closing: 4.1) Negotiate final investment with counterparties;

- 4.2) Prepare final risk materials; and

- 4.3) Closing can occur when conditions are met and Board conditions approved.

- 5) Funding Monitoring & Exit:

- 5.1) Funding occurs over course of project;

- 5.2) Manage assets and monitor performance, results and outcomes; and

- 5.3) Regular reporting.

In December 2022, the Bank published a sustainability update, Sustainability and Impact at the CIB, which details the sustainability outcomes and the impacts of its investments. In support of this work, a sustainability framework was developed to embed sustainability into the organization through three core pillars of: sustainable investing, impact as the bottom line, and a sustainable corporation. The report also included the CIB's first set of climate disclosures aligned to the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD).

- Advisory services: The CIB provides advice on how revenue-generating projects could be structured to ensure they would be attractive to private and institutional investors and of benefit to Canadians. To date, the CIB has focused its advisory services in two areas: opportunities likely to lead to a CIB investment in one of its priority sectors; and opportunities likely to attract private and institutional investment because of the nature of the project and investor interest in the CIB model.

As part of its advisory services, the CIB also offers Project Acceleration funding for infrastructure projects. These projects can take years to plan and develop, and often face considerable delays due in part to insufficient development funding. The CIB has established a $500 million target for Project Acceleration. These funds can be allocated to projects within the CIB’s priority sectors in which it expects to invest, to address this problem. The fund can be used to expedite due diligence reviews, and planning and development activities (e.g., engineering studies, or demand forecasting), and to help finance early-works construction.

- Knowledge and research:The CIB is developing and distributing knowledge and research products, in partnership with leading research institutions and experts across Canada. These aim to inform partners and the larger infrastructure community of important trends, challenges, and opportunities, and to heighten public awareness and understanding of the benefits, opportunities, and challenges in delivering infrastructure.

2.5 Governance and accountability

As a federal Crown corporation, the CIB is accountable to Parliament through the Minister of Intergovernmental Affairs, Infrastructure and Communities. The Government sets high-level priorities for the Bank through policy documents, such as federal budgets, and provides guidance for their implementation in Ministerial Statements of Priorities and Accountabilities. The CIB executes on these priorities in accordance with its legislative framework. The Bank was intended to strike a balance between arms-length operation and independent investment decision making, while also ensuring accountability and collaboration with public partners.

Each year, as required by the Financial Administration Act and the CIB Act, the Bank develops and submits a corporate plan, including its operating and capital budgets. With the concurrence of the Minister of Finance, the Minister recommends the corporate plan for approval. The corporate plan requires Governor in Council approval and the operating and capital budgets require approval by the Treasury Board. The capital budget outlines the CIB’s planned investments across its priority sectors. A summary of the corporate plan is tabled in Parliament. This process provides accountability and allows for the Government and the CIB to align on a strategic vision for the organization.

As part of its annual planning, in its initial years the CIB provided a list of intended projects with high level details of potential investments. Over time, reflecting its experience in operations, the CIB has moved to providing portfolio plans that detail each of its priority sectors rather than specific projects.

The CIB is governed by an independent Board of Directors who guide and oversee the CIB’s business activities. The organization is led by a Chief Executive Officer, who is appointed by the Board of Directors, subject to the approval of the Governor in Council. The Board exercises its authority in accordance with the CIBAct and Part X of the Financial Administration Act,Footnote 11 which sets out the control and accountability regime for Crown corporations, including strategic planning and financial reporting. The CIB’s by-laws prescribe the rules that govern the internal management of the corporation.

The Board is composed of the Board Chair and not fewer than 8, but not more than 11, other directors who are appointed by the Governor in Council on the advice of the Minister of Intergovernmental Affairs, Infrastructure and Communities. All directors are independent from the Bank’s management structure and serve for a term up to four years. The Board Chair serves for a term that the Governor in Council considers appropriate. When their terms expires, directors may be reappointed for an additional term or continue in office until a successor is appointed.

The CIB is also required to hold an annual public meeting to provide information on its activities and to provide the opportunity for members of the public to ask questions.

Since 2017, the CIB has focused on establishing the necessary corporate and organizational processes to manage the significant taxpayer funds entrusted, including:

- processes for engaging with private proponents on unsolicited proposals;

- processes and policies to support investment decision making;

- a risk management system for active monitoring of investments; and

- annual third-party audits to safeguard the assets and integrity of financial data.

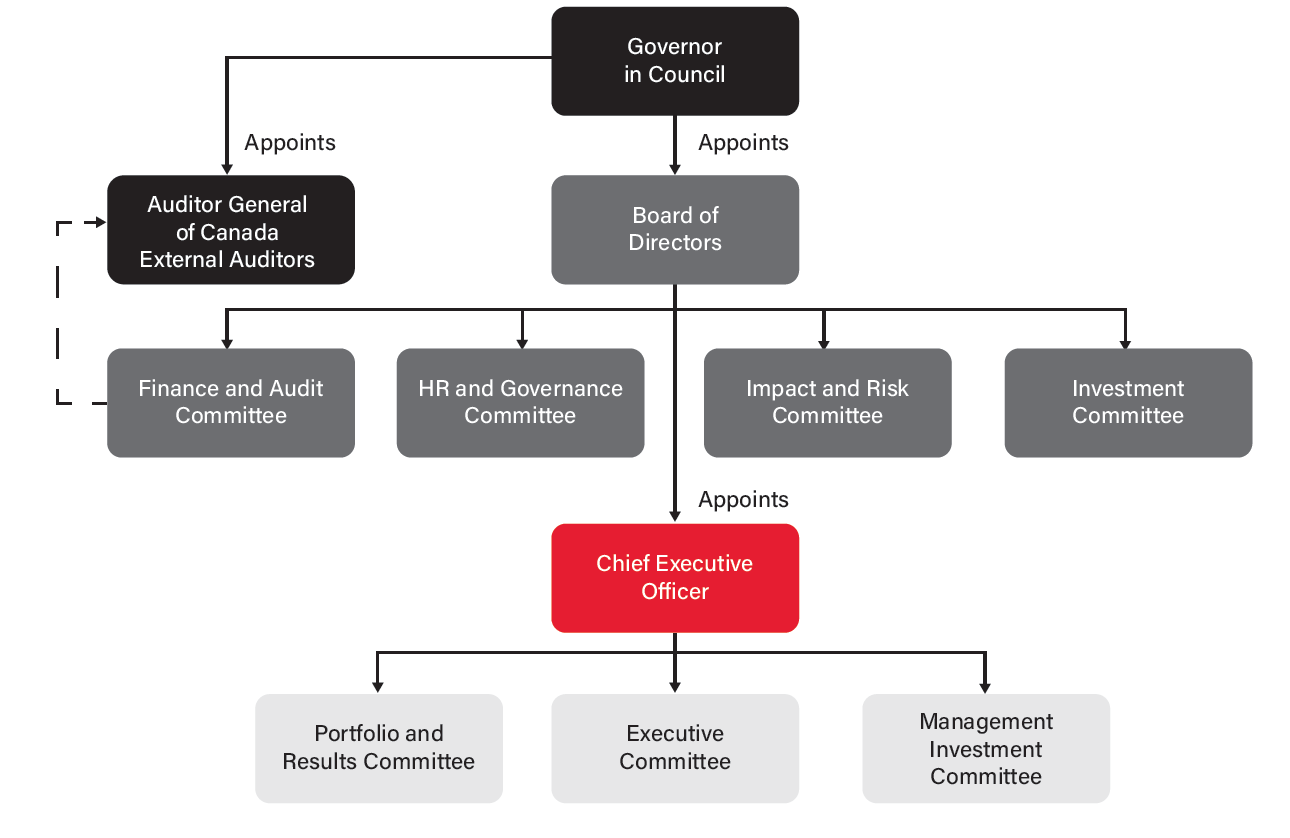

Corporate Governance Structure

Source: Canada Infrastructure Bank Act, Financial Administration Act and CIB 2021-22 Annual Report.

Text Description: of Figure 7 Corporate Governance Structure

Figure 7 is the Corporate Governance Structure of the CIB.

The CIB is governed by an independent Board of Directors appointed by the Governor in Council.

The Board of Directors appoints the Chief Executive Officer of the Bank, who oversees the Portfolio and Results Committee, the Executive Committee and the Management Investment Committee.

The Board of Directors oversees the Bank’s business, activities and other affairs through the Finance and Audit Committee, the Human Resources (HR) and Governance Committee, the Impact and Risk Committee and the Investment Committee.

The Auditor General of Canada and an auditor appointed annually by the Governor in Council serve as the joint external auditors of the CIB.

The Office of the Auditor General of Canada (OAG) audits the CIB’s annual financial statements jointly with an independent external auditor. Their task is to verify that the statements fairly reflect the CIB’s operating results and financial position. The OAG will conduct a special examination at least once every 10 years to confirm that assets are being safeguarded and controlled; financial, human, and physical resources are being managed efficiently; and operations are being conducted effectively. In addition to the joint auditors, the CIB also maintains an independent internal audit service to ensure effective internal controls and processes.

The 2021 Statement of Priorities and Accountabilities established that the CIB is expected to draw on a diverse range of talent and perspectives from across Canada as well as international best practices. This includes a continued commitment to diversity in the CIB’s workforce and to fostering the inclusion of a broad range of voices and views in governance and decision-making. In undertaking these functions, the CIB is expected to take into consideration Canada's gender, linguistic, cultural and regional diversity, including the unique perspectives of Indigenous Peoples.

2.6 Collaboration with government programs and initiatives

Within parameters set out by the Government and the CIB Act, the Bank makes independent decisions on investments and operations. CIB support can be supplemented by other federal as well as provincial, territorial, or municipal programs and investments. This requires close collaboration and partnership between the Bank and other public bodies. Engaging with federal partners or public partners across Canada can also help to refer project opportunities that are well-suited to the CIB’s model.

On an operational level, many of the CIB’s priority sectors interact with existing federal programs and initiatives that provide targeted funding for infrastructure-related projects in similar sectors. In recognition of the potential for overlap or duplication, the CIB routinely engages with federal departments to coordinate efforts and ensure federal programming works in a complementary manner with the CIB. Examples of how the CIB coordinates with federal departments include the following:

- Infrastructure Canada (INFC): As the CIB and INFC are both making investments in and providing funding to zero-emission buses (ZEBs) and public building retrofits, both organizations coordinate on the design of these complementary programs, as well as on the larger priorities outlined in the Investing in Canada Plan. INFC officials often refer projects seeking federal support to the CIB when the project may be aligned with the CIB model. To support sound oversight and assist the CIB in undertaking coordination across numerous federal departments (discussed below), the CIB and INFC officials have established four engagement tables (Advisory and Investments; Corporate; Knowledge and Research; and Communications) that meet regularly to share information, discuss issues, and ensure alignment with Government policy directions and activities. Finally, through INFC engagement with its stakeholder community, INFC supports the CIB and the designated Minister for the CIB by ensuring awareness of the Bank and its policy premise and mandate.

- Innovation, Science and Economic Development Canada (ISED): The CIB works with the ISED’s Universal Broadband Fund to coordinate on the deployment of large-scale broadband projects to provide minimum universal 50/10 Mbps access. The CIB works with ISED ’s Strategic Innovation Fund, specifically its Net Zero Accelerator, on possible projects in: clean fuels; hydrogen; carbon capture, use, and storage (CCUS); and industrial retrofits, such as the CIB’s investment in Algoma Steel’s installation of electric arc furnaces.

- Natural Resources Canada: The CIB works closely with this department responsible for energy policy and electricity systems, in financing large, high-priority clean power projects, such as the Atlantic Loop. The CIB aligns with Government policy regarding CCUS, hydrogen, clean fuels, small modular reactors, and electric vehicle charging.

- Transport Canada: The CIB collaborates with this department on investment opportunities in trade and transportation infrastructure that aligns with Government policy, such as those funded through the National Trade Corridors Fund. The CIB also works with Transport Canada (in conjunction with Public Services and Procurement Canada, and INFC) in supporting the development of projects such as the High-Frequency Rail project, and the New Westminster Bridge replacement.

- Crown-Indigenous Relations and Northern Affairs Canada: Through financing and advisory services, the CIB collaborates with this department on advancing Northern clean power projects through financing and advisory services, including the Atlin Hydro Expansion, Taltson Hydro Expansion, and Kivalliq Hydro-Fibre Link.

- Environment and Climate Change Canada: The CIB collaborates with this department on several policy areas, including electrification and the measurement of GHG emissions reduction associated with investments.

In support of this coordination with federal departments, the CIB has put in place Memorandums of Understanding (MOUs) or service standards with several departments. These guide investments in the Bank’s priority sectors and they help ensure investments are complementary to and align with Government priorities, as well as the terms and conditions of Government programs. The CIB also interacts with other public-sector sponsors and bodies to provide advice and/or to structure projects.

3. Results

Across its five priority sectors, the CIB’s investments have enabled the development of necessary infrastructure projects that support a vibrant economy through greater connectivity, as well as projects that support Canada’s transition to a low-carbon economy. Through its work in advising project proponents and governments, and through its research and data work, the CIB is promoting the uptake of alternative financing models for infrastructure development and delivery. Stakeholders engaged through the Review acknowledged the help they received from CIB staff and that the institution has begun to serve as a centre of expertise, sharing knowledge on projects, plans, and opportunities.

Through its Annual Reports, Financial Statements, and other disclosures, the CIB reports on its results regularly to Parliament and Canadians. This section provides a high-level overview of the CIB’s outcomes by priority sector, region, and business line over the course of the Review period.

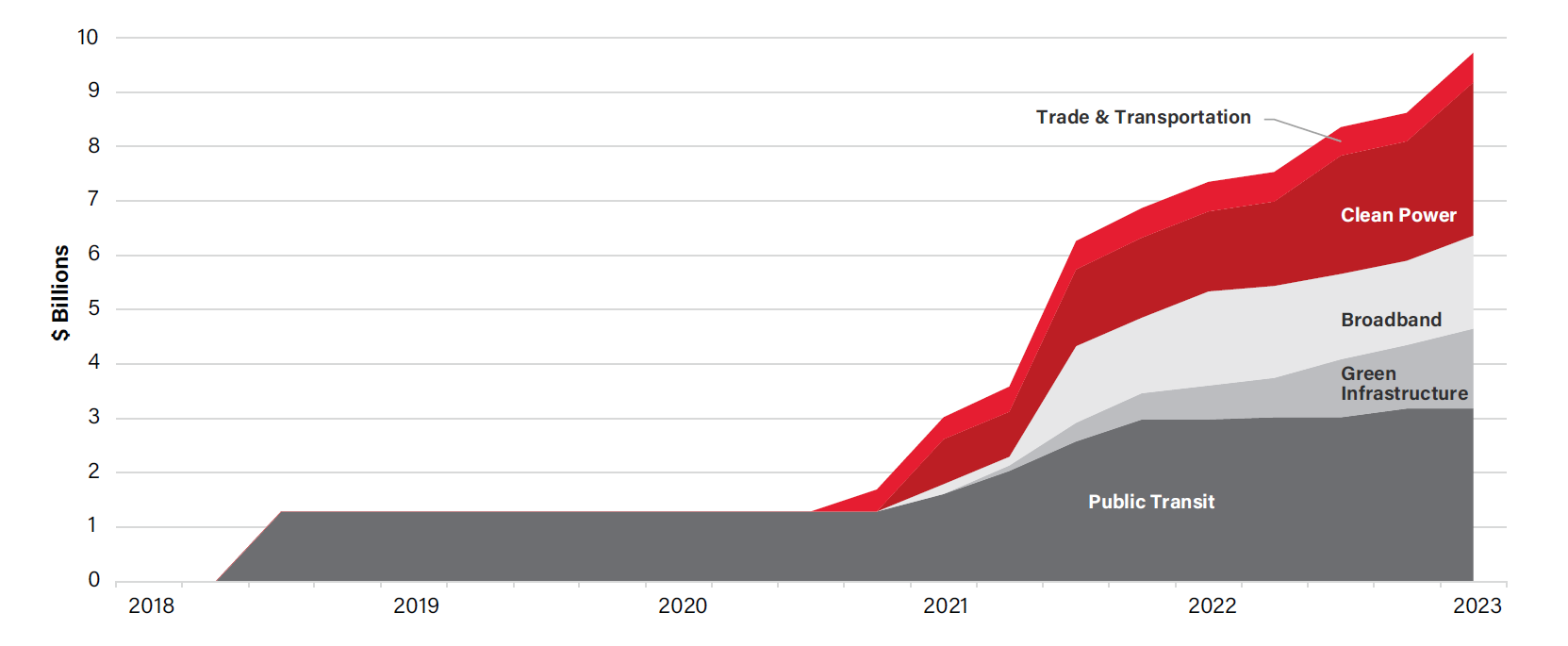

3.1. Portfolio growth

As of March 2023, the CIB has committed $9.7 billion (of its $35 billion in investment capital) to 46 projects across Canada, representing total capital invested from all partners of nearly $27 billion. These investments have attracted approximately $8.6 billion in private-and institutional financing. The CIB has reached financial close on 42 projects, of which 29 are in active construction and one is in operations. A complete list of announced CIB projects to date can be found in Annex B.

Cumulative CIB Investment Commitments

(by priority sector and calendar date of investment commitment)

Source: CIB submission to the Legislative Review: Investing in Impact: A Submission to the Minister of Intergovernmental Affairs, Infrastructure and Communities’ Legislative Review of the Canada Infrastructure Bank Act.

Text Description: of Figure 8 Cumulative CIB Investment Commitments

Figure 8 shows the cumulative CIB Investment Commitments by priority sector and calendar date of investment commitment from Q3-2018 to Q1-2023.

Figures in $ billions

|

Q3-2018 |

Q4-2018 |

Q1-2019 |

Q2-2019 |

Q3-2019 |

Q4-2019 |

Q1-2020 |

Q2-2020 |

Q3-2020 |

Q4-2020 |

Q1-2021 |

Q2-2021 |

Q3-2021 |

Q4-2021 |

Q1-2022 |

Q2-2022 |

Q3-2022 |

Q4-2022 |

Q1-2023 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Broadband |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

164 |

164 |

1406 |

1406 |

1739 |

1695 |

1564 |

1564 |

1700 |

Clean |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

825 |

825 |

1425 |

1472 |

1472 |

1552 |

2177 |

2177 |

2827 |

Green |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

100 |

340 |

477 |

626 |

725 |

1064 |

1164 |

1477 |

Public Transit |

1283 |

1283 |

1283 |

1283 |

1283 |

1283 |

1283 |

1283 |

1283 |

1283 |

1613 |

2027 |

2570 |

2970 |

2970 |

3018 |

3017 |

3176 |

3178 |

Trade |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

408 |

408 |

458 |

516 |

532 |

532 |

532 |

532 |

532 |

532 |

The CIB accelerated its financing activity over the last two years, with 45 investment commitments since the launch of the Growth Plan in October 2020.Footnote 12 The CIB expects this pace of investment over a five year horizon would translate to $35 billion in financial closes by 2027-28.Footnote 13

3.2. Investments by priority sector

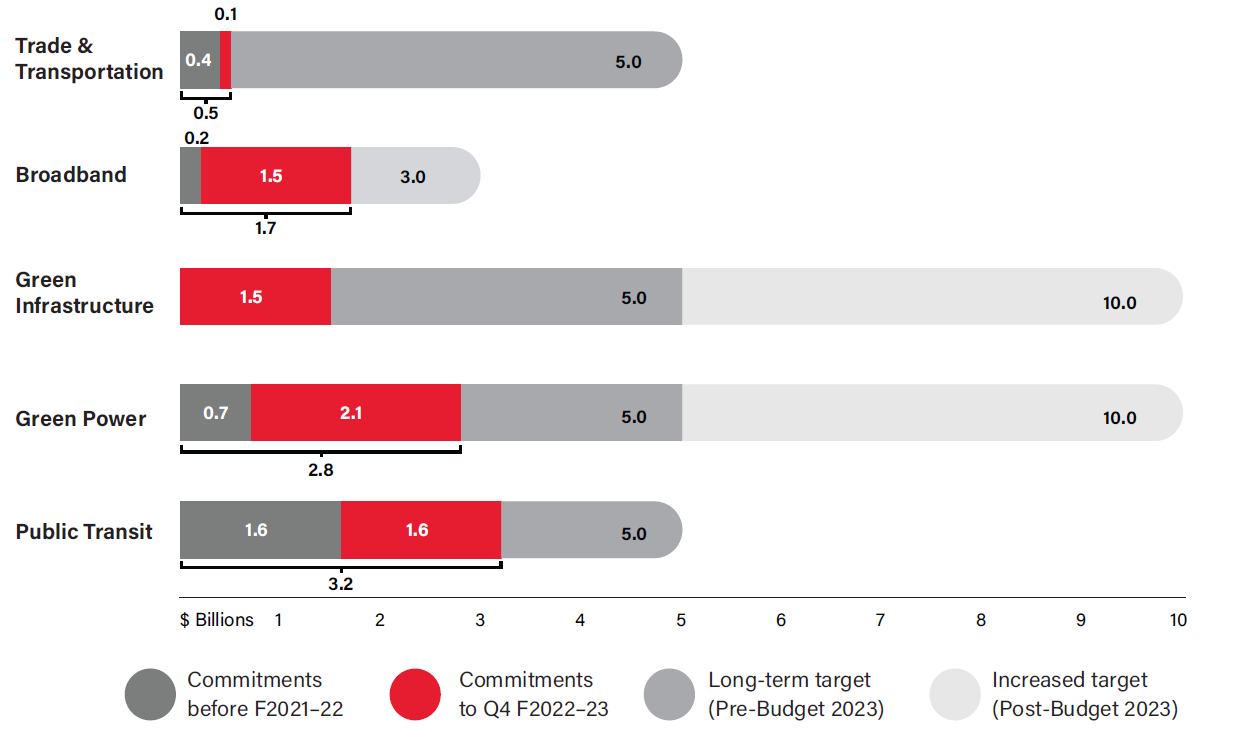

As of March 2023, the CIB’s $9.7 billion in investment commitments break down is as follows: $3.2 billion in Public Transit; $2.8 billion in Clean Power; $1.5 billion in Green Infrastructure; $1.7 billion in Broadband; and $0.5 billion in Trade and Transportation. Across the priority sectors, the CIB has also made investment commitments of $316 million in partnership with and of benefit to Indigenous communities.

Public Transit has seen the largest level of investment due to the Réseau express métropolitain (REM) project, followed by several investments through the ZEB Initiative. Levels of investment in the Clean Power sector (i.e., clean generation, transmission and storage, and district energy), and Green Infrastructure (i.e., retrofits, low-carbon energy transition, and water and wastewater) sectors have gained traction recently.

To date, Broadband investment commitments in 8 projects have totaled $1.7 billion. Trade and Transportation partnerships have included investments in agricultural irrigation, Indigenous infrastructure, and support for governments advancing large transformative projects, such as the High-Frequency Rail project, where the CIB advised the Government on a proposal from VIA Rail to deliver high-frequency rail service on dedicated tracks along the Quebec City-Toronto corridor.

Budget 2023 increased the sector targets in Green Infrastructure and Clean Power to $10 billion each. The following table outlines the CIB’s progress towards long-term investment targets for its priority sectors.

Progress towards long-term investment targets

(based on projects reaching investment commitment or financial close)

Source: CIB submission to the Legislative Review: Investing in Impact: A Submission to the Minister of Intergovernmental Affairs, Infrastructure and Communities’ Legislative Review of the Canada Infrastructure Bank Act.

Text Description: of Figure 9 Progress towards long-term investment targets

Figure 9 shows the commitments and progress towards long-term investment targets of CIB projects reaching investment commitment or financial close by priority sectors. The breakdown of the commitments and progress towards long-term investment targets is as follows:

Figures in $ billions

Priority Sector |

Commitments before F2021-22 |

Commitments to Q4 F2022-23 |

Progress towards long-term target |

Long-term target (Pre-Budget 2023) |

Increased target (Post-Budget 2023) |

|---|---|---|---|---|---|

Trade and Transportation |

0.4 |

0.1 |

0.5 |

5.0 |

n/a |

Broadband |

0.2 |

1.5 |

1.7 |

3.0 |

n/a |

Green Infrastructure |

0.0 |

1.5 |

1.5 |

5.0 |

10.0 |

Clean Power |

0.7 |

2.1 |

2.8 |

5.0 |

10.0 |

Public Transit |

1.6 |

1.6 |

3.2 |

5.0 |

n/a |

n/a: not applicable.

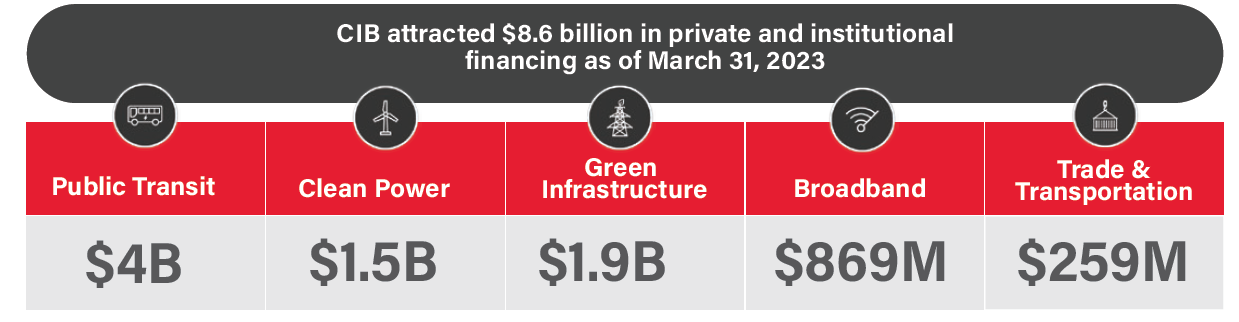

Investments have been made in collaboration with provincial, territorial, municipal, and Indigenous (PTMI) governments, and these have attracted approximately $8.6 billion in private and institutional capital and $8.7 billion in capital from public sector partners. Of the $8.6 billion in private and institutional capital, 47% was for Public Transit-related projects, followed by Green Infrastructure projects (22%), Clean Power (18%), Broadband (10%), and Trade and Transportation (3%). Private and institutional capital was secured through collaboration with more than 40 private sector partners and institutional investors.

CIB projects - Examples of private and institutional partners

| Project | Priority Sector | Private & Institutional Partner(s) |

|---|---|---|

Réseau Express Métropolitain (REM) |

Public Transit |

CDPQ Infra |

Manitoba Fibre |

Broadband |

Valley Fiber, DIF Capital Partners |

ATG Alberta Indigenous Broadband |

Broadband |

ATG Arrow Technology Group Ltd. Partnership |

Enwave District Energy |

Clean Power |

Enwave Energy Corporation |

Markham District Energy |

Clean Power |

CIBC |

Enerkem Varennes Carbon Recycling |

Green Infrastructure |

Shell, Suncor and Proman |

Algoma Steel Retrofit |

Green Infrastructure |

Algoma Steel Inc. |

Alberta Irrigation |

Trade & Transportation |

10 irrigation districts |

Tshiuetin Railway |

Trade & Transportation |

Tshiuetin Rail Transportation Inc. |

Source: CIB data.

The CIB has also established initiatives to deploy capital to smaller or standardized projects more efficiently. For example, through the Indigenous Community Infrastructure Initiative (ICII), established in 2021, the CIB lends from $5 million-$100 million to Indigenous communities to support infrastructure investments across the CIB’s priority sectors. Since launching the ICII, the CIB has made $195 million in investment commitments to 7 projects in Indigenous communities across seven provinces and territories; one such project is the Port Stalashen Wastewater Treatment Plant.

Port Stalashen Wastewater Treatment Plant, British Columbia

The CIB is investing $6.4 million in the new Port Stalashen Wastewater Treatment Plant (WWTP), which will be located on shíshálh Nation lands near Sechelt, British Columbia. The project will play a critical role in enabling economic growth, protecting the coastal environment, and safeguarding public health. The current wastewater treatment plant has reached its end of life.

Problem/Risk addressed: shíshálh Nation Government District (sNGD) was unable to secure long-term and affordable private-sector financing to facilitate the development and construction of the project. The WWTP is operated on a breakeven basis, presenting an economic gap. sNGD approached the CIB for a loan to address the lending gap.

Alignment to CIB’s mandate: The project draws on incremental and existing user fees and land-parcel taxes.

Partners: shíshálh Nation Government District.

Outcomes: This new facility will serve 91 connected residential units and support the conversion and connection of 88 buildings, which currently rely on septic wastewater systems.

Source: Based on CIB website and CIB data

Through the ZEB Initiative, the CIB is providing loans to bus owners, including transit and school bus operators, to modernize bus fleets to zero-emission vehicles on an accelerated basis. Under this initiative, the CIB’s financing can cover the higher upfront capital costs of ZEBs.

Finally, through the Building Retrofits Initiative, the CIB is providing financing for energy efficiency retrofit projects in the public and private sectors. With these initiatives, CIB financing can drive investment in projects that deliver reductions in greenhouse gas emissions. As of March 31, 2023, the CIB had made commitments of $1.6 billion for projects under the ZEB Initiative and $913 million in commitments for energy-efficiency retrofits.

Private and Institutional Capital Attracted

Source: Developed for this Report based on CIB data.

Text Description: of Figure 11 Private and Institutional Capital Attracted

Figure 10 shows the private and institutional capital attracted by the CIB.

As of March 31, 2023 the CIB attracted $8.6 billion in private and institutional financing.

The breakdown by priority sector is as follows: $4 billion for Public Transit, $1.5 billion for Clean Power, $1.9 billion for Green Infrastructure, $869 million for Broadband, and $259 million for Trade and Transportation.

While the CIB has a mandate to invest in projects of both national and regional significance, because it remains an optional tool for partner governments, it has not established specific regional targets or quotas. Nevertheless, the CIB has endeavored to have broad regional distribution of its investment capital. In its most recent five-year Corporate Plan, the CIB includes a long-term target of having 6 investments reach financial close in each of its five geographic regions (i.e., Northern, Western, Ontario, Quebec, and Atlantic) as part of its strategic priority of investing to modernize infrastructure. Footnote 14

To date, a higher proportion of investment has occurred in Ontario and Quebec due to large projects like the REM and the Darlington Small Modular Reactor. This proportion is influenced by uptake of project owners in these areas. Additionally, there can be challenges in identifying projects at an appropriate scale to attract private and institutional investment in smaller and remote regions. Nonetheless, the CIB is very active in advisory work across Canada and also assists in identifying regional and northern projects which may be better suited to other federal programs.

Darlington Small Modular Reactor, Ontario

The CIB is investing $970 million in Phase 1 of the Darlington Small Modular Reactor (SMR) project. Phase 1 includes project design, procurement of long lead-time equipment, utility connections, site preparation and project management requirements.

Problem/Risk Addressed: The project faced an economic gap caused by higher costs associated with it being a first-of of-a a-kind technology, with unique circumstances that inhibit early private- sector interest.

Alignment to CIB’s mandate: The project is structured to require private capital as part of Phase 2. The project earns revenue from its rate base.

Partners:Ontario Power Generation.

Outcomes:The 300-megawatt SMR will provide enough electricity to power 300,000 homes and will avoid approximately 740,000 tonnes of greenhouse gas emissions annually — this is equivalent to the emissions of nearly 160,000 gas-fuelled cars.

Source: Based on CIB website and CIB data.

Kivalliq Hydro-Fibre Link, Nunavut and Manitoba

The CIB is working with the Kivalliq Inuit Association and Sakku Investments Corporation on the Kivalliq Hydro-Fibre Link project.

This project would bring renewable, sustainable, and reliable hydroelectricity to Indigenous Peoples in remote communities. It would modernize their electricity systems and potentially reduce their reliance on diesel power generation, while supporting their economic interests.

The project would also bring broadband connectivity to the region for the first time, enhancing telecommunications services for residents and businesses, and for public service delivery.

Source: Based on CIB website and CIB data.

Regional representation has increased each year, and the CIB expects this trend to continue. Across geographic regions, notable investments or advisory engagements include: the Port Stalashen Wastewater Treatment Plant in British Columbia; Kahkewistahaw Landing Infrastructure in Saskatchewan; the Manitoba Fibre project; Pirate Harbour Wind Farm in Nova Scotia; the Atlantic Loop in Nova Scotia and New Brunswick, the Tshiuetin Railway in Northeastern Quebec and Western Labrador and the Kivalliq Hydro-Fibre Link in Nunavut and Manitoba.Footnote 15

Pirate Harbour Wind Farm, Nova Scotia

The CIB is advising the Port Hawkesbury Paper Mill on the development of the Pirate Harbour Wind Farm, which would reduce the Mill’s reliance on fossil fuels for energy, thereby decreasing GHG emissions. The project would add clean, renewable energy generation to Nova Scotia’s main transmission system, and it would help optimize the Mill’s operations.

The CIB is conducting analyses, reviewing the project’s estimated costs and revenues, exploring financing options, and assessing the environmental, social, and economic benefits.

Source: Based on CIB website and CIB data.

Regional Project Commitments, Financial Closes, and Partnership Distribution

Source: CIB 2023 Market Update.

Text Description: of Figure 15 Regional Project Commitments, Financial Closes, and Partnership Distribution

Figure 11 is a representation of the map of Canada showing the geographical distribution of CIB regional project commitments, financial closes, and partnership agreements. The breakdown is as follows: Alberta – 7, British Columbia – 5, Manitoba – 1, New Brunswick – 0, Newfoundland and Labrador – 1, Northwest Territories – 1, Nova Scotia – 1, Nunavut – 1, Ontario – 10, Prince Edward Island – 0, Quebec – 8, Saskatchewan – 3, Yukon – 0. Source: CIB 2023 Market Update.

3.3. Partnerships

The CIB works with federal, provincial, territorial, and municipal governments, as well as with Indigenous communities and partners from across the Canadian infrastructure landscape, acting as a catalyst to get projects built in new and innovative ways of planning, funding and delivery. Collectively, these organizations are driving public infrastructure development across the country. As a partner in the early stages of a project, the Bank provides advice to public sponsors to inform their decisions about priorities and investment options, and to help them achieve their infrastructure goals.

Réseau express métropolitain (REM), Quebec

The CIB invested $1.28 billion in the REM project, an automated electric light-rail system. It features 26 stations and 67 km of track, and it will nearly double Montreal’s transit capacity.

Problem/Risk addressed: Greenfield transit projects face significant ridership/revenue risks that make it difficult to raise debt financing.

Alignment to CIB’s mandate: CIB financing helped crowd-in $3.53 billion of institutional investment from Caisse de Dépot et Placement du Québec (CDPQ). Revenue is generated through ridership.

Partners: CDPQ Infra, Government of Quebec.

Outcomes: The REM is projected to reduce 27,200 tonnes of GHG emissions in each year of its operation, to create 34,000 jobs during construction, and to create more than 1,000 permanent jobs.

Source: Based on CIB website and CIB data.

The CIB is also working with private and institutional partners, including pension funds, who can play a critical role in accelerating infrastructure investment. In these cases, the Bank identifies and develops appropriate ways to structure, innovate, and allocate risks and returns among the partners, which has helped connect private and institutional capital to numerous projects, such as the Montreal REM project, which attracted $3.53 billion in institutional capital.

Manitoba Fibre

The CIB is investing $164 million in the Manitoba Fibre project. The project involves 2,657 km of fibre-optic cabling, connecting 49,000 underserved households with fibre-to-the-home across rural municipalities.

Problem/Risk addressed: An economic gap exists due to the low population density and current lack of broadband infrastructure in Manitoba, resulting in a high cost of connection per household.

Alignment to CIB’s mandate: The CIB is financing Valley Fiber with DIF Capital Partners, a major Dutch infrastructure fund, and without any public funding. The project earns revenue from its users.

Partners: DIF Capital Partners, Valley Fiber Limited.

Outcomes: Valley Fiber aims to serve 49,000 new, underserved households with service between 50MB/10MB and 1G/1G in southern Manitoba.

Alberta Irrigation

The CIB is investing $466 million in Phase 1 of the Irrigating Alberta infrastructure initiative. The primary objectives of this phase are to improve the efficient delivery of water, increase irrigation opportunities, and reduce water loss.

Problem/Risk addressed: Due to the uncertain nature of revenues, agriculture sector growth can face obstacles in attracting long-term private capital to finance large projects.

Alignment to CIB’s mandate: The project is revenue generating through the water rates that will be charged to farmers. The CIB is investing alongside a grant from the Government of Alberta, as well as an investment from Irrigation Districts in Alberta. These irrigation districts are investing on behalf of private-sector farmers.

Partners: Government of Alberta, Irrigation Districts.

Outcomes: Phase 1 work is expected to result in approximately 56,100 new irrigated acres.

Source: Based on CIB website and CIB data.

3.4. Advisory services

The CIB engages with all orders of government to inform potential public partners about the CIB and its role, and to understand their priorities and where investment gaps may exist. It also works with potential partners to analyze whether a proposed project or plan might be appropriate for CIB investment. This could include identifying steps the potential partner would need to take for a project to qualify for financing, such as the development of a business case. It could also include creating possible scenarios for revenue generation.

A core objective of the CIB ’s advisory services is to offer its expertise and advice to explore the potential and options for Bank involvement. It endeavors to do so in a manner that helps to advance projects for potential private, institutional, or CIB investment, or to quickly identify those that are not appropriate for CIB investment. Typical advisory work includes advising a project through analyses, reviewing estimated costs and revenues; exploring financing options; and/or assessing environmental, social, and economic benefits.

There are several early examples of how the CIB ’s advisory services are advancing the development of large and complex projects and accelerated investment decisions on proposals, including initiatives such as the High-Frequency Rail project. The CIB is also participating alongside other governments on the Atlantic Loop electricity interconnection project. The CIB has helped both projects move from their initial concept phases to the development of options for structuring investments.

Atlantic Loop, New Brunswick, Nova Scotia and Quebec

Atlantic Loop is a regional transmission project that would strengthen clean power trade across Atlantic Canada. TheCIB is actively working with utilities in the region, including Nova Scotia Power, New Brunswick Power, and Hydro Quebec to customize investment solutions with the potential of attracting private capital while achieving goals that benefit Canadians. The CIB has identified novel project financing solutions to lower costs and accelerate investment in this important regional infrastructure priority

Source: Based on CIB website and the CIB submission to the Legislative Review: Investing in Impact: A Submission to the Minister of Intergovernmental Affairs, Infrastructure and Communities’ Legislative Review of the Canada Infrastructure Bank Act.

High Frequency Rail (HFR), Quebec-Ontario

The HFR project aims to enhance passenger experience in the Quebec City-Toronto corridor by improving reliability, frequency, and on-time performance of trains, while mitigating financial impact on taxpayers and supporting Canada’s net zero commitment.

The CIB advised the Government of Canada on the Via Rail proposal to deliver a reliable and frequent passenger train service on dedicated tracks along the corridor. With VIA Rail, the CIB has established a joint project office to accelerate project development, including scoping and costing of the project, as well as to identify options for financial structuring. This allowed the Government to proceed with further procurement for this project around the design, capital costs and business case.

CIB remains an active advisor and partner and could be a potential investor in the HFR project.

Source: Based on CIB website and the CIB submission to the Legislative Review: Investing in Impact: A Submission to the Minister of Intergovernmental Affairs, Infrastructure and Communities’ Legislative Review of the Canada Infrastructure Bank Act.

In this kind of work, the CIB and a project partner might establish an MoU or similar engagement to guide their efforts, define project objectives, and clarify roles and responsibilities. As of March 2023, the CIB has 13 announced engagements with project sponsors in six provinces and two territories,Footnote 16 which are helping to advance projects across Trade and Transportation, Clean Power, Broadband, and Green Infrastructure priority sectors. For advisory work where an MoU has been put in place, the CIB might invest in the project, pending due diligence and decision making by its Board. Annex C provides a detailed list of these announced engagements.

Calgary-Banff Rail, Alberta

The CIB is advising the Government of Alberta on a 130 km sustainable passenger rail service. It would provide a modern and sustainable travel option from the airport to one of Canada’s most popular tourism destinations.

The project focuses on stimulating tourism and increasing mobility options for Albertans and visitors. The project would also reduce GHG emissions and congestion in the Calgary-to-Banff-National-Park corridor.

Source: Based on CIB website and CIB data.

Georgina Island Fixed Link, Ontario

The CIB is working with the Chippewas of Georgina Island First Nation to review the proposed Georgina Island Fixed Link.

The Chippewas of Georgina Island First Nation are located on and off the east shore of Lake Simcoe, approximately 100 km north of Toronto.

Environmental benefits include replacing the seasonal, diesel-fueled ferry service and ice road, which are not considered safe or reliable, especially during harsher weather conditions.

Source: Based on CIB website and CIB data.

3.5. Knowledge and research

The CIB complements its advisory work through its knowledge and research initiatives, which also inform its investments. To understand evolving infrastructure needs and challenges, the CIB leverages statistics and datasets maintained by various governments and agencies. It also tracks global infrastructure trends by monitoring and analyzing investment data from a range of databases and market intelligence services.Footnote 17

Within the CIB, knowledge and research activities range from commercial- to public orientation. Commercial activities can yield insights on markets and opportunities for CIB investment. Public activities can inform governments, sectors, and sponsors of infrastructure more broadly as to the nature of issues, challenges, and solutions.

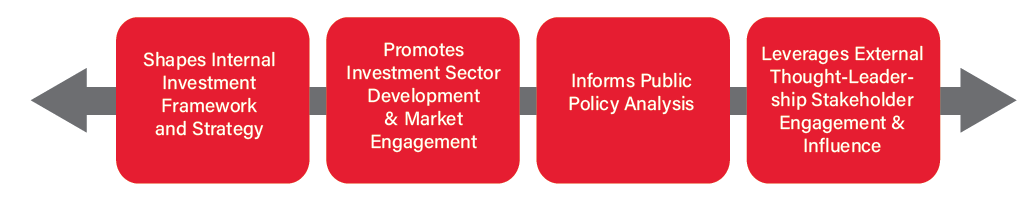

Outcomes of the Knowledge and Research Function

Source: CIB

Text Description: of Figure 23 Outcomes of the Knowledge and Research Function

Figure 12 displays a spectrum diagram listing the four main outcomes of the CIB knowledge and research function. These outcomes are:

- 1) To shape internal investment framework and strategy;

- 2) To promote investment sector development and market engagement;

- 3) To inform public policy analysis; and

- 4) To leverage external thought-leadership stakeholder engagement and influence.

For example, in 2021, the CIB collaborated with the Public Policy Forum, which hosted the Sustainable Finance Roundtables on climate analytics, capital mobilization and expansion of the “green bond” market in Canada. The discussion focused on theCIB’s Growth Plan and the strategies for mobilizing private and institutional capital for infrastructure investments that reduce greenhouse gases.

In 2022, the CIB undertook the Green Retrofit Economy Study in partnership with the Canada Green Building Council and Delphi Group. The study evaluated the potential for Canada to scale-up retrofits for large industrial, commercial, and multi-residential buildings. This involved identifying options to address workforce needs and supply-chain bottlenecks.

Most recently, the CIB partnered with the Infrastructure Institute at the University of Toronto on research to advance the concept of land value capture. The purpose of the research is aimed to enhance understanding of revenue tools that can be used to recover and reinvest part of the appreciated value of land arising from public transit expansion. The research found the CIB is well placed to address two key barriers to land value capture: the timing of funding, and the allocation of risk.

The CIB advances dialogue and participation in innovative infrastructure financing models across Canada by regularly undertaking regional and industry engagements with public, private, and Indigenous leaders. In 2022-2023, the CIB team undertook tours of Edmonton, Calgary, and Montreal that included investment announcements and roundtables with business and industry leaders such as the Business Council of Alberta, the Quebec Infrastructure Council, and the Quebec Federation of Chambers of Commerce. Additionally, CIB representatives undertake speaking roles at major events and conferences, which in 2022-2023, included the Ontario Economic Summit, the Canadian Council of Public Private Partnerships, and Arctic 360.

CIB’s Knowledge and Research Projects

| Project | Partners |

|---|---|

| Green Retrofit Economy Study | Canada Green Building Council and Delphi Group |

| Secure Smart Cities: Making Municipal Critical Infrastructure Cyber Resilient | Cybersecure Policy Exchange at Toronto Metropolitan University |

| Clean Power Roadmap for Atlantic Canada | Natural Resources Canada, Governments of New Brunswick and Nova Scotia, and provincial utilities |

| Land value capture for public transit projects | Infrastructure Institute at the University of Toronto |

| Climate Impacts on Canada’s Electricity System | Canadian Energy Research Institute |

| A Microgrid Playbook: Conditions and Opportunities for Investment | The Conference Board of Canada |

| Sustainable Finance Roundtables | Public Policy Forum |

Source: Based on CIB submission to the Legislative Review: Investing in Impact: A Submission to the Minister of Intergovernmental Affairs, Infrastructure and Communities’ Legislative Review of the Canada Infrastructure Bank Act.

4. Key findings

Overall, the Review has found that the CIB is playing an important role in the Government’s support for infrastructure development in Canada. The rationale underlying the CIB ’s creation remains valid and its mandate should be re-affirmed. Likewise, its enabling legislation is appropriate and allows the CIB to meet its expanded mandate and objectives. The CIB has evolved in response to early challenges. As the model has been put into practice, the Bank’s roles and responsibilities have been adjusted to address these challenges. The Review also found several opportunities for key actions to position the CIB for future success.

4.1. The premise underpinning the creation of the CIB remains sound

Several developments underline the continuing importance of adopting new mechanisms to leverage private-sector capital, expertise, and innovation. In Canada and globally, these developments include a persistent infrastructure gap; growing capital needs to support the transition to a net-zero economy; the need to increase Canada’s participation in an increasingly digital economy; and the acute shortage of essential infrastructure in Indigenous communities.